GBP/USD Forecast: Can sterling surge above critical confluence? Trump, Biden hold the keys

- GBP/USD has been recovering as markets await the results of the US elections.

- The upcoming UK lockdown and Brexit are also in play.

- Tuesday's four-hour chart is showing a confluence of lines at around 1.2980.

Make America Great Again Again? Not so fast. It is Election Day and President Donald Trump is facing defeat according to the recent polls. However, while rival Joe Biden's lead is significant in national polls, several critical states are closer.

Markets want to see a decisive election result, preferably giving Biden in the White House and Democrats control of the Senate – critical for passing a generous stimulus bill. That would send the safe-haven dollar plunging and GBP/USD higher.

On the other side the market reaction, the greenback would gain ground if there is no clear winner according to the results and especially if the elections go down to the wire and make their way to the courts.

See 2020 Elections: Three states traders should watch, plus places that could provide surprises

The first scenario, of a quick and decisive Biden victory, would come from southern states. Early voting in Florida, North Carolina, and Georgia surpassed 90% of the total 2016 vote count and counting is quick there. If the former Vice-President wins even one of these states – or even Texas – it is all but over. However, Biden's lead in the south is minimal.

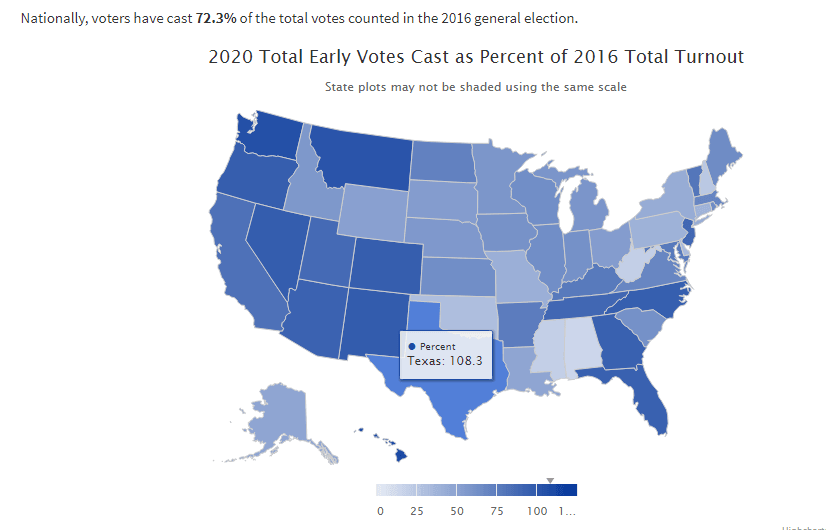

Trump is leading in Texas, but turnout in the Lone Star state is at 108.3% of the 2016 vote, indicating a desire for change:

Source: US Elections Project

If Trump carries the south, the focus shifts to low-early turnout and slow counting northern states. While Wisconsin, Michigan and Minnesota will likely go to Biden, Trump has better chances in Pennsylvania, where legal battles have already been seen in the months leading to election day. Counting in the Keystone State kicks off only on Tuesday.

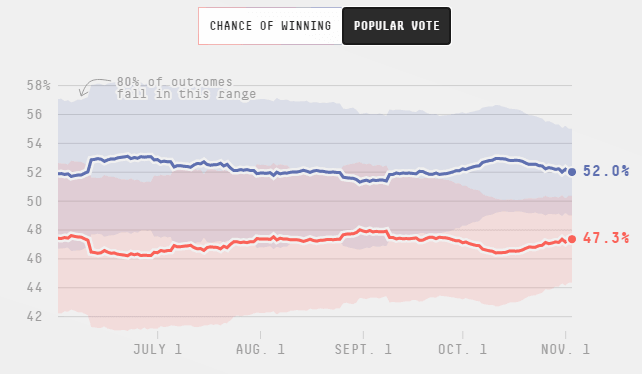

Biden is leading in Pennsylvania, but his support has been eroded in recent days:

Source: FiveThirtyEight

The battle for the Senate will likely be decided in North Carolina, where the race is close as well.

How three US election outcomes (and a contested result) could rock the dollar

The focus on the US elections is overshadowing everything else, yet it is still worth noting that UK Prime Minister Boris Johnson is facing significant criticism for his decision to impose a second nationwide lockdown. The embattled PM's shuttering will likely pass muster in parliament, yet due to votes from the opposition. Coronavirus cases continue rising in Britain and a collapse of hospitals is still feared.

The Bank of England convenes for its "Super Thursday" decision, and more stimulus is on the cards. If the BOE announces negative interest rates, the pound could fall, but more bond-buying would boost it.

See BOE Preview: Lockdown raises chances of negative rates, streling could suffer

Brexit talks continue and in recent days, no news is good news for sterling., The latest reports suggest progress on fisheries and state aid, the thorniest topics.

The focus is on the elections, but after the dust settles, other topics will return to play.

GBP/USD Technical Analysis

Critical resistance awaits at 1.2980, which was both a low point and a high point in late October. Moreover, the 50 and 100 Simple Moving Averages converge at this point. Momentum is to the downside but it has waned, while the pair has recaptured the 200 SMA.

All in all, there is a chance of break higher, but it is far from confirmed.

Above 1.2980, the next lines to watch are 1.3025, 1.3065, and 1.3085.

Support is at 1.2880, followed by the double-bottom of 1.2860 and 1.28.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.