Cardano Price Analysis: ADA bulls light up the fire for a massive 80% move

- Cardano has broken above an ascending triangle’s hypotenuse, kick-starting upswing to $1.4.

- Technical levels are generally improving, as reinforced by the bullish MACD indicator.

- A correction will return into the picture if ADA fails to hold above the 50 SMA.

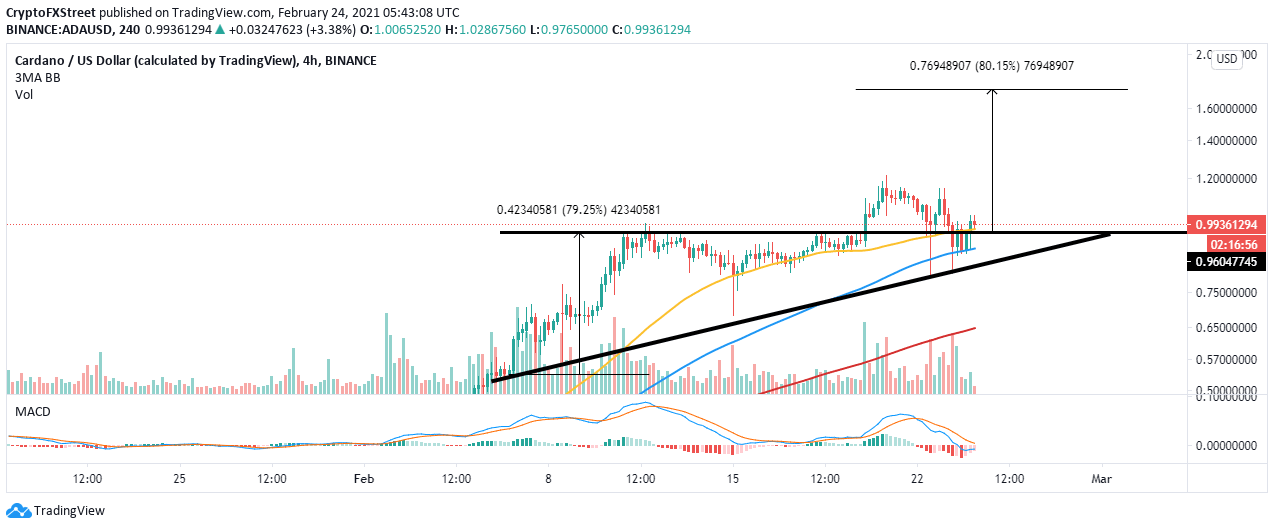

Cardano bulls are working hard to resume the uptrend following a correction from the new yearly high at $1.21. The bullish outlook came after a triangle breakout with an 80% target of $1.72. With the triangle pattern still in the picture, ADA is looking forward to a massive upswing that may overshoot the all-time high at $1.4.

Cardano’s technical and on-chain picture improve

Following the widespread breakdown in the market on Tuesday, ADA held onto support at $0.8 in conjunction with the triangle’s hypotenuse. A rebound ensued with buyers pushing the price above the x-axis and the 50 Simple Moving Average.

ADA is doddering at $0.99 amid the persistent push for gains above $1. The bullish outlook is likely to be validated by the Moving Average Convergence Divergence (MACD) on the 4-hour chart. This indicator is useful in identifying entry and exit positions in the market. For now, the bears look exhausted as buyers grow stronger.

It is essential to keep an eye on the MACD line because crossing above the signal line will signify an entry position in anticipation of an upswing. In addition, the MACD’s bullish outlook, while the ascending triangle has an 80% target of $1.72.

ADA/USD 4-hour chart

According to the In/Out of the Money Around Price (IOMAP) by IntoTheBlock (ITB), Cardano has a relatively smooth path towards the new all-time high. However, bulls will have to focus on breaking above the subtle resistance between $1.07 and $1.04. Here, approximately 39,000 addresses had previously bought nearly 956,000 ADA. Trading beyond this level will encourage more buyers to join the market, thus increasing the tailwind.

Cardano is sitting on areas with immense support on the flip side, invalidating any potential losses in the near-term. The most robust support runs from $0.96 and $0.98. Here, roughly 38,000 addresses had previously bought approximately 2.5 billion ADA. Below this support, the model highlights two more massive support areas.

Cardano IOMAP model

Looking at the other side of the fence

It is worth mentioning that ADA will not continue with the majestic rally to $1.72 if the support at the 50 SMA on the 4-hour chart is lost. Another big blow would be a breakdown under the triangle’s x-axis. On the downside, Cardano may retest the anchor provided by the 100 SMA. If push comes to shove, losses could extend under the hypotenuse toward the 200 SMA.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637497449305732233.png&w=1536&q=95)