Chiliz Price Prediction: CHZ ignores bearish on-chain metrics, embarks on liftoff to $1

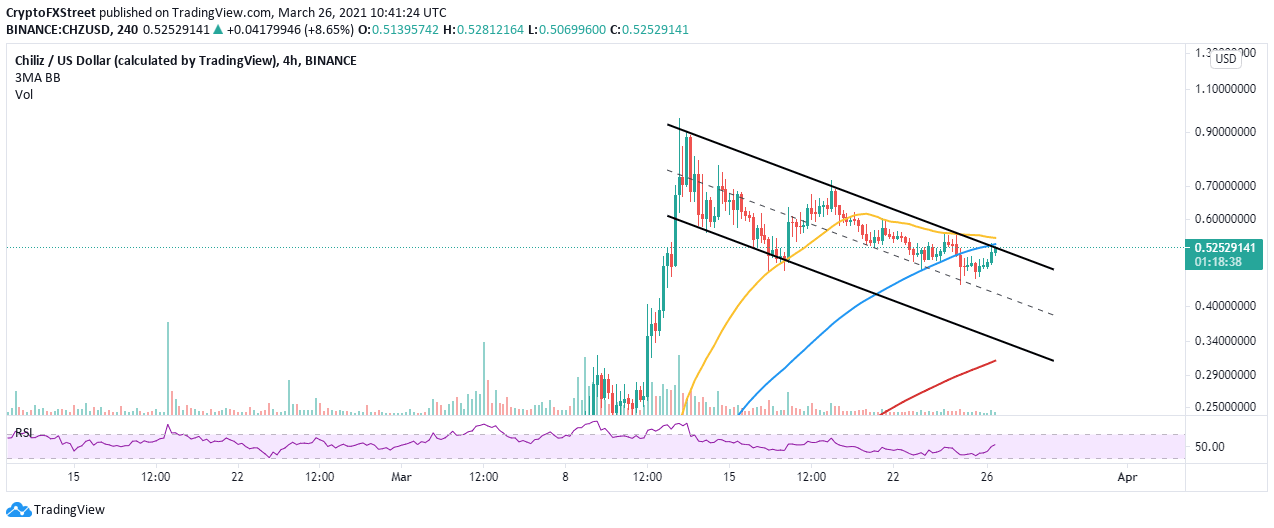

- Chiliz is drawing closer to breaking out of a descending parallel channel.

- Price action past the 50 SMA and 100 SMA on the four-hour chart will add credibility to the potentially massive upswing.

- Declining network growth is a bearish signal likely to deter the anticipated recovery.

Chiliz is joining other cryptocurrencies to close the week in the green. The push for recovery comes after an extended downtrend from the beginning of the week. Moreover, CHZ has lost 45% of its value from the all-time high of $0.95. Therefore, the ongoing recovery was greatly anticipated amid the calls to elevate the token beyond $1.

Chiliz primes for another upswing

Chiliz is trading at $0.52 while battling the resistance at the descending parallel channel’s upper boundary. Also contributing to the overhead pressure are the 50 Simple Moving Average (SMA) and the 100 SMA on the four-hour chart. If these hurdles are overcome, CHZ could start extending the bullish leg to the record high and perhaps hit $1.

The bullish outlook has been validated by the Relative Strength Index (RSI) on the four-hour chart. A continued movement toward the overbought region will further strengthen the bull’s presence in the market.

CHZ/USD 4-hour chart

Looking at the other side of the picture

According to Santiment, Chiliz network growth is on a declining trend. The freefall in the number of new addresses joining the protocol began after a 30-day high of 3,333 on March 12.

At the time of writing, only 1,200 addresses have joined the Chiliz network on the day. This represents a 64.5% drop and is a significantly bearish signal. In other words, price recovery could lag or be sabotaged entirely.

Chiliz network growth

It is worth mentioning that a correction may come into play if the uptrend at the time of writing hits a barrier at the channel’s upper boundary. The 100 SMA reinforces the resistance at this level, hence the possibility of a reversal. On the downside, support is expected at the middle border and at $0.4, respectively.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B14.01.37%2C%252026%2520Mar%2C%25202021%5D-637523557101280432.png&w=1536&q=95)