Cardano Price Prediction: ADA in a reversal mode as an accurate technical indicator flashes “buy”

- Cardano price sell-off reverses as Tom DeMark Sequential indicator flashed a buy signal.

- A six-hour candlestick above the supply barrier at $1 could see ADA rise 20%.

- Transactional data suggest that ADA's upswing might be tough due to underwater buyers at $1.1.

Cardano price has been on a stellar rise toppling every all-time high in its path. However, the recent market sell-off has delayed its ascent at best. Despite a 30% drop, ADA bulls seem unwavering and are already pushing the price higher.

Cardano price aims for a higher high

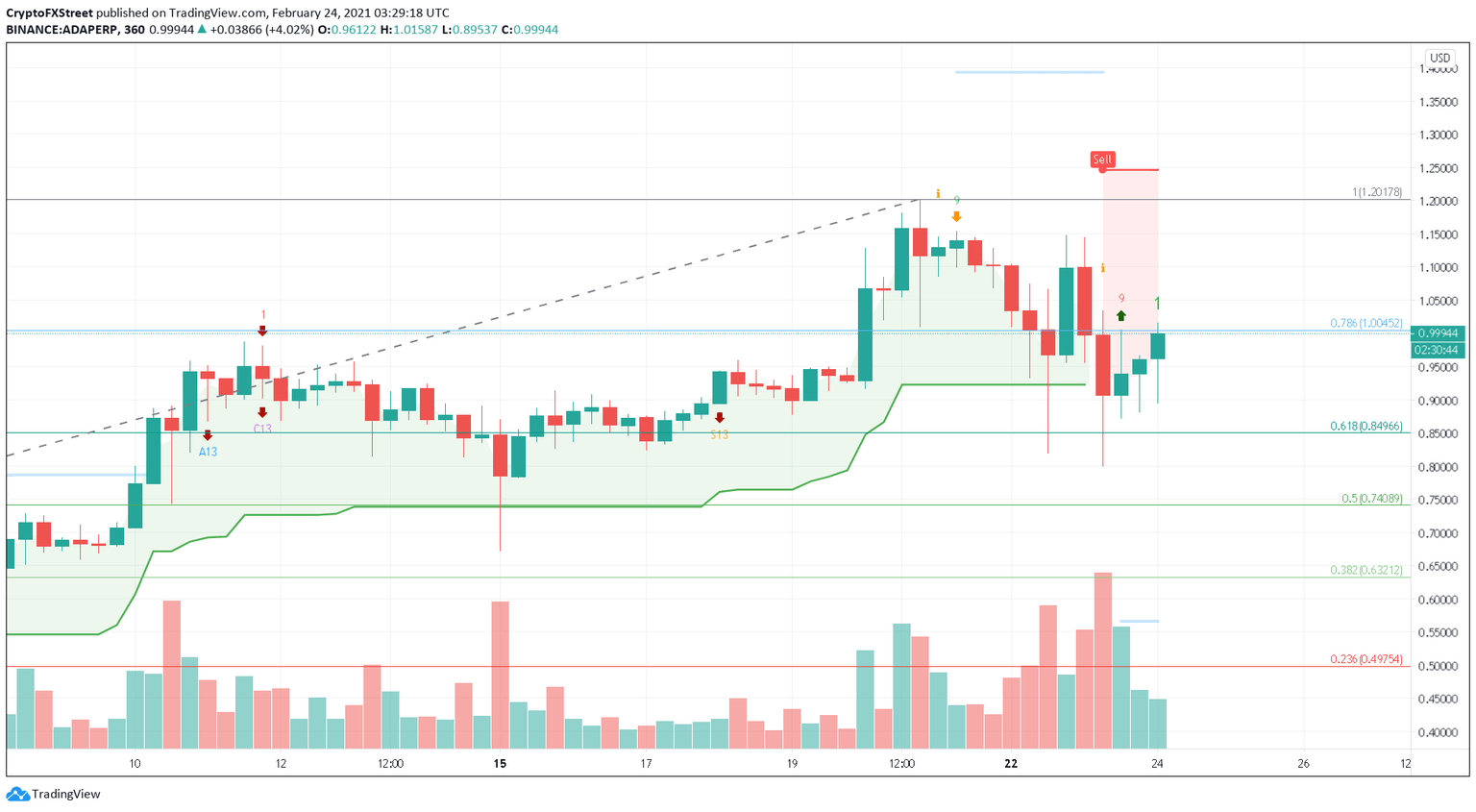

Cardano price shows the presence of resilient buyers around the $0.85 level. On February 23, the Tom DeMark (TD) Sequential indicator flashed a buy signal in the form of a green nine candle. This setup forecasts a one to four candlestick upswing.

