Trading veteran converts big portion of Bitcoin holdings into Ethereum expecting higher returns

- Ethereum keeps flashing massive bullish signals, attracting investors from Bitcoin.

- Peter Brandt flips bullish on Ethereum, converting up to half of his Bitcoin holdings to Ethereum.

- High transaction fees on the Ethereum protocol suggests that the rally might delay as investors wait for normalization.

Ethereum continues to receive massive attention from both investors and traders. The largest altcoin has managed to sustain price action above $1,000 despite the rejection at the record high of around $1,481. Many analysts believe that Ethereum will shoot up to $3,000 in the near term, as covered in the recent past.

Consequently, Peter Brandt, a prominent investor, believes that “ETH/BTC is the best bet.” He is so bullish on Ether to the extent of converting a substantial portion of his BTC holdings to ETH.

Why is Ethereum attracting investors’ attention?

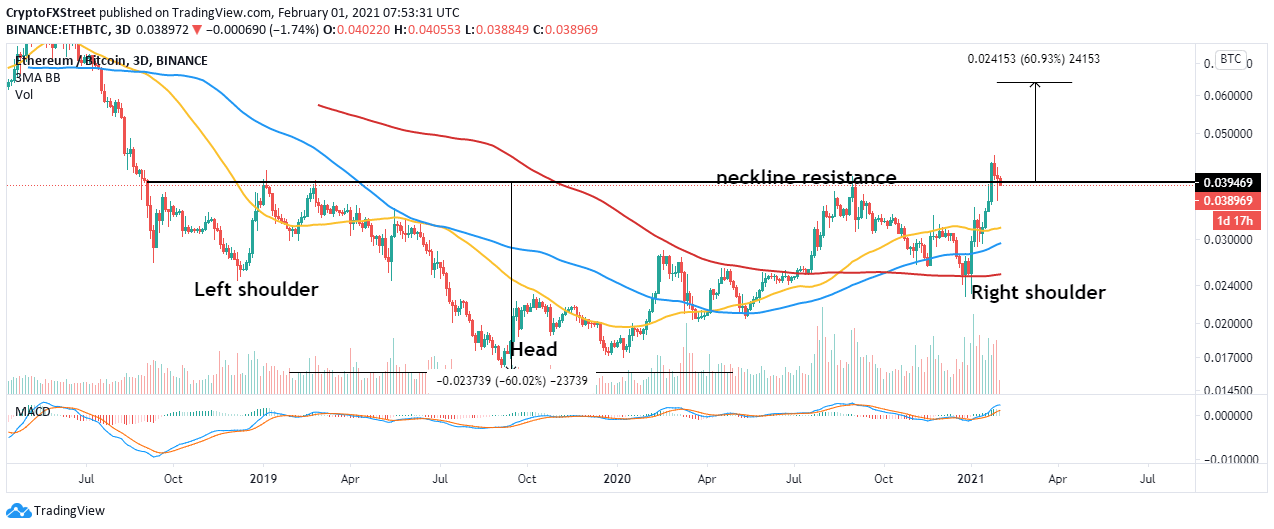

The 3-day ETH/BTC chart brings to light the formation of an inverse head-and-shoulders (H&S) pattern. This pattern is used in technical analysis to predict bullish outlooks once the asset’s price breaks above the neckline’s resistance. Traders incorporate this pattern when entering into a long position. It is essential to watch out for a surge in volume to confirm the sharp breakout.

Based on the H&S pattern, a conservative prediction is a 60% upswing to 0.0367 from the neckline’s resistance. However, the most optimistic breakout target is a 150% spike to 0.099. Realize that the Moving Average Convergence Divergence stresses the bullish outlook following a recent cross of the MACD line (blue) above the signal line.

ETH/USD 3-day chart

Is ETH/BTC the best bet to make? – Peter Brandt thinks so

Peter Brandt is a long-term Bitcoin bull that has recently flipped bullish on Ethereum. Intriguingly, the investor who owns Bitcoin agrees that the largest cryptocurrency “has had one heck of a run.” And he believes that “it has a long way to go.”

However, he has turned his attention to the pioneer smart contract token. He reckons that ETH/BTC is on the verge of a significant move. Brandt is comfortable with converting between a third and a half of all his Bitcoin holdings to Ethereum.

Simultaneously, another analyst, CryptoThies, predicts ETH/BTC possible rally to its all-time high around 0.1. The analysts shared his roadmap prediction of the digital asset pair, suggesting that February will be an exciting month for ETH/BTC.

Potential roadmap for $ETH vs $BTC in 2021. Based on standard crypto seasonality (Oct-June, followed by consolidation June-October). Assumes that #ethereum revisits former ATH vs #BTC at .1, which would be around 30% market dominance pic.twitter.com/gbVnjRNmPK

— CryptoThies ♔ (@KingThies) January 31, 2021

Looking at the other side of the picture

Santiment, one of the leading on-chain analysis platforms, cautions that the rising gas fees on the protocol could impede the rally. Currently, $11.45 (three-week high) is needed to complete a transaction on the Ethereum protocol.

Ethereum average fees/median fees

Usually, high fees lead to a cooling effect as users wait for the fees to return to normal levels. Santiment suggests that a market top is not a guarantee. However, the increase in gas fees demands caution.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B12.35.11%2C%252001%2520Feb%2C%25202021%5D-637477697747425026.png&w=1536&q=95)