Cardano Price Forecast: ADA’s uptrend hits exhaustion, 10% pullback in sight

- Cardano price is taking a break after hitting a new all-time high at $1.20 on February 21.

- ADA could now pullback towards $0.93.

- Transaction history shows stable support at $1.06, but a breach of this level could drag this cryptocurrency down to $0.92.

Cardano price saw a 600% increase since the start of 2021. After hitting a new all-time high of $1.20 on February 21, ADA bulls show signs of exhaustion.

Cardano price needs to reset

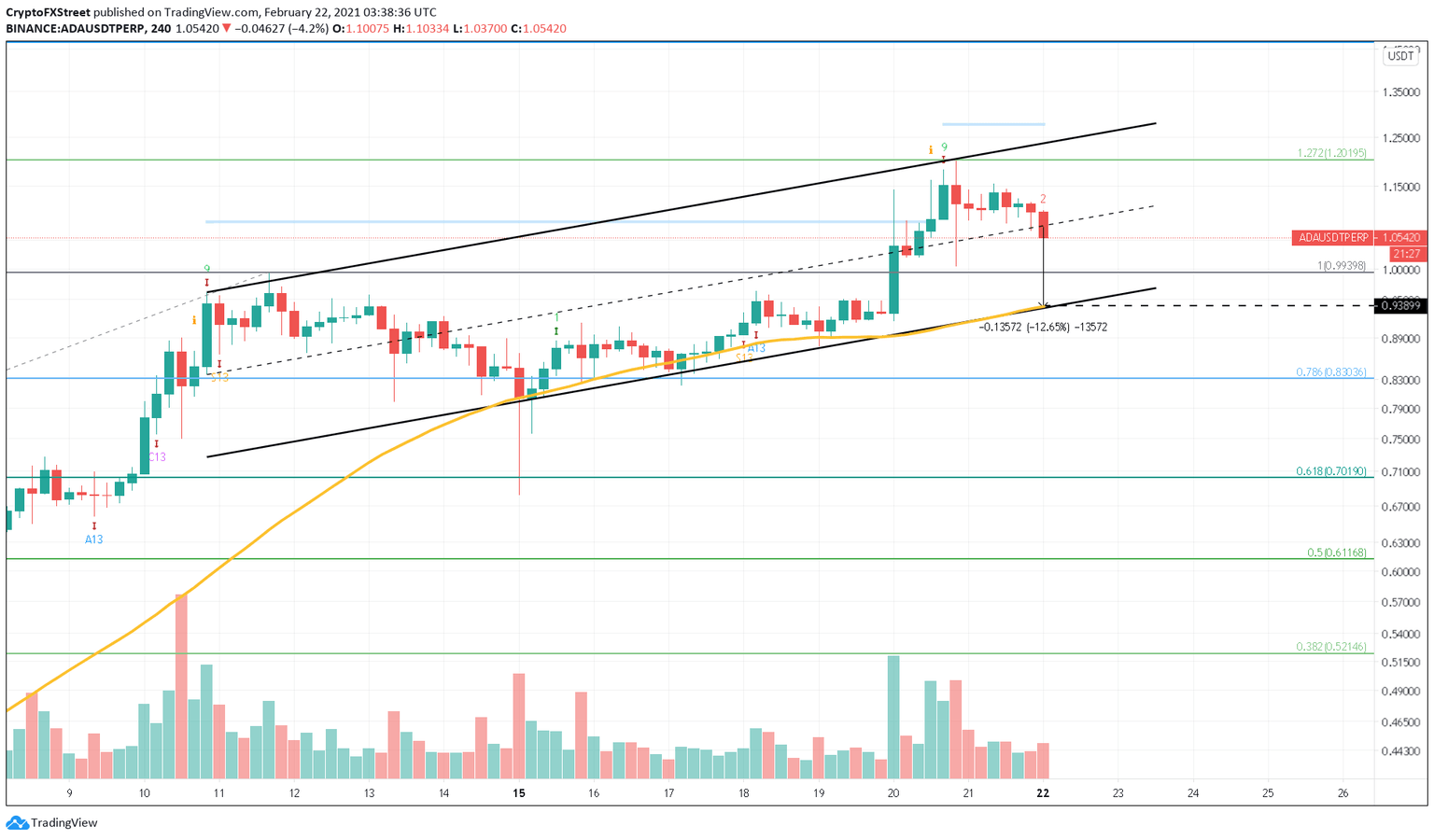

Cardano price surged from $0.96 to $1.20 between February 10 and February 20, forming a higher high. Drawing a trendline between the swing highs and the swing lows shows the formation of an ascending parallel channel.

