- The GBP/USD is trading above 1.3000 level after the US Nonfarm payroll report came out mixed tilted to the downside while the Bank of England Governor Mark Carney said Brexit uncertainty is “uncomfortably high.”

- The UK manufacturing and services PMI fell in July with the surprising uptick in construction activity.

- The Bank of England dovish rate hike on Thursday made no cushion for Sterling as Carney emphasized gradual and limited scope for future moves higher.

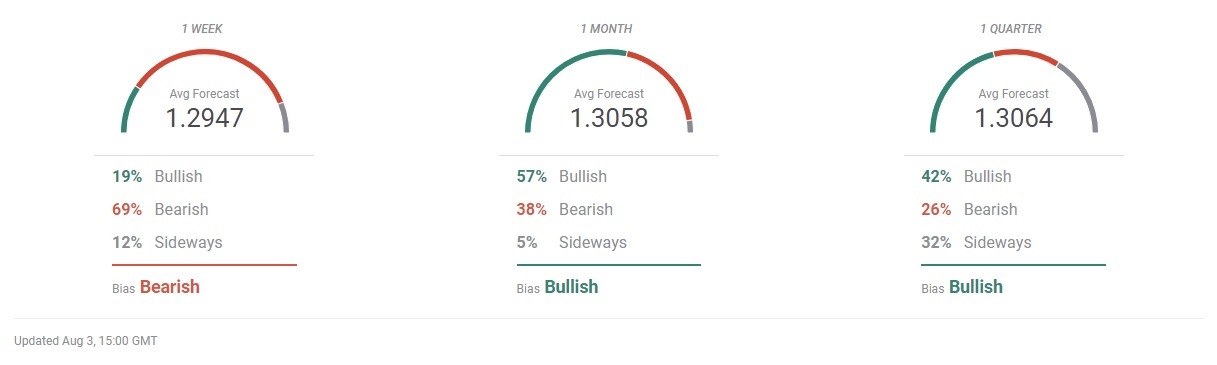

- The FXStreet Forecast Poll turned increasingly bearish after the Bank of England delivered dovish rate hike with stop rate seen at 1.2947 in one week time from now.

Sterling is set to end the first week of August flat near 1.3000 psychologically important level after sliding below that level on weak UK services PMI and the Bank of England Governor Mark Carney comments who said that Brexit uncertainty is “uncomfortably high” on Friday.

Over the whole week, Sterling is about to close 100 pips lower near 1.3000 level after opening near 1.3100 level and jumped as high as 1.3170 throughout the week. The Bank of England raised the Bank rate by 25 basis points in a unanimous vote on Thursday helping Sterling to recover shortly above 1.3120 level. With the Bank of England dovish rhetoric on subsequent press conference saying future rate hikes will only be very gradual and limited, the GBP/USD slumped to 1.3000 area and remained stuck to that level even as it fell as low as 1.2975 intraday on Friday.

It was the Bank of England Governor Mark Carney who stirred the Brexit waters on Friday saying the uncertainty related to Brexit negotiations just 11 weeks before the Brexit deal should be sorted is “uncomfortably high” after repeatedly voicing Brexit uncertainty as a major source of risk to the economic and inflation outlook in the UK in the press conference after Thursday’s August Inflation Report.

On the top of it, the UK services PMI fell unexpectedly sharply to 53.5 in July from 55.1 in June adding to Sterling’s weakness on Friday. The news of falling services PMI added to the previous report on manufacturing PMI that also saw a deceleration in the economic activity in July.

On the other side on the Atlantic, both Federal reserve meeting and Friday’s nono-farm payroll report headlined the week. While the US Federal Reserve meeting kept rates unchanged as widely expected after the rate hike delivered in June, the July employment report came out mixed. Both events had a relatively mild market response as the number of new jobs created in the US came out below expectation at 157K while US unemployment dropped slightly to 3.9% in July and wages rose 2.7% in line with expectations.

While the first week of August was relatively strong in terms of expected data with central banks meetings, the second week of August is expected to be slower. The UK will see the preliminary GDP estimate released for the second quarter of this year while the US inflation data headline next week’s Friday. After the Bank of England hiked the Bank rate sounding relatively optimistic on the UK economic outlook, the UK data on second-quarter GDP and manufacturing output are unlikely to alter the negative trend for Sterling during the course of the second week of August.

