ChainLink Elliott Wave technical analysis [Video]

![ChainLink Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Cryptocurrencies/Coins/Chainlink/Chainlink_Crypto_31_03_XtraLarge.jpg)

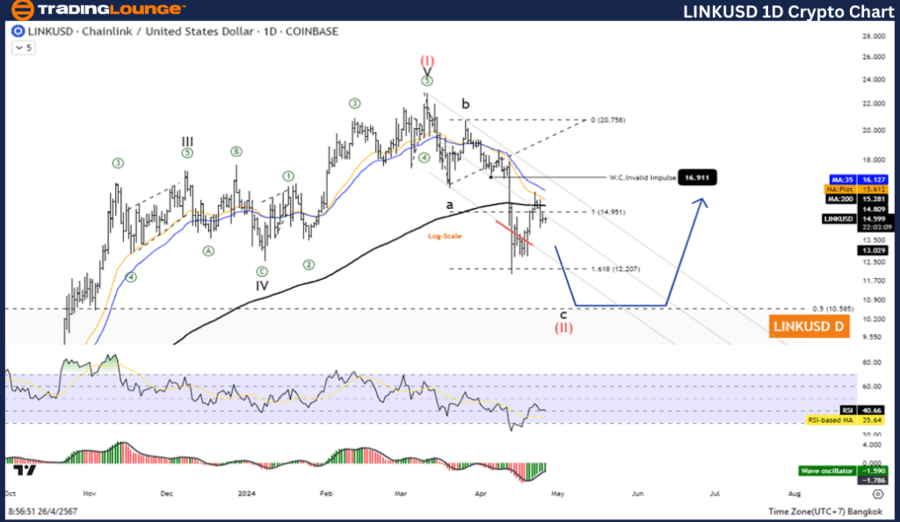

Elliott Wave Analysis TradingLounge Daily Chart.

ChainLink/U.S. dollar(LINKUSD).

LINK/USD Elliott Wave technical analysis

Function: Counter Trend.

Mode: Corrective.

Structure: Zigzag.

Position: Wave C.

Direction next higher degrees: Wave (I) of Impulse.

Wave cancel invalid level: 8.498.

Details: The corrective of Wave (II) is equal to 61.8% of Wave (I) at 8.702 Log scale chart.

ChainLink/U.S. dollar(LINKUSD)Trading Strategy: The second wave correction is likely to go down to test the 10.585 level before rising again in the third wave. Therefore, the overall picture is a short-term pullback to continue rising. Wait for the correction to complete to rejoin the trend

ChainLink/U.S. dollar(LINKUSD)Technical Indicators: The price is above the MA200 indicating a Downtrend, The Wave Oscillator is a Bearish Momentum.

LINK/USD Elliott Wave technical analysis

Function: Follow Trend.

Mode: Motive.

Structure: Impulse.

Position: Wave 5.

Direction next higher degrees: Wave ((C)) of Zigzag.

Wave cancel invalid level: 81.238.

Details: The Five-Wave Decline of Wave ((C)) trend to test 11.582 Leve

ChainLink/U.S. dollar(LINKUSD)Trading Strategy: The second wave correction is likely to go down to test the 10.585 level before rising again in the third wave. Therefore, the overall picture is a short-term pullback to continue rising. Wait for the correction to complete to rejoin the trend.

ChainLink/U.S. dollar(LINKUSD)Technical Indicators: The price is above the MA200 indicating a Downtrend, The Wave Oscillator is a Bearish Momentum.

LINK/USD Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.