US ADP Employment Change February Preview: How soon will the small business sector bounce?

- Private payrolls to expected to add 177,000, half the October-November average.

- Lead for Friday's Nonfarm Payrolls forecast at 180,000.

- Manufacturing Employment PMI unexpectedly gains in February, highest in 23 months.

- Dollar may get modest boost from strong ADP.

Employment remains at the center of the US economic recovery. The end of December and January lockdowns that crippled hiring are expected to liberate the labor market. The question is how soon?

The clients of Automatic Data Processing (ADP) the largest US private payroll company are forecast to add 177,000 workers in February, following a similar 174,000 increase in January.

ADP and NFP

February's Nonfarm Payrolls are projected to add 180,000 workers after shedding 227,000 workers in December and adding just 49,000 in January, the two worst months of the recovery.

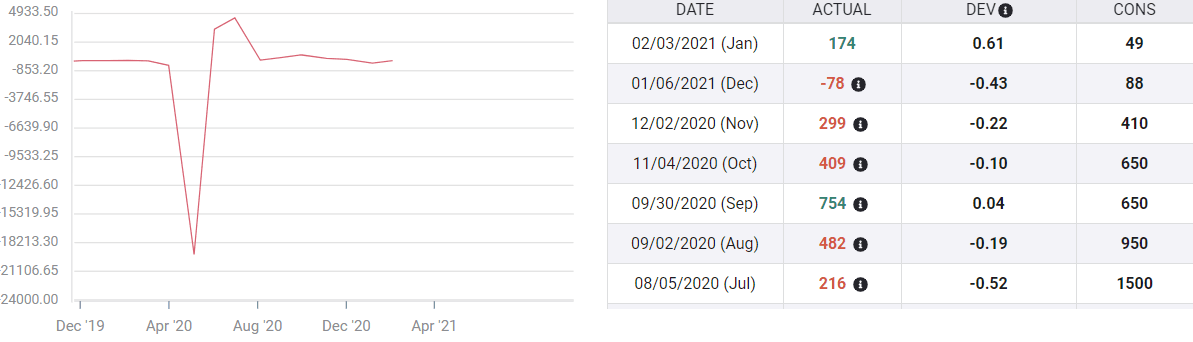

ADP Payrolls

The private payrolls of ADP matched direction over those two months, dropping 78,000 in December and recovering to 174,000 in January. The January total was half the 354,000 average in October and November.

Hiring has declined over the course of the recovery in both payroll counts. The December and January lockdowns and restrictions had a greater impact on NFP's national numbers because they include small business and service positions that do not use the elaborate payroll services of ADP.

Although it is historically uncommon for ADP to add more jobs in one month than NFP, that may become more frequent until the labor market revovery reaches the restaurant, travel and small business sectors.

Manufacturing PMI

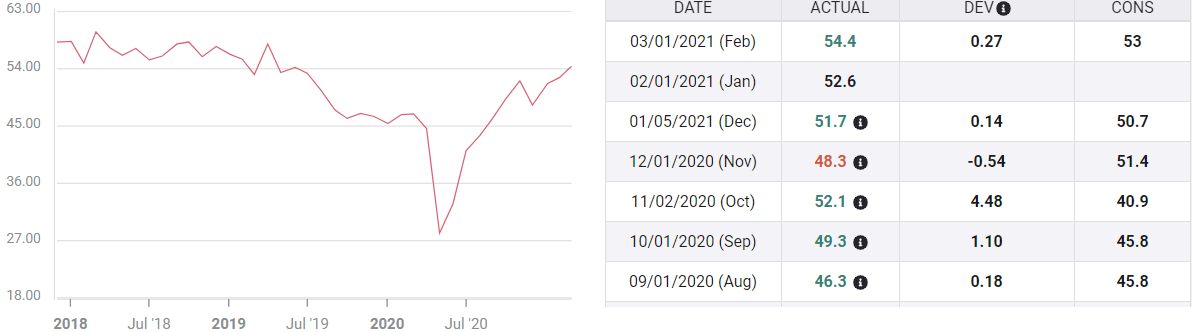

Business optimism in the manufacturing sector has been running ahead of analysts estimates for several months.

In February the overall Purchasing Managers' Index was expected to rise from 58.7 to 58.8. Instead it jumped to 60.8, the best reading in 30 months. New Orders climbed to 64.8 from 61.1. The Prices Paid Index was said to drop to 80 from 82.1, it rose to 86.

The Employment Index was predicted to reach 53 from 52.6, in fact, it rose to 54.4 the highest in 23 months.

Employment PMI

FXStreet

Manufacturing industries, though about 15% of US economic activity, have long been considered a leading indicator for the overall economy. The optimism of factory managers should carry over to the large businesses of service side. The question is the disposition of small businesses.

Conclusion

Markets are keyed on employment. The figures from ADP provide a clue, but not a strong indication of the far more important NFP numbers.The market and dollar response will be modest.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.