- EUR/USD has been on the rise amid optimism about stimulus and the president.

- The presidential elections, US retail sales, and coronavirus on both sides of the pond stand out.

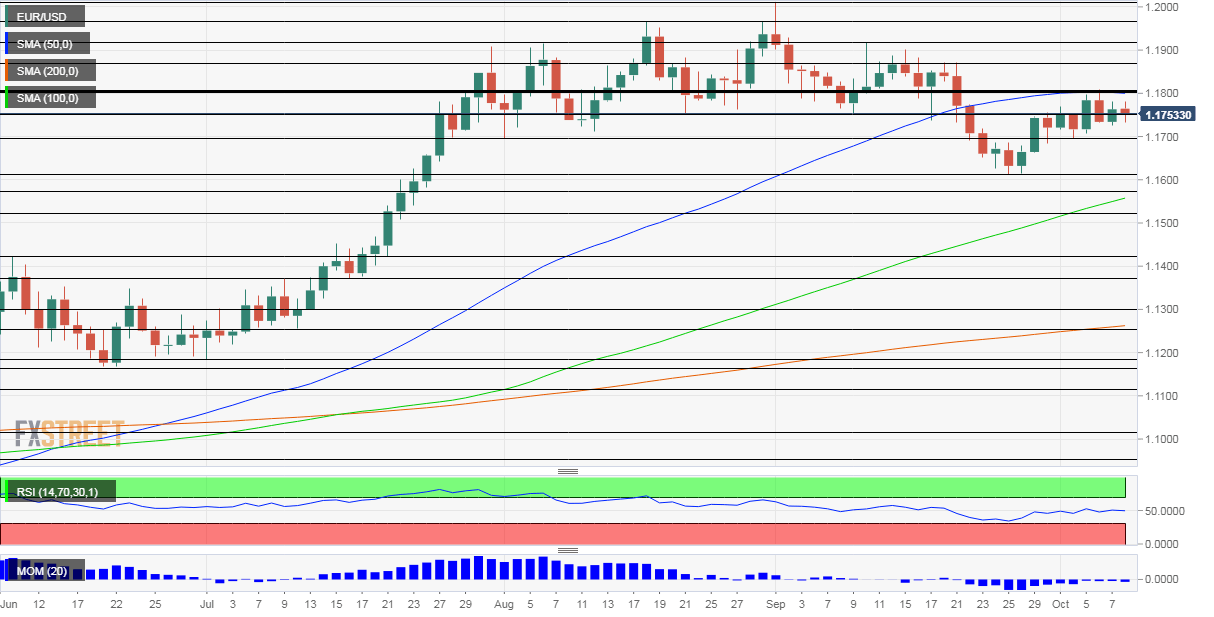

- Mid-October's daily chart paints a mixed picture.

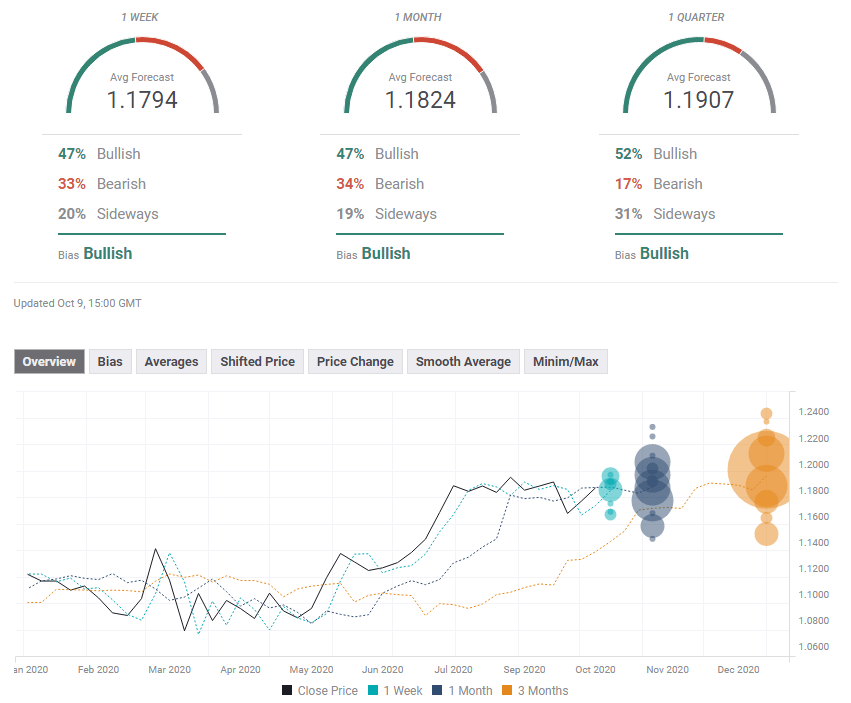

- The FX Poll is pointing to gradual gains for the currency pair.

