USD/JPY Weekly Forecast: Higher US Treasury rates, not if but when?

- USD/JPY trades through the 23.6% and 38.2% Fibonaccis of the 2021 gain .

- Dollar weakens as Treasury yields continue to decline.

- BOJ and Fed policy decisions are awaited next week.

- Rebound above 108.00 limits immediate downside risk.

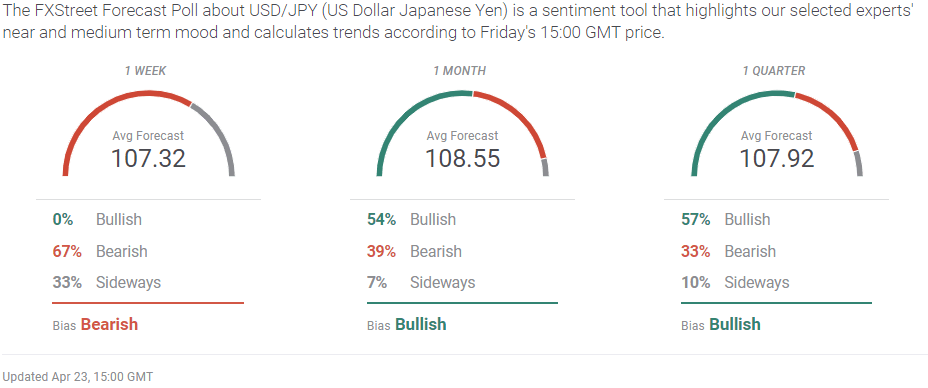

- FXStreet Forecast Poll sees test lower then recovery.

The USD/JPY has come under steady selling pressure for the last three weeks after reaching its 2021 and one-year highs on March 31 at 110.96. A brief pause from April 8 to April 12 around 109.50 soon gave way to last Friday’s close at 108.78, just below the 23.6% Fibonacci level of this year's gain at 108.82.

Monday’s 80 point plunge was the biggest one-day drop since February 9 and easily pushed through support at 108.50 and 108.25. There has been no recovery with each session finishing incrementally lower.

The 38.2% Fibonacci line at 107.67 inevitably attracted sellers but the drop to 107.48 and rebound has marked a temporary bottom. The next substantial support is not until 107.00, the point from where the USD/JPY took off early March.

American Treasury yields have been the prime motive force for the dollar this year. Their reversal in April, modest though it has been at about 20 basis points out of 83 for the 10-year yield, has been sufficient to call out the profit-takers en masse.

US 10-year Treasury yield

CNBC

Japanese inputs into USD/JPY trading have been conspicuously lacking.

The Bank of Japan (BOJ) policy flexibility is constrained by its huge positions in Japanese Government Bond (JGB) and equity markets.

The US economy continues to gain strength, this week’s jobless claims numbers fell to the lowest of the pandemic era, belying the forecast for an increase. Nonfarm Payrolls, Retail Sales and Purchasing Managers Indexes have been robust in March.

Federal Reserve policy is expected to remain unaltered at next week’s FOMC meeting despite a growth forecast to be at 6.5% or higher this year and rapidly accumulating signs of inflation. The US economy has reemployed about 64% of the 22.4 million payroll losses in the March and April lockdowns.

In Ottawa on Wednesday, the Bank of Canada became the first central bank to reverse direction and reduce its pandemic accommodation. The amount was small, C$1 billion out of C$4 billion. This was enabled by the Canadian success at restoring 90% of their layoffs to employment.

So far Federal Reserve Chair Jerome Powell and the other governors have maintained their commitment to easy monetary policy and yield intervention despite the heating US economy. The lack of central bank endorsement, however subtle, for the sharp rise in Treasury rates to the end of March, is one of the reasons for the reversal in yields.

Given the Canadian decision, speculation on the Fed’s turn is natural, but Chair Powell has secured bank policy to the labor market. With 8.4 million by the payroll count yet unemployed, it will be a few months at least before the governors light up the taper.

The Bank of Canada can taper because the Federal Reserve will not

Japanese statistics were modestly better in February, or more accurately, less poor, but had no market effect. Industrial Production on the year was down 2% from -5.2% in January. The Tertiary Index which tracks the domestic service sector rose 0.3%, the first positive month in four. National Core CPI reached 0.3% for the year in March, its highest reading in eight months but remained negative in the overall rate.

American data underscored the rising economic tide. Initial Jobless Claims fell to 547,000, about where they were in the fall of 2009, a year after the financial crisis. Home sales have declined since last October’s record, but they remain exceptionally strong.

USD/JPY outlook

The USD/JPY bias is lower but with a close eye on Treasury rates and by extension the US economy.

Neither the BOJ or the Fed is expected to produce policy changes but Fed Chair Jerome Powell’s press conference will hold the most potential.