Technically, the GBP/USD is moving within a downward sloping trend channel with technical oscillators including Momentum and the Relative Strength Index staying near the neutral zone. The Slow Stochastics has made a bearish crossover in the neutral zone after the Bank of England delivered a dovish rate hike with the outlook for future hikes muted due to Brexit uncertainties and fundamentally weaker UK economy compared with that of the US. The GBP/USD is now expected to sustainably break 1.3000, a psychologically important round big figure to target 1.2950 and 1.2880 further.

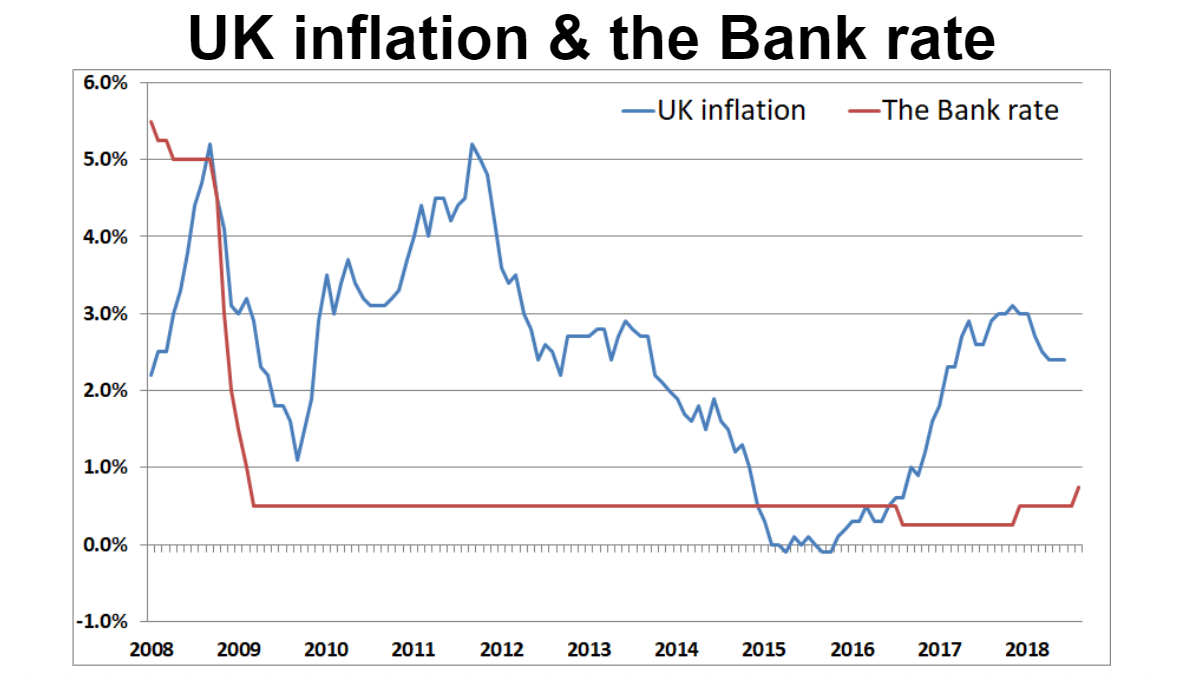

A decade of the UK inflation and the Bank rate

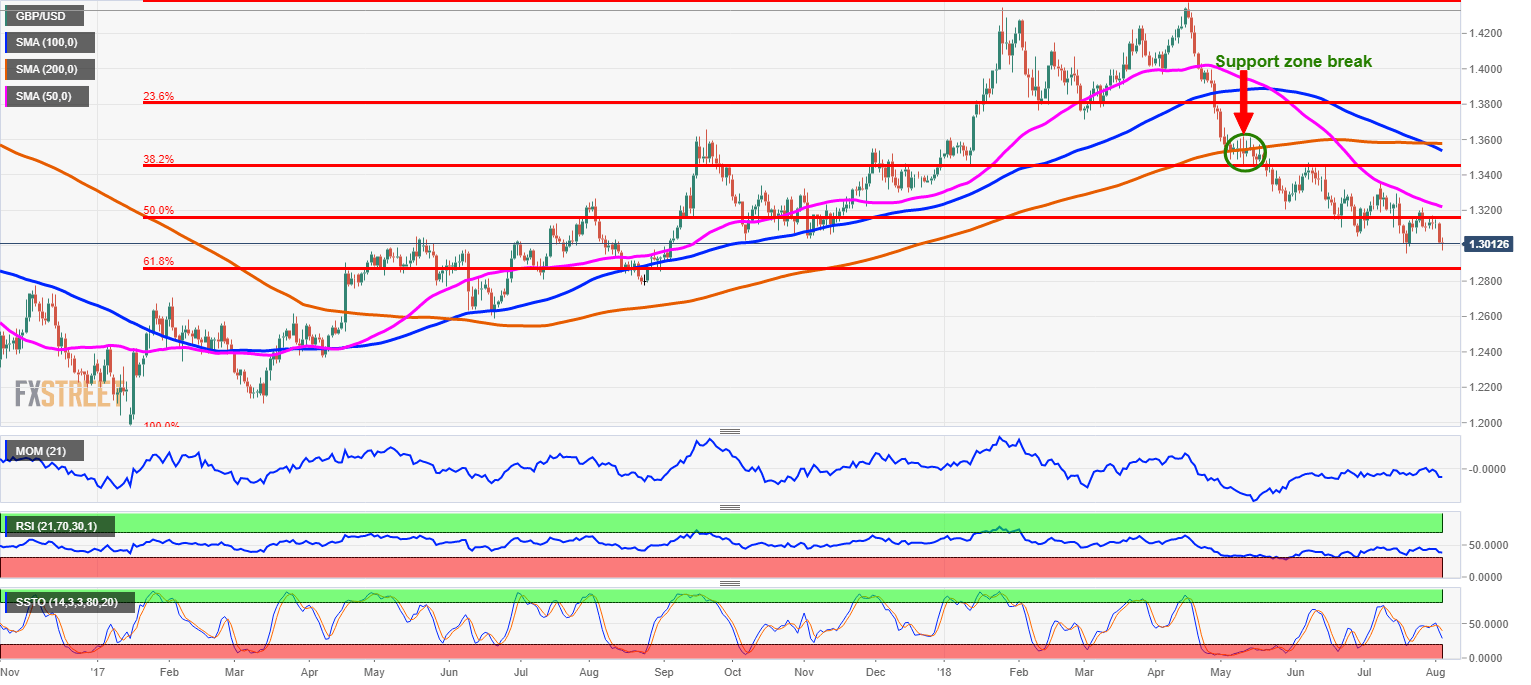

Technical analysis

GBP/USD daily chart

The daily chart saw Sterling open the first week of August at 1.3100 with the uptrend lifting the spot rate to a high of 1.3170 on Tuesday. Slowing economic activity in manufacturing saw Sterling falling below 1.3100 level. Even the Bank of England expected rate hike and the unanimous vote on the Monetary Policy Committee members in voting for a rate hike had the only temporary effect on Sterling that rose to 1.3127 on Thursday. The GBP/USD reversed the course after the rhetoric from the policymakers at the press conference after the August Inflation Report repeatedly accented “gradual and limited” approach to the future path of monetary policy while voicing Brexit deal concerns. Technical oscillators like Momentum and the Relative Strength Index moved lower, but remain stuck in the neutral zone on the daily chart and the Slow Stochastic made a bearish crossover in the neutral territory. The GDP/USD should close below the psychological level of 1.3000 to target 1.2870, representing 61.8% Fibonacci retracement of the uptrend from a post-Brexit low of 1.1940 to 1.4373. On the upside 1.3100 looks to be a solid resistance before 1.3160 representing 50% Fibonacci retracement of above mentioned post-Brexit correction of Sterling higher.