Deal or no deal? And how is the president doing? Markets were torn with conflicting reports on both fronts, sending the safe-haven greenback up and down. Politics and the virus are set to have a growing impact on EUR/USD in the upcoming week.

This week in EUR/USD: Trump's coronavirus dominates markets

Donald Trump's disease: The president's coronavirus episode gripped global headlines. After receiving strong medications and spending three days in the hospital, Trump returned triumphantly to the White House and sounded upbeat. His doctors insisted he is still "not out of the woods," and fears receded. The safe-haven dollar advanced in response to positive reports and retreated amid concerns that his situation is worse than the strongman's image he would like to portray.

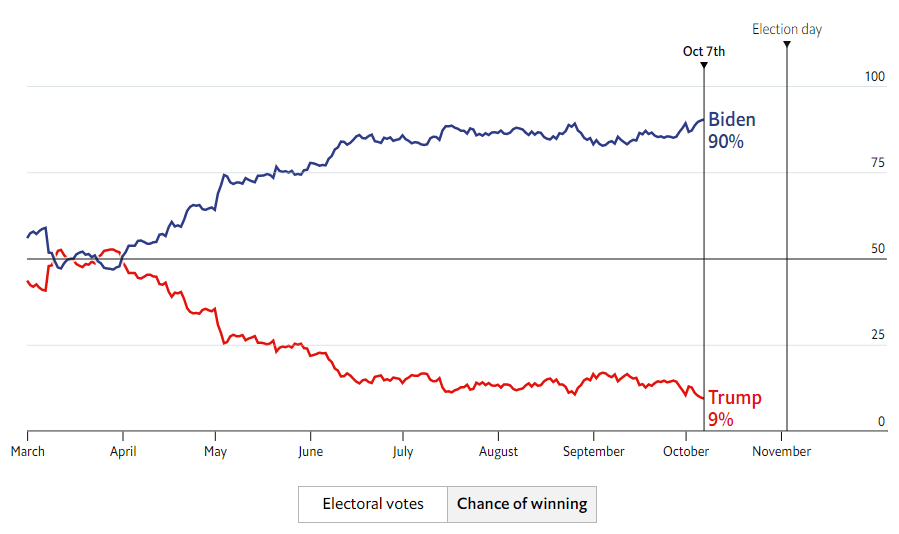

Vice Presidential debate: Both the president and his rival Joe Biden are septuagenarians, and at the age of COVID-19, there is a chance that their No. 2 could step in. The more civilized debate came amid growing chances for Democrats to win a clean sweep. National and state polls showed a shift from a Biden lead to landslide territory. Investors prefer a clear result and more stimulus, something that a "blue wave" can provide.

Biden has a 90% chance of winning according to The Economist´s model:

Source: The Economist

US fiscal stimulus: As also seen in the previous week, the next relief package's fate has a greater impact than politics – often outweighing the Trump's coronavirus condition. Stocks rose, and the dollar dropped while Republicans and Democrats held long talks, until Trump abruptly cut off talks, triggering a reversal. The economy is the single topic in which Trump competes with Biden, and the president's self-harm may still be reversed.

More Who will be the next president? Markets seem to care more about Congress' actions (for now)

After Jerome Powell, Chairman of the Federal Reserve, Trump's surprise urged lawmakers to approve further stimulus and painted a worrying picture of the economy. While the ISM Services Purchasing Managers' Index beat estimates, COVID-19 cases are rising in most US states, and without government support, the recovery could be further derailed.

