- The USD/JPY inched higher amid a stronger USD, a dovish BOJ, and trade talk.

- A calmer week sees US inflation and also Japanese GDP.

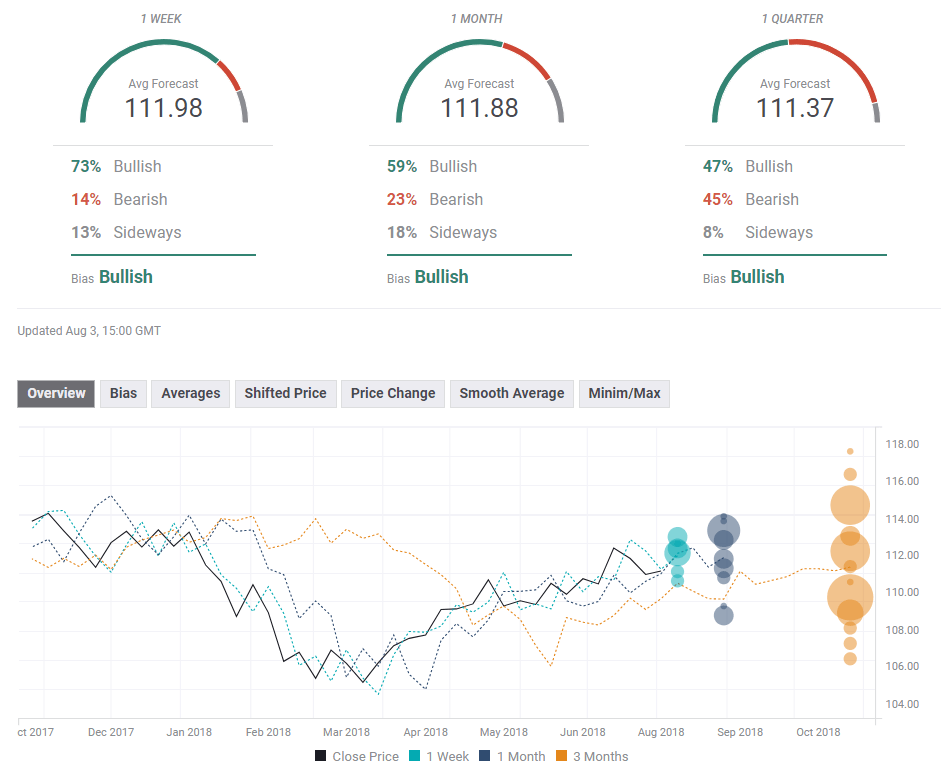

- The pair holds onto uptrend support, a positive technical sign and the FX Poll shows a bullish bias.

This was the week: BOJ, Fed, yields, and trade

The turn of the month was packed with events. The Bank of Japan made some tweaks to its policy, such as enlarging the band permitted for the 10-year yield. However, they remain far from the 2% core inflation goal, and their policy remains very loose, weighing on the yen.

On the other side of the Pacific, the Federal Reserve left its policy unchanged and made marginal changes to its wording. They now see the economy is strong and in general, remain on track to raise rates in September.

US 10-year bond yields flirted with the 3% level amid growing borrowing needs by the government. The tax cuts and increased spending increase the deficit.

On the trade front, the sense of truce is gone. While NAFTA negotiations are progressing smoothly, US-Sino relations have deteriorated again. The two economic giants were reportedly seeking to restart negotiations, but a lack of progress resulted in the US threatening to raise the tariff from 10% to 25% on $200 billion of Chinese goods. China devalues the yuan in what seems like a retaliation. The imposition of these duties is due at the end of the month.

The USD/JPY fell alongside stock markets, indicating the return of the Yen to its safe-haven role.

The last word of the week came from the US Non-Farm Payrolls report. Wages, which were the center of attention, came out exactly as expected: 2.7% YoY and 0.3% MoM. That left the scene to the headlline figure which disappointed with a gain of only 157,000 jobs in July. On the other hand, upwards revisions worth 59,000 jobs for the past two months improved the picture. The best data point was the underemployment rate, U-6, also known as the "real unemployment rate". It fell to 7.5%, the lowest since 2001.

The US Dollar did not move too much on the NFP, as it does not change the path of rate hikes for the Federal Reserve.