ADA has dropped nearly 13% after getting rejected from the channel’s upper trendline. Now, a downswing can be expected to the middle or lower trendline.

These support levels sit at $1.06 and $0.93, respectively.

ADA/USDT 4-hour chart

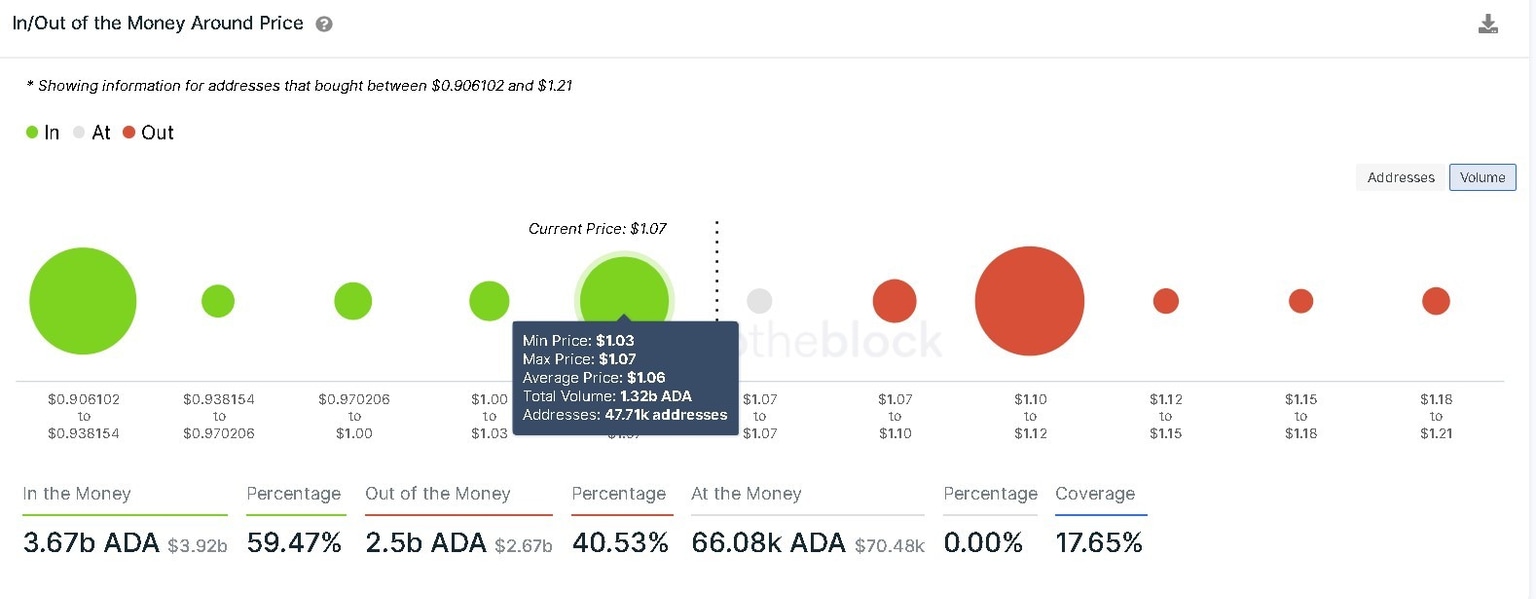

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model supports such a bearish thesis. The on-chain metric shows that 47,500 addresses had purchased roughly 1.32 billion ADA around $1.06.

Thus, a 4-hour candlestick close below this level will put these investors “Out of the Money,” inducing a spike in selling pressure.

In such a case, Cardano price could slide down towards the channel’s lower trendline at $0.93, which also coincides with the 50 four-hour moving average (MA).

Here, the IOMAP cohorts reveal that around 96,000 addresses hold 2.2 billion ADA.

Cardano IOMAP chart

It is worth noting that the IOMAP also shows that 42,500 addresses purchased 2.38 billion ADA at an average price of $1.10. Therefore, a 4-hour candlestick close above this supply barrier could invalidate the bearish thesis and start a new uptrend.

Under such circumstances, Cardano price could retest its all-time high at $1.20.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.