- GBP/USD has been advancing to 1.40 amid a calmer market mood.

- UK Chancellor Sunak's budget and progress on US stimulus hold the keys to the next moves.

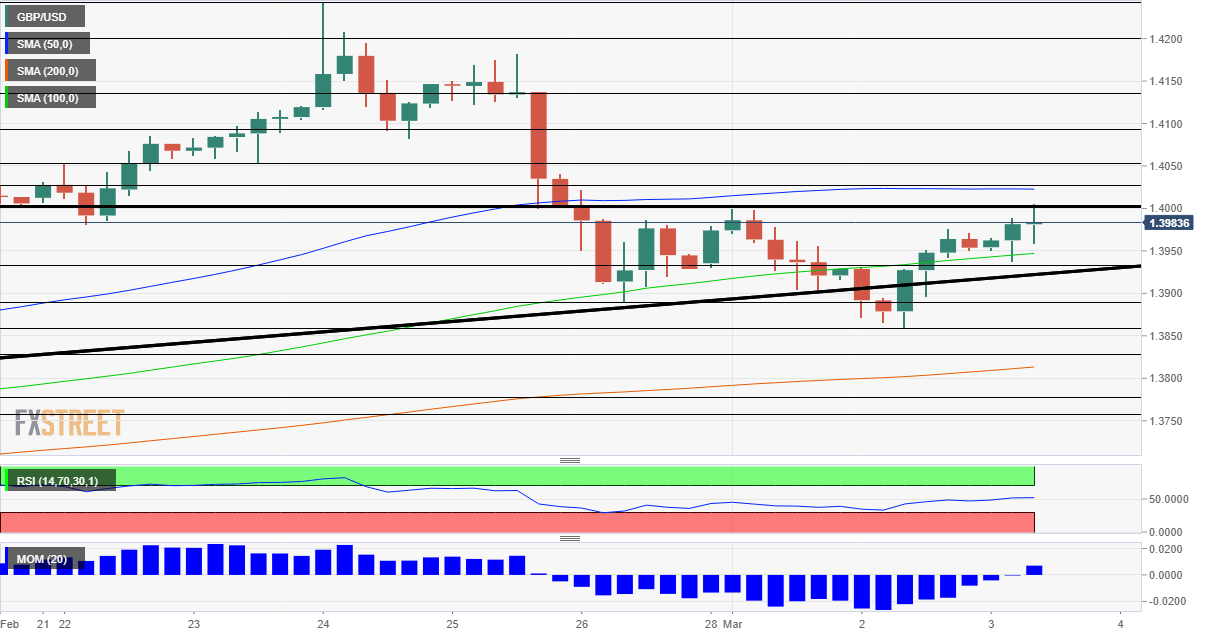

- Wednesday's four-hour chart is painting a mixed picture.

Read his lips – new taxes are coming? UK Chancellor of the Exchequer Rishi Sunak is set to extend the government's successful furlough scheme through September, in a step that would boost the economy and is already helping sterling. However, corporation tax rises remain a mystery.

If Britain hikes levees on companies, sterling's upside move could stall, while leaving a hole in the budget would allow for further gains.

So far, GBP/USD has been able to advance thanks to some calm in markets. US ten-year bond yields have stabilized above 1.40%, allowing the dollar to take a break from its gains. Lael Brainard, Governor at the Federal Reserve, said that the speed of the move in bonds "caught her eye." However, the bank still sees an increase on returns as a positive sign.

One of the main drivers of higher Treasury yields – and the dollar – has been President Joe Biden's $1.9 trillion covid relief package. After passing the House, the Senate is set to begin debating it on Wednesday, and lawmakers are set to strip out or water down some of the measures. How much will be left out? If Democrats unite around most parts of the legislation, the dollar could resume its gains, but if the scope falls toward $1 trillion, the greenback could cool down.

US data is also of interest. The ADP jobs report is set to show an increase of 177,000 private-sector positions in February, a moderate increase that would be in line with expectations for Friday's Nonfarm Payrolls. The ISM Services PMI is set to show rapid growth in America's largest sector – and its employment component is also critical for the NFP. The manufacturing PMI smashed estimates.

See:

- US ADP Employment Change February Preview: How soon will the small business sector bounce?

- US ISM Services PMI February Preview: Expect more than expected

All in all, cable is at crossroads with politicians holding most of the keys toward the next moves.

GBP/USD Technical Analysis

Momentum on the four-hour chart has turned to the upside, providing ammunition for the bulls, which have also pushed above the 100 Simple Moving Average. On the other hand, the psychological cap of 1.40 looms, and so does the 50 SMA.

Above 1.40, the next level to watch is 1.4020, which is where the 50 SMA hits the price. It is followed by 1.4050, which provided support in late February, and then by 1.4095 and 1.4140.

Some support awaits at 1.3935, the daily low, followed by 1.3885, last week's bottom. The weekly trough of 1.3855 is next.

Where next for the dollar as the Fed refocuses, bonds bring action, jobs set to cause jitters

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.