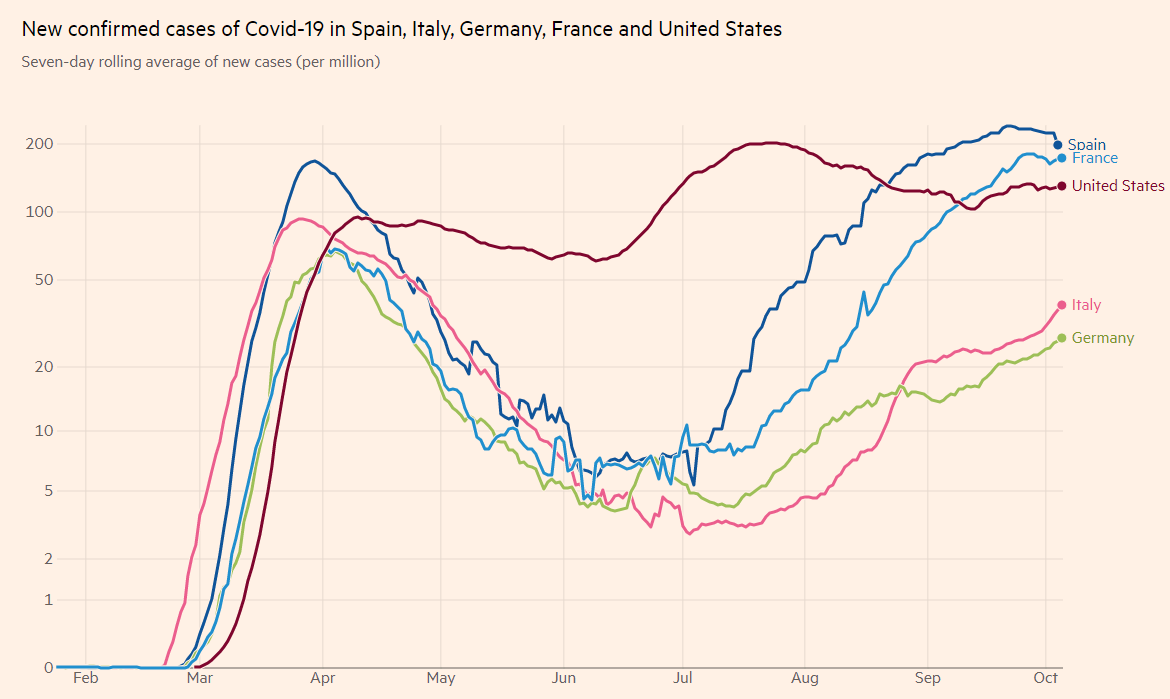

European infections: The eurozone is faring even worse in recent weeks. Bars in Paris were ordered to shutter, and so was nightlife in Berlin. Madrid is under lockdown and remains Europe's hotspot. Spain's Services PMI dropped considerably, potentially serving as the canary in the coal mine for other countries.

Source: FT

Christine Lagarde, President of the European Central Bank, expressed concern about the incomplete and uncertain recovery, weighing on the euro. However, she also reiterated the ECB's position that the exchange rate is not a target, allowing the common currency to stabilize.

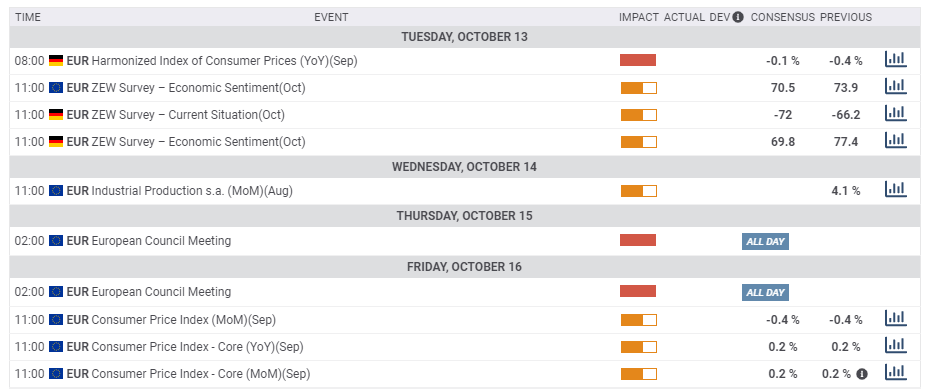

Eurozone events: COVID-19 figures, EU Summit

More restrictions in Europe? Rising COVID-19 infections could result in new limitations in additional countries and cities. So far, the news has hamstrung the euro but did not trigger a downfall. If the uptrend in cases extends, the common currency could struggle. Conversely, if the measures taken in several capitals bear fruit, it could provide relief for the euro.

EU leaders convene on Thursday and Friday with several topics to tackle. Brexit may top the agenda, but it tends to impact the pound than on the euro. The common currency received a considerable boost in July when heads of state agreed on a €750 billion package, including a €500 billion in grants.

Since then, there have been delays in implementation, and pushing the funds forward would boost. Several countries, such as Spain, have already presented plans on how to deploy the money. Disagreements about the rule of law in Poland and Hungary and migration may hobble progress on economic matters.

The German ZEW Economic Indicator is set to edge lower in October after surprising the upside in September. Investors reported struggles at present but were optimistic about the recovery. If the increase in coronavirus cases pushes sentiment lower, it could drag the common currency down with it.

Final inflation figures and industrial output statistics are also of interest, but the focus – like in the US – is on politics.

