Ethereum price to make a u-turn and hit new all-time highs

- Ethereum price sees buying volume explode after the shift in sentiment caused by the US central bank rate decision.

- ETH bulls are clawing back against the bears with a U-turn move.

- Expect that if this rally continues into Christmas, new all-time highs will be in the making for 2021.

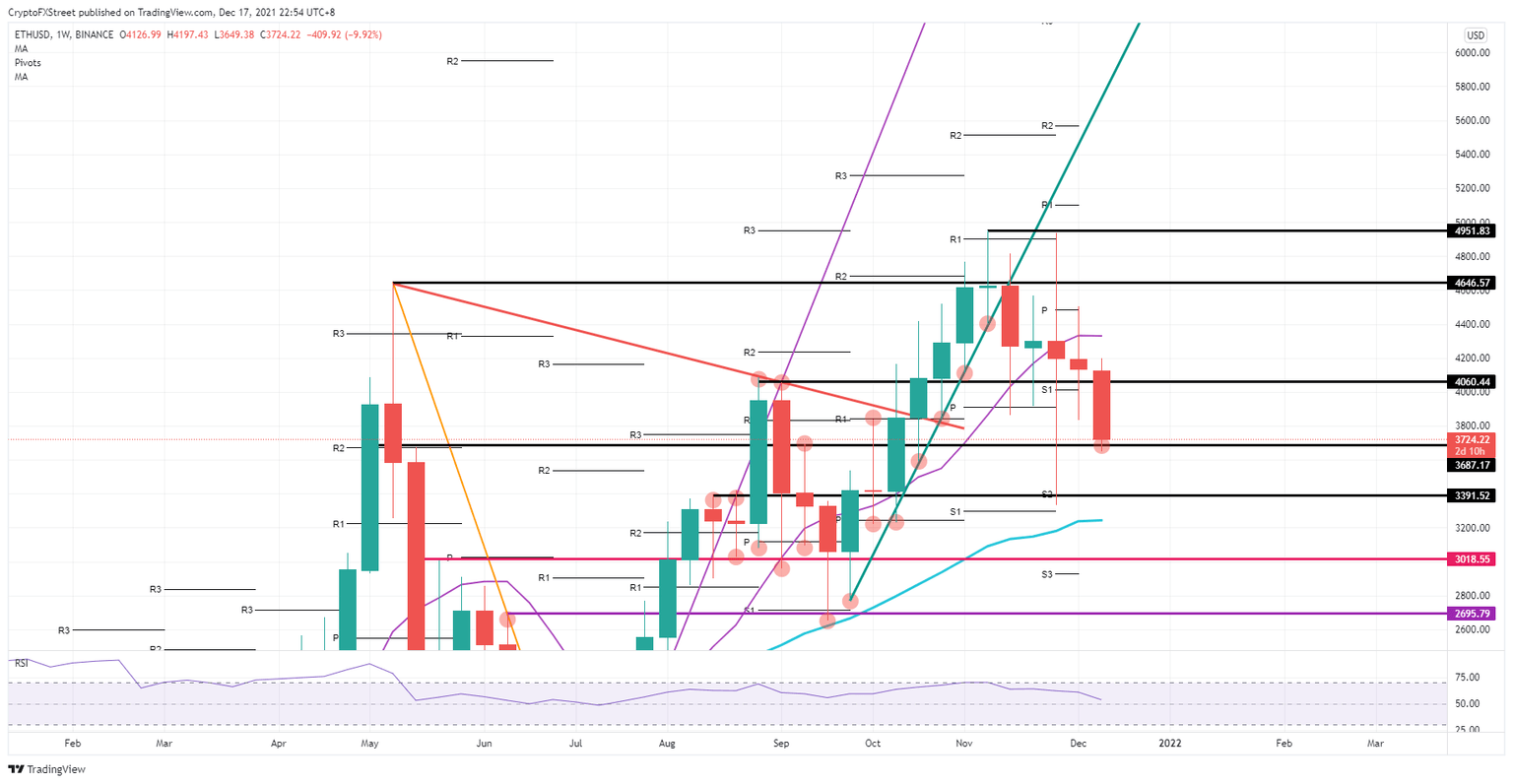

Ethereum (ETH) price saw some whipsaw price action in November with the falling knife event from Bitcoin after hitting new all-time highs just a few days before. Since then, ETH price has been looking for ground where bulls would gather and feel confident enough to support price action. As the price bounced off $3,687, expect a rally into Christmas to pop back up towards $4,646 with possible new all-time highs by year-end.

Ethereum bulls are coming back

Ethereum price was complicated to trade and not for the feeble or weak-hearted investor as price action ranged 30% in just one week, hitting new all-time highs and making a new low for the last quarter of the year. Bulls, however, jumped on the shift in tone from the US central bank to jump into the window of opportunity at $3,687. With that, it just took bulls a full trading day to get back above $4,063.

However, with that speed, bulls fear that the Relative Strength Index (RSI) will overheat too much and could refrain ETH price action from making new all-time highs for 2021. Instead, the best scenario would be to see a very slow but solid uptick towards Christmas, hitting $4,646 and New Year at $5,000. This way, 2022 is set for ETH at record highs and can only go further from there, as more media attention will attract more investors and buying interest.

ETH/USD weekly chart

The only thing that could get in the way of this rally would come from some more negative Omicron or other Covid related headlines, putting pressure on the overall risk sentiment. WIth liquidity dying down, it could make it more difficult for investors to get out of their positions, causing sudden corrections that could trigger further sell-offs with ETH price that would mean a retest at $3,391 and a firm test at $3,018 with the psychological $3,000 level just below.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.