Ethereum price prepares for a massive breakout ahead of CME's ETH futures launch

- The crypto community awaits the launch of CME Ether futures on February 8.

- The derivatives are anticipated to be a game-changer for Ethereum amid the new record high.

- Technicals and on-chain metrics suggest that Ethereum is poised to rally to a new all-time high of around $1,700.

Ethereum hit a new all-time high at $1,446 on Tuesday, bringing back attention to the altcoins. Intriguingly, the majestic price action comes two weeks before the Chicago Mercantile Exchange (CME) launches Ethereum futures. Analysts and speculators believe that this launch is going to be significantly bullish for Ethereum.

Ethereum prepares for liftoff to $1,700 ahead of the CME futures launch

The Ethereum CME futures launch will occur on February 8 and aims to empower investors with proper risk management. The derivatives have been "developed by the leading, most diverse, and regulated marketplace" and home to the renowned Bitcoin futures and options.

The CME Ether futures will be cash-settled, meaning that they will be paid in cash and not the underlying asset. According to the prediction made in December, for some analysts like Spencer Noon, ETH futures were long overdue.

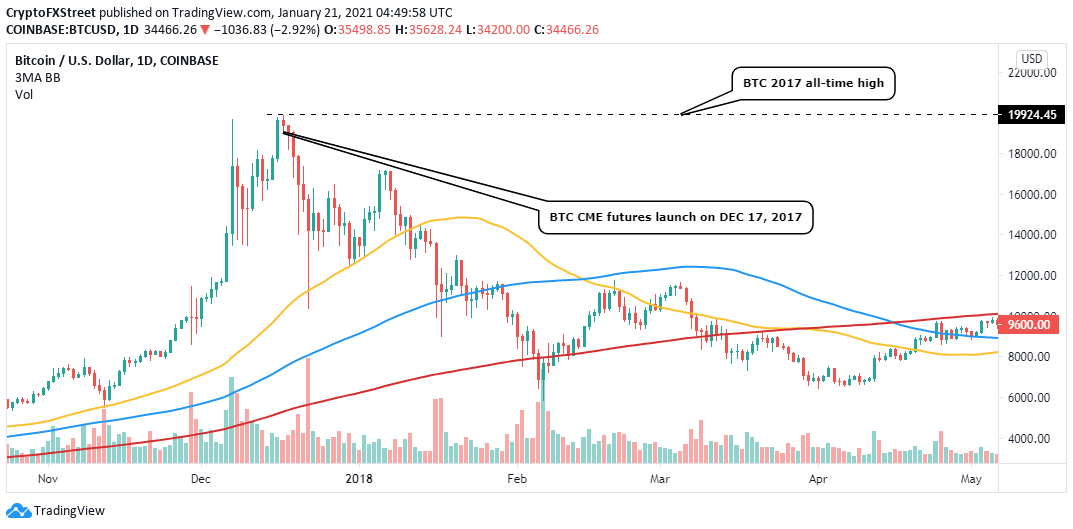

CME launched Bitcoin futures in 2017 amid the bull cycle that saw the price close in on $20,000. However, the price action was not as remarkable as the 19% spike to $19,016 following CBOE Bitcoin futures' debut, just seven days earlier. Although investors expected a significant move in Bitcoin price, the derivatives' launch on CME only pushed Bitcoin to $19,932 (former 2017 all-time).

BTC/USD 4-hour chart

On the contrary, the launch of Ethereum is the only major event in the ongoing bull unlikely to be diffused. Simultaneously, Ethereum has already broken out to a new all-time high and currently receives more investors' attention.

According to David Grider, an analyst at Fundstrat Global Advisors, Ethereum can hit $10,500 by the end of 2021. The medium-term technical outlook points to highs of $3,000, as explained with on-chain metrics.

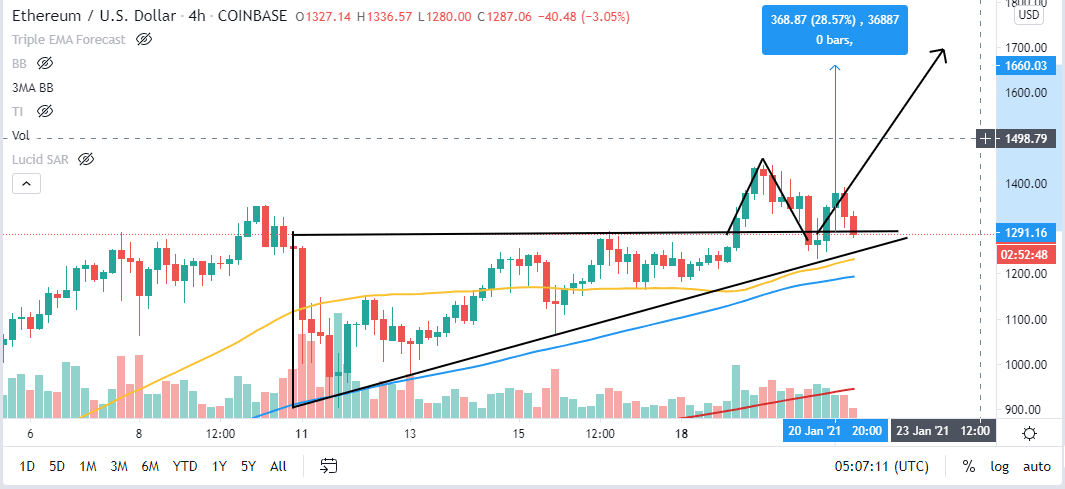

In the meantime, Ethereum has retreated from the newly established all-time high in search of support at a higher low. A recent breakout above an ascending triangle stalled at $1,446. Ether appears to have tested the x-axis of the triangle twice, but its upside has been limited below $1,400.

The initial breakout above the pattern is still viable and impactful as long as the hypotenuse holds firmly. Besides, Ethereum is in a safe zone if it maintains in the region between $1,200 and $1,300. On the upside, the enormous altcoin eyes gain to $1,700 before launching the futures product on CME.

ETH/USD 4-hour chart

On the other hand, IntoTheBlock's IOMAP model reveals that Ethereum has a relatively clear path to $1,400. However, attention must be channeled between $1,311 and $1,326, where roughly 221,000 addresses had previously purchased nearly 2 million ETH. On breaking above this area, Ethereum may rally to $1,400 first, then complete the leg up to $1,700.

Ethereum IOMAP chart

On the downside, the cryptoasset is sitting on an area with immense support, proposing that declines are unlikely in the short-term. The most robust support runs from $1,256 to $1,294. Here, roughly 123,000 addresses bought 6.6 million ETH. As long as this buyer congestion range remains intact, Ethereum bulls will have ample time to prepare for the upswing to $1,700.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637468047161022481.png&w=1536&q=95)