EUR/USD Forecast: How three US election outcomes (and a contested result) could rock the dollar

- EUR/USD may ride on a blue wave and surge.

- A victory for Biden with a Republican-controlled Senate could trigger a moderate downfall.

- Euro/dollar has room to rise if Trump is re-elected.

- The nightmare scenario is that the results of the elections are contested.

The second wave of coronavirus is locking the euro to the downside – but traders have little time to consider the implications of the virus as the all-important US elections are set to rock markets.

President Donald Trump is trailing rival Joe Biden in the race to the White House. However, the race remains open and the reaction depends on two other factors – the Senate, and how quickly the event is settled.

With covid climbing on both sides of the Atlantic, the immediate question for markets is the size of the stimulus bill. Democrats and Republicans seemed to zero in on a massive $2 trillion package but eventually failed to agree and pass it.

Each time headlines suggested an imminent accord, the safe-haven dollar retreated and EUR/USD advanced. When prospects diminished, the greenback received fresh demands, sending the world's most popular pair down. While the recent decline is mostly attributed to new European lockdowns, the lack of relief from Washington is also a downer for euro/dollar.

How will the elections impact the pair? Here are four scenarios:

1) Surfing the blue wave

According to FiveThirtyEight, Biden has an 88% chance of becoming America's 46th president. The model is based on state polls – which matter more than the national mood.

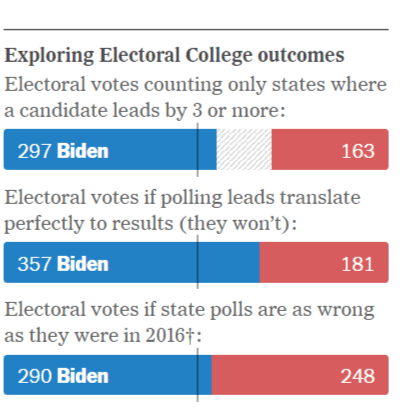

The former Vice-President's lead is robust that he could overcome a 2016-style error in surveys that sent the current president to the White House. According to the New York Times' Upshot, Biden would win 290 electoral votes in case the polls are underestimating Trump like four years ago.

Source: NYT

In such a scenario, Dems would also win the Senate and the House, allowing them full control of the government. They could swiftly pass a generous stimulus bill, either worth around $2 trillion like they were close to signing off with the GOP, or even $3.4 trillion they originally passed in May.

In both scenarios, there is a significant downside for the dollar and upside for EUR/USD. It would also provide relief from the other scenarios that markets fear.

2) President Biden, Republican Senate

The battle for the Senate is considerably closer than the presidency. According to FiveThirtyEight, the center-left party has a 74% chance of flipping the upper chamber, close to what the site gave Hillary Clinton back in 2016. With several tight races, there is room for the GOP to cling onto the Senate.

Source: FiveThirtyEight

In opposition, the Republicans could play hardball and refuse to pass a meaningful package, compromising on $1 trillion they suggested in September or even lower. Moreover, the stalemate in Congress would also weigh on markets.

Euro/dollar has room to fall on concerns that the world's largest economy is not doing enough to rise from the crisis – nor lift the rest of the world.

3) Trump wins, EUR/USD rises

Everybody remembers 2016 – the hopeful Trump base, shocked Democrats, and the rest of the world. While over 70 million have voted a week before the elections, there may still be last-minute movement in favor of the incumbent – or the polls may be skewed to the same direction again.

More 2020 US Election: Polling, history and the submerged Trump vote

According to RealClearPolitics, the gap on the national level is 7.1%, which is not insurmountable:

Source: RCP

In case Trump pulls off another electoral college victory, Republicans are also likely to cling onto the Senate. While Majority Leader Mitch McConnel and his colleagues were reluctant to support the president's efforts before the elections, a fresh mandate could empower Trump to push for a larger package.

In this case, EUR/USD would move higher, albeit not massively.

4) Nightmare scenario – EUR/USD crashes

All the previous scenarios refer to the final outcome. What if there is no agreed verdict? The scenario of a contested election is far from theoretical as Trump refused to commit to accepting the results. He continuously made unsubstantiated claims of fraud and his party tried to limit mail-in ballots, which Democrats rely on more than Republicans.

In case the president wins the perennial swing state of Florida – which is already counting early voting – it would likely go down to the wire in Pennsylvania. The governor of the Keystone State is a Democrat while the legislature is controlled by Republicans.

Who makes the final ruling on rejected ballots, how long the count lasts or calling a recount? These are some of the questions possible in one state. Legal battles could erupt over additional issues in other states as well. Moreover, both Trump and Biden could claim victory.

Eventually, Americans will agree on an outcome, but a protracted process – and potential violence on the streets – could be detrimental to markets. The safe-haven dollar could surge, sinking EUR/USD.

Conclusion

The US elections are critical to the next moves in EUR/USD. The four different scenarios provide unique paths for the currency pair, with high-volatility outcomes looking more likely.

See 2020 Elections: Seven reasons why this is not 2016, time to focus on the Senate

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.