Here are the events lined up in the eurozone on the forex calendar:

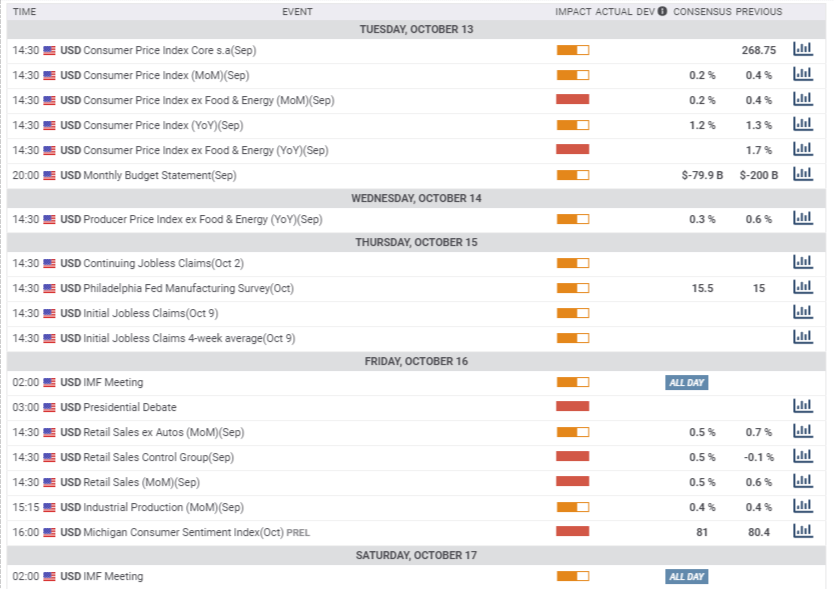

US events: Presidential politics, state of the consumer

It is all about fiscal stimulus – the bigger the package and the sooner it arrives, the more stocks could rise, and the dollar could fall. If Democrats and Republicans get closer and eventually strike a deal, it would boost EUR/USD. On the other hand, a blame game between the parties would weigh on the currency pair.

If Trump sticks to his word and keeps his fellow Republicans away from the negotiating table, it would increase the elections' already growing focus. As mentioned earlier, Biden has a significant lead, and the focus could shift to polls around tight Senate races.

A clean sweep for Dems would likely result in a generous package. Still, if Republicans cling onto the upper house, they would likely become even more opposed to any government spending, rediscovering fiscal discipline after losing the White House.

Trump cannot be written off just yet. While Biden has a robust lead and Americans are already voting, the second presidential debate provides the incumbent a chance to make a comeback. With the president still sick with COVID-19, it is unclear if the encounter occurs and under which conditions. Polls showed Biden enlarging his lead after the first chaotic clash, but that may not necessarily be the case the second time around.

More: State of the race: Where do Trump and Biden stand after the first debates, fast news

US coronavirus statistics may also gain more traction, as they are now rising in most American states as the temperatures are falling. Are consumers refraining from shopping? The University of Michigan's preliminary Consumer Sentiment Index for October could provide insights into the current situation. More importantly, retail sales data for September is set to rock markets.

After disappointing figures in August, modest increases are on the cards for the previous month. Consumption is the vast majority of the US economy, making it a market mover. Moreover, it could shake up fiscal stimulus talks. After August's drop in the Control Group – a core component used for Gross Domestic Product calculations – Republicans raised their offer.

Will bad news turn into good news once again? Investors are set to quickly forget weak data if the result is more government money.

Other figures to watch are weekly jobless claims and industrial output, but political developments are set to have the upper hand.

Here are the scheduled events in the US:

EUR/USD Technical Analysis

Euro/dollar has bounced off the lows but is still not out of the woods. While the currency pair is trading substantially above the 100 and 200 Simple Moving Averages, momentum remains downside.

Critical resistance awaits at 1.1810, where the 50-day SMA converges with the October high. It is followed by 1.1870, a high point in late September, followed by last month's peak of 1.1920. Further above, 1.1965 and 1.2010 await EUR/USD.

Strong support is at 1.17 – a psychologically significant level that cushioned the pair in October and August. It is followed by the September trough of 1.1610, and then by 1.1680 and 1.1530.

EUR/USD Sentiment

Rising coronavirus cases in Europe and the low chances of a fiscal deal in the US imply a higher chance of a downfall for EUR/USD.

The FXStreet Poll is providing showing that experts see a gradual increase, especially in the longer term. The average targets have been marginally upgraded in the past week.

Related Reads

- GBP/USD Weekly Forecast: The art of the no-deal(s) set to send sterling down

- 2020 Elections: How stocks, gold, the dollar could move in four scenarios, nightmare one included

- Elections Matter: The pause that decides

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.