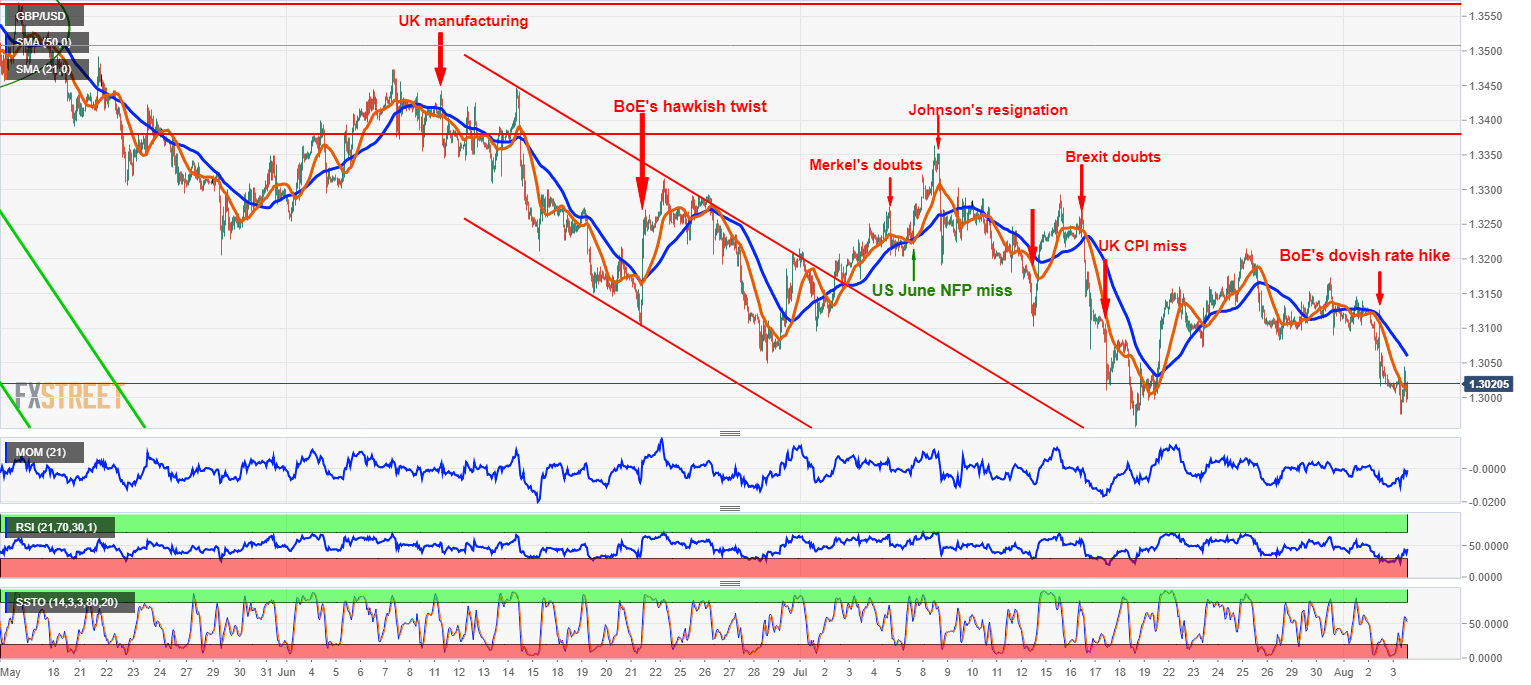

GBP/USD 1-hour chart

The GBP/USD looks a bit less bearish on a 1-hour chart with technical oscillators like Momentum and the Relative Strength Index moving upwards from the oversold positions with GBP/USD stabilizing at around 1.3000 level before the weekend after falling in the wake of the Bank of England August Inflation Report press conference. Both Momentum and the Relative Strength Index are more neutral now and the Slow Stochastics moved from the oversold position with bullish crossover. With spot struggling to break 1.3000 before the weekend, for the future direction the currency pair need to sustainably close below 1.3000 to target 1.2950 next before moving towards 1.2900 round big figure.