Even the slightest hint that the governors are considering the conditions for removing accommodation could revive the dollar. The market assumption on higher US rates is not if but when?

March Retail Trade (Sales) in Japan are expected to be vibrant and could give the yen a footing but it has been a long time since the consumer economy in Japan warranted market attention.

In the US, first quarter GDP arrives on Thursday one day after the FOMC meeting. If it is stronger than the 6.5% forecast and especially if Chair Powell is positive on the economy, it could give the dollar a fillip.

This month’s steep 2.6% drop in the USD/JPY from March 31 left the pair poised at 107.99 on Thursday, just above the 32.6% Fibonacci line at 107.67. That level provided no substantial support and was calmly, if briefly, crossed to 107.48 in early New York action on Friday.

The area from 107.00 to 108.00 had been traversed in one session on March 4 and its base will be the natural destination and first major support if the USD/JPY drops again below 108.00

The lack of follow-through on Friday after the three week decline and the rebound above the 38.2% Fibonacci line is an indication that the selling energy has waned and was largely profit driven.

Fundamental economic factors still favor the dollar and the US economy but markets have been keyed on the reflection in Treasury returns and will not buy the dollar unless US rates resume their climb.

Japan statistics April 19–April 23

Industrial Production in February was mixed. Better on the year at -2% after -5.2% in January but worse at -1.3% for the month after 4.3% prior. Core consumer prices for the year rose 0.3% in March, the first positive month in four, but the headline and ex Fresh Food figures remained negative. The Jibun Bank Manufacturing PMI scored 53.3 in April, its best reading since April 2018.

FXStreet

US statistics April 19–April 23

This week's data reinforced the picture of a strengthening US economy.

US Initial Jobless Claims at 547,000 in the April 16 week suggests that the employment recovery is finally reaching the hourly positions most affected by the pandemic economic fallout. Existing Home Sales remained strong and New Home Sales soared 20.7%, promising more construction jobs.

FXStreet

Japan statistics April 26–April 30

The BOJ meeting on Monday will, mostly out of habit, recieve market attention. No policy changes are anticipated but the governors might tweak their bond and equity purchase amount. Consumer buying in March is forecast to revive after three negative months which would improve the overall economic outlook as would a better than expected sentiment number for April.

FXStreet

US statistics April 26–April 30

The FOMC meeting on Wednesday will dominate markets and restrain movement until it is completed. While no policy alteration is anticipated, the economic views of Chair Powell will be of utmost interest. The more positive he is, the better for the dollar and Treasury yields.

First quarter GDP on Thursday also has potential to move the dollar, particularly if better than the 6.5% forecast. Durable Goods, Personal Income and Spending and the Personal Consumption Expenditure Price Index will be noted but will not stir markets as their information largely restates Retail Sales, Annual Hourly Earnings and CPI for March.

USD/JPY technical outlook

Friday’s rebound over 108.000 after the morning dip through the 38.2% Fibonacci level to 107.48, is a good indication that the immediate, and largely profit driven, selling has reached a natural limit.

From the close on January 5 to March 31 the USD/USD had gained 7.8%, largely on the back of rising US Treasury rates. The technical selling that took over in April once Treasury yields had reversed their frenzied climb, depended on the acquiescence of the credit market. If US rates had resumed their increases, the USD/JPY would surely have followed.

For the moment, the USD/JPY has reached stability though there remains a slight bias lower. Even at 108.00 the USD/JPY is still 5.2% higher from the January low and without a recoup in US rates the selling will eventually resume.

Will the US economy continue its renaissance, will Treasury yields reflect that growth and, most importantly, will the Federal Reserve permit the credit market expression?

The March and April head and shoulders formation has a base at 108.35 which is the first resistance line. The 38.2% Fibonacci has performed its function and will not be active if the USD/JPY falls again.

The Relative Strength Index at 37.73 is close to oversold, which is not surprising given the steep drop this month, but is not a buy signal given the potential for more profit selling.

The sharp moves of March and April have relegated the moving averages (MA) to distant influence, 21-day MA at 109.32, 100-day MA at 106.11 and the 200-day MA at 105.73.

Over time, currency markets normally retrace their ranges to the 61.8% Fibonacci level. For the USD/JPY that is more than two figures below the current market at 105.77. The pull of that profit level will increase rapidly over the immediate future.

Resistance: 108.35, 108.50, 108.80, 109.30, 109.95

Support: 107.50, 106.72 (50% Fibonacci), 106.50, 105.80, 105.77 (61.8% Fibonacci)

USD/JPY Forecast Poll

The FXStreet Forecast Poll sees immediate weakness though not far below Friday's low of 107.48. The rebound in the one-month and one-quarter views are largely technical. If US interest rates begin to rise they will take the USD/JPY with them.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.