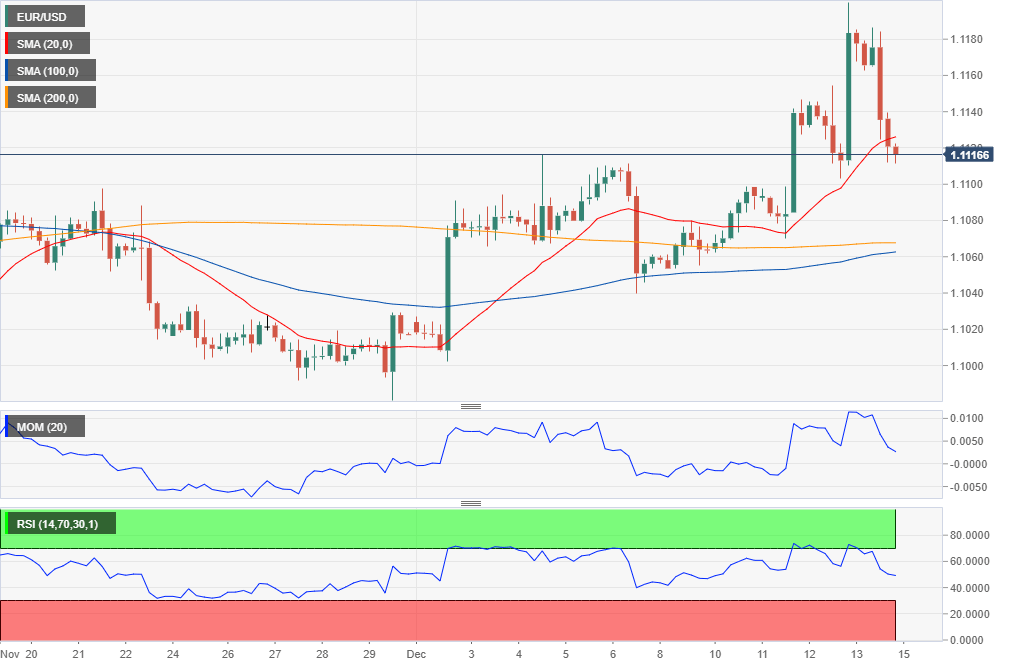

EUR/USD Current Price: 1.1116

- US Treasury Secretary Mnuchin to provide details on phase one of the trade deal.

- Markit will release the preliminary estimates of its PMI for both economies this Monday.

- EUR/USD at risk of losing further ground on a break below 1.1065.

After flirting with 1.120 and reaching a 1-month high, the EUR/USD pair trimmed half of its weekly gains on Friday, ending the day in the red at 1.1116. The dollar tumbled on uncertainty, amid contradictory headlines related to the trade deal between the US and China, later soaring on the back of news indicating that phase one of a trade deal between both economies was reached. Over the weekend, China announced it suspended additional tariffs on the US meant to be implemented this Monday, while the US is expected to do the same, after agreeing to long purchases of US goods, mostly agricultural.

US Treasury Secretary Mnuchin said that details about the deal will soon be released, adding that the new trade relationship with China would be “very good” for global growth, adding that phase two of negotiations will begin immediately. Speaking of which, Markit will release the preliminary estimates of December PMI this Monday for most major economies. For sure, the effects of the trade deal in the world’s economies will take some time to be shown, and investors will likely kick-start the week with optimism, less concerned about numbers have to say, at least for now.

EUR/USD short-term technical outlook

The EUR/USD pair retreated from a multi-week high of 1.1199, a few pips below the 61.8% retracement of its latest daily slump, ending the week below the 50% retracement of the same decline. The daily chart shows that the pair was unable to sustain gains beyond