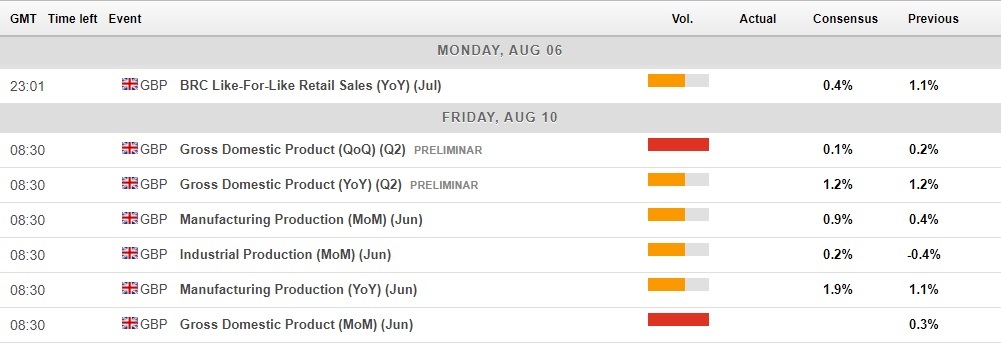

Economic fundamentals in the week ahead

The UK macro calendar for the second week of August includes only Friday’s first estimate of second-quarter GDP that could possibly influence the GBP/USD significantly. The preliminary estimate of Q2GDP in the UK is expected to bring 0.1% Q/Q increase while the UK GDP is expected to rise 1.2% y/y. At the same time, the UK manufacturing output is due next week with expectations pinned to 0.9% m/m increase in June.

UK economic calendar for August 6-10

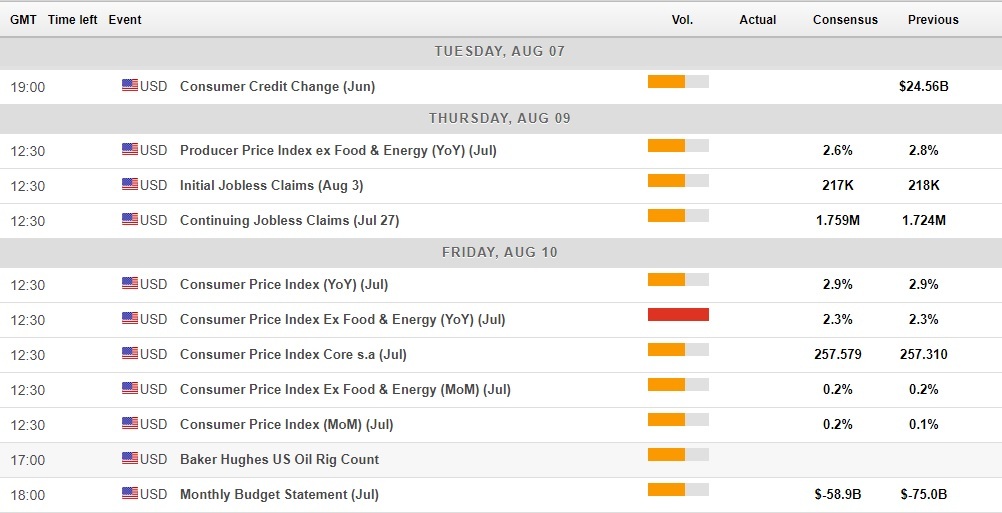

On the other side of the Atlantic, the second week of August is set to deliver mainly inflation indices with both consumer price index and producer price index due. While producers prices are rather volatile, the US core inflation index is the important indicator for the future path of monetary policy.

Next Friday’s consumer price index in the US is expected to increase 2.9% over the year in July while core inflation stripping the consumer basket off food and energy prices is expected to remain steady at 2.3% y/y.

US economic calendar for August 6-10

Forecast for the next week

The FXStreet Forecast Poll for the week ahead turned slightly more bearish for Sterling estimating the exchange rate of GBP/USD at 1.2947, down from 1.3078 last week and with the GBP/USD spot rate at around 1.3020 at the time of finishing this report on Friday afternoon in Barcelona.

While bullish versus bearish predictions distributed 32% of bullish versus 63% of bearish predictions among forecasters participating at the FXStreet Forecast Poll last week, the current forecast for the second week of August expects spot rate to fall to 1.2947 with only 19% of bullish versus 69% of bearish predictions for the week ahead. After the Bank of England hiked the Bank rate to 0.75% delivering dovish outlook for the policy rate, the FXStreet forecasters turned increasingly bearish, with the share of the bullish forecast diminishing.

As long as longer-term forecasts are concerned, the FXStreet Forecast Poll turned back more bearish after factoring in the rate hike prospects saw Sterling falling lower anyway on rate outlook. Compared to last week when FXStreet Forecast Poll saw GBP/USD at 1.3171 in one month time from now, the median forecast for one month is now 1.3058 compared to 1.3031 two weeks ago and compared to 1.3218 three weeks ago. The same bearish turn is seen in predictions for three months time from now, with FXStreet Forecast Poll forecasting GBP/USD at 1.3064 in three months time from now compared to 1.3195 last week, 1.31181 forecasted two weeks ago and 1.3245 predicted three weeks ago.

Related Forecasts

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.