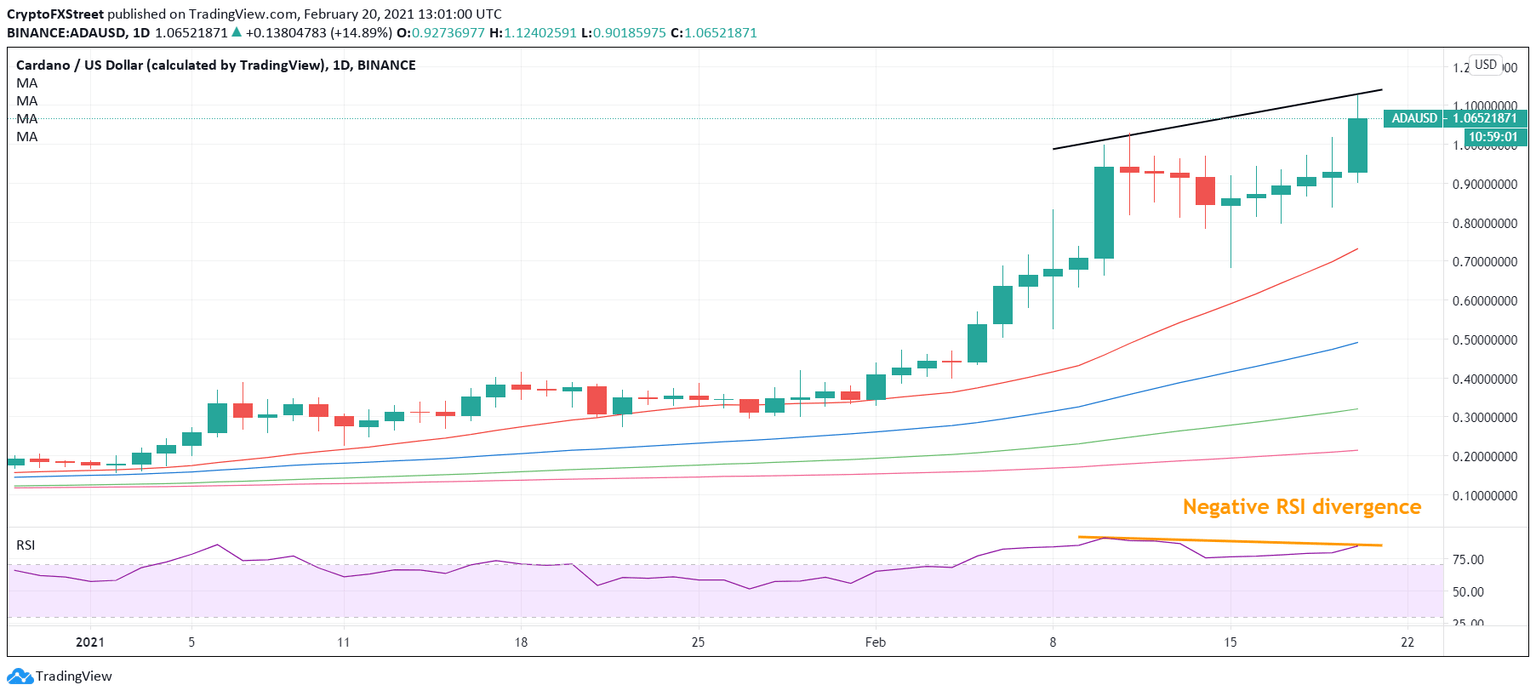

Cardano Price Forecast: Negative RSI divergence signals caution for ADA bulls

- ADA/USD’s uptrend seen losing momentum.

- Negative price-RSI divergence spotted on the 1D chart.

- The no. 6 coin could correct to 21-SMA.

Cardano (ADA/USD) hit the highest level on record at $1.1240 early Saturday, now holding the higher ground above $1.00 levels, as the investors digest the 14% rise during the last 24 hours.

The sixth most widely traded cryptocurrency has gained a whopping 21%, extending its six-day winning streak into Saturday.

ADA/USD: Buyers’ exhaustion setting in?

However, the buyers are seemingly turning cautious amid a negative price-Relative Strength Index (RSI) divergence spotted on the daily chart.

ADA/USD: Daily chart

The retracement from record highs could probe the immediate cushion seen at the bullish 21-simple moving average (SMA) at $0.914.

Further south, the psychological level at $0.90 could challenge the bearish commitments.

Alternatively, the ADA bulls could retest the all-time-highs, with eyes set on the $1.13 threshold.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.