Chiliz Price Forecast: CHZ consolidates before a 50% rally

- Chiliz price has notably decreased the selling pressure behind it over the last four days.

- Extreme overbought condition has also been eliminated.

- Meanwhile, CHZ sits on top of stable support provided by the midline of a descending channel.

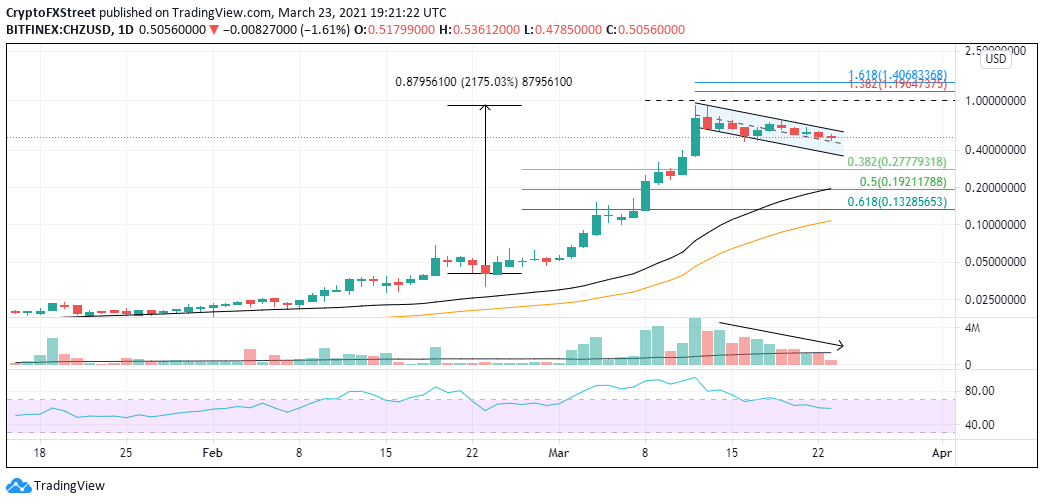

Chiliz price gained almost 2,200% from the February 23 close at $0.040 to the March 12 high at $0.920 as the platform underpinning Socios.com rode the non-fungible token (NFT) wave in sports and entertainment. Since the high CHZ has corrected almost 50%, it has been on declining volume and has reacted positively to support levels.

Chiliz price keeping traders honest

A descending channel has framed the decline since the March 12 high of $0.920, with CHZ firmly holding the channel’s mid-line over the last six trading days. As a result of the drift lower, it has released the extreme overbought condition in which the Relative Strength Index (RSI) printed the highest reading since the altcoin began trading.

If the current decline continues on lower volume and above the mid-line of the channel at $0.470, the outlook for CHZ is optimistic moving forward.

The first resistance for a renewed uptrend is the high of the channel at $0.590, but after that, heavy buying can quickly propel it to the all-time high at $0.920, representing a gain of 56% from the breakout.

Due to the magnet effect of round numbers, traders can expect Chiliz price to rally above the all-time high and extend to $1.00, adding another 14% to the breakout.

Higher profit targets include the 1.382 extension level at $1.19 and then the 1.618 Fibonacci extension level at $1.41.

CHZ/USD daily chart

A daily close below the channel’s mid-line would taper the bullish forecast and put the lower trendline in play at $0.374.

If the channel breaks, it will usher in the complete liquidation of CHZ. The next credible support is the 0.382 retracement of the February 23 - March 12 advance at $0.277. At that point, panic will be raging, and the merging of the 50-day simple moving average (SMA) and 0.50 retracement level at $0.192 becomes the ultimate support.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.