At the time of writing, ADA was already on this uptrend with the third candlestick trading around the supply barrier at $1, which coincides with the 78.6% Fibonacci retracement level.

Therefore, a six-hour candlestick close above this level would confirm the bullish momentum and provide the so-called “Ethereum killer” a chance to retest its all-time high at $1.2.

ADA/USDT 6-hour chart

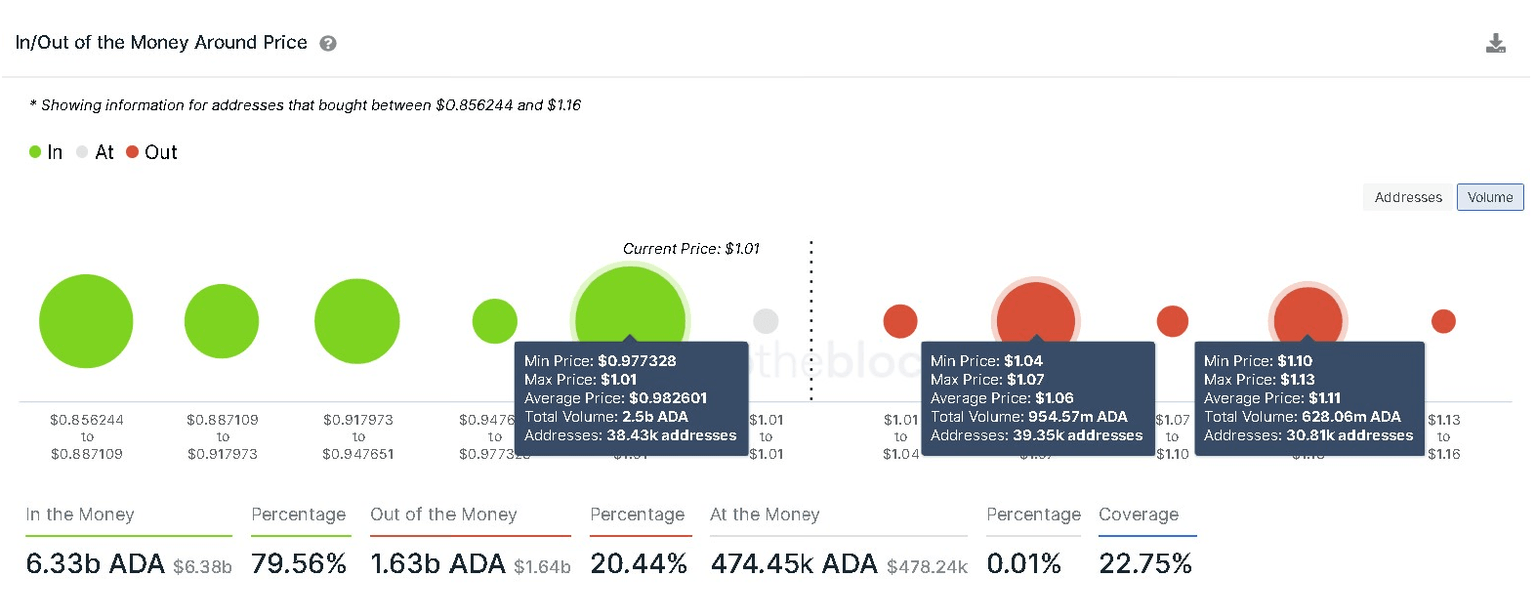

Adding credence to this bullish outlook is IntotheBlock’s In/Out of the Money Around Price (IOMAP) model, which shows little to no resistance ahead. The only supply barrier that could deter ADA’s upswing is at $1.1, where nearly 30,800 addresses hold about 628 million ADA.

Therefore, the smart contracts platform token needs to overcome this supply barrier to retest $1.2 and perhaps extend its bull rally to 127.2% Fibonacci retracement level at $1.45.

Cardano IOMAP chart

A bearish scenario would kick-in if ADA gets rejected around the resistance barrier at $1.1. This outcome could push ADA down to support at $0.98, where 38,500 addresses hold nearly 2.5 billion ADA.

An unforeseen spike in buying pressure here leading to a breakdown of this support level could be fatal for Cardano. In such a case, ADA would drop 11% to the next immediate demand barrier at $0.87.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.