Ethereum price needs a swing low confirmation so ETH can rally to $4,500

- Ethereum price is above a crucial support level at $3,912, attempting to set up a higher low.

- On-chain metrics suggest that ETH has a chance at a record higher if it can overcome the resistance level at $4,200.

- A breakdown of the $3,669 support level will create a lower low, invalidating the bullish thesis.

Ethereum price is at an inflection point as buyers try to set up a bullish regime. If successful, ETH will likely trigger a short-term uptrend that can evolve into a bull rally under certain conditions.

Ethereum price at crossroads

Ethereum price rallied 13% between December 15 and December 16 after bouncing off the $3,669 support level twice. This ascent sliced through the overhead barrier at $3,912 and is currently trying to flip it into a support level.

If successful, this will create a higher low, indicating the start of a bullish trend. In this situation, ETH will attempt to overcome the $4,155 hurdle and collect liquidity resting above it. An increased buying pressure is required to flip this resistance area and retest the $4,433 ceiling or the $4,500 whole number.

ETH/USDT 4-hour chart

While the technical outlook reveals one more resistance level at $4,788, on-chain metrics indicate that clearing $4,500 will put Ethereum price on a freeway to $5,000 or higher. IntoTheBlock’s Global In/Out of the Money (GIOM) model shows that a significant cluster of underwater investors is present at around $4,236. Here, 1.24 million addresses that purchased roughly 12 million ETH are “Out of the Money.”

Therefore, clearing this barrier will push these holders into the “profitable” territory, decreasing the overall selling pressure.

ETH GIOM

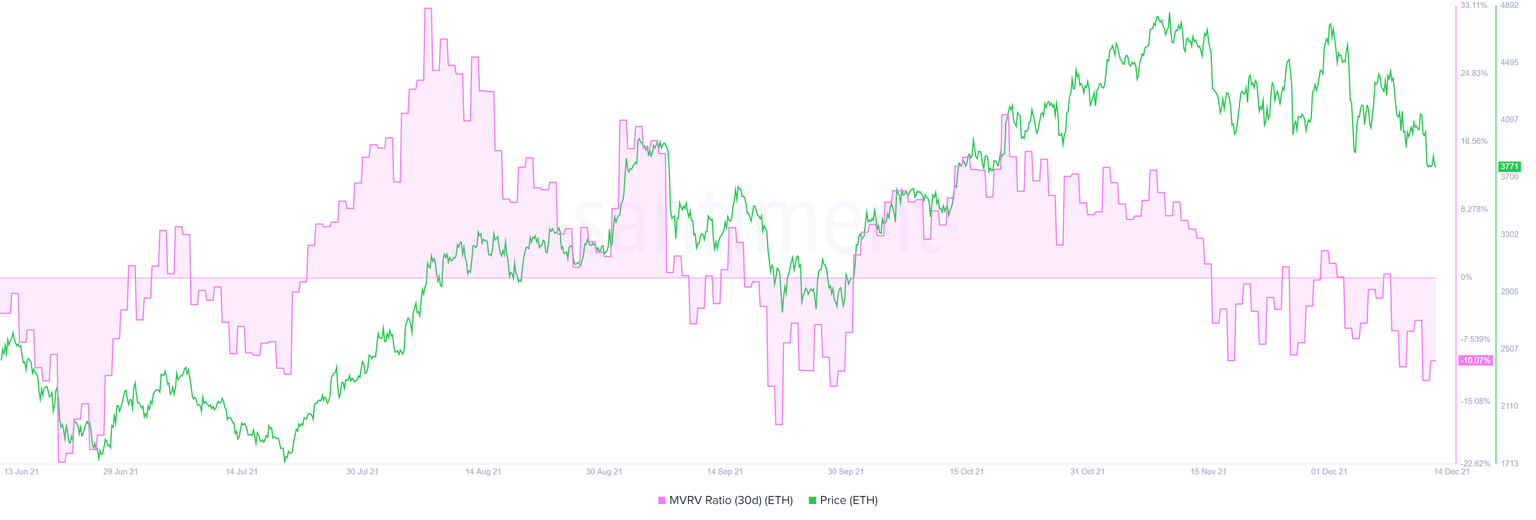

Further supporting the bullish outlook is the 30-day Market Value to Realized Value (MVRV) model for Ethereum price.

This on-chain metric is used to determine the average profit/loss of investors that purchased ETH over the past month. The 30-day MVRV for ETH hovers at -10%, indicating that short-term investors are not profitable. However, -10% is the ‘opportunity zone,’ where long-term holders accumulate.

Therefore, a reversal in trend seems likely for ETH.

ETH 30-day MVRV

On the other hand, if Ethereum price fails to hold above $3,912, it will indicate a weakness in bullish momentum. This development will knock ETH down to the immediate support level at $3,669. While the buyers have a chance to make a comeback here, a lower low below this level will invalidate the bullish thesis.

In such a situation, Ethereum price could revisit the $3,415 barrier.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.