US events: Culminating in inflation Friday

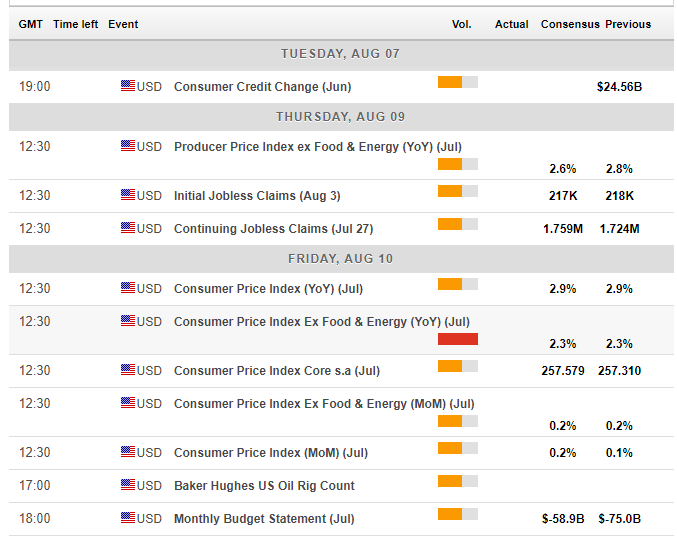

After a strong start to the new month, the first full week of August is calmer. It begins with Consumer Credit on Tuesday and becomes more interesting with the Producer Price Index on Thursday. Core PPI is rising at a faster pace than consumer inflation, reaching 2.8% in June. The figure for July is expected to be more moderate.

The primary event of the week is the Consumer Price Index (CPI) for July, published on Friday. The Federal Reserve cares primarily about core prices, and these have accelerated to 2.3% YoY in June. A repeat of the same level is on the cards now. It is important to note that despite an increase in the Core CPI, the Core PCE dropped to 1.9%. The central bank explicitly targets core prices.

Apart from economic indicators, bond yields are gaining traction once again as movers of the US Dollar. Higher 10-year yields are positive while a flattering of the yields curve, a rise in the two-year vs. the 10-year, is US Dollar negative.

Here are the top US events as they appear on the forex calendar:

Japan: GDP and the safe-haven role

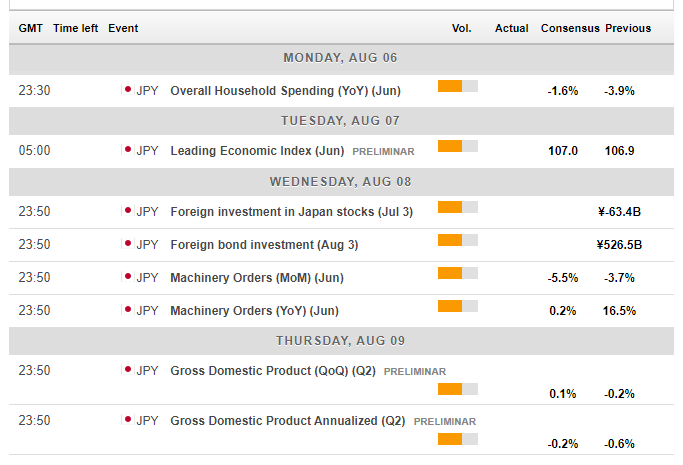

The Japanese economic calendar features events every day. While the yen moves more on the BOJ, stock markets, and geopolitics, there are a few notable figures. Overall Household Spending on Monday is set to fall once again while the Leading Economic Index on Tuesday carries expectations for a rise.

Foreign investment in Japanese stocks was negative while bond investment was positive. It will be interesting to see the fresh data.

The preliminary GDP figures for Q2 will be of more interest. Economic growth was likely meager last quarter, only 0.1% QoQ. Year over Year, markets expect 0.5%.

The yen's behavior is tentatively changing back to its traditional role: a safe haven currency. Another fallout between the US and China will thus boost the yen while negotiations could send it lower. It was somewhat hard to note this reversion in a week that featured so many other events. A calmer week may test this old/new reaction function.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

The USD/JPY continues trading above uptrend support, and this serves as a bullish sign. Other indicators are also upbeat: the pair is above the 50 and 200-day Simple Moving Averages, the Momentum is positive, and only the Relative Strength Index (RSI) is listless.

All in all, the bias is somewhat bullish.

The early-August high of 112.15 coincides with the support that the pair enjoyed while trading on higher ground in July. Further above, 113.20 was the peak in July. Looking to higher ground, we are back to levels last seen in January, 113.45.

111.40 capped the pair in mid-May and continues playing a role. Further down, 110.50 held the USD/JPY from falling in late July. 110.25 was a low point in early July and defends the round 110.00 level.

USD/JPY Sentiment

The Fed is hawkish and the BOJ is dovish, but that does not imply gains. A lot depends on trade relations between China and the US and the reactions in stock markets. The ongoing tensions are likely to balance any upside movements.

The FXStreet forex poll of experts shows a bullish tendency on all time frames. In addition, targets have moved up since last week's poll, but mostly for the short-term.

Related Forecasts

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.

-636688831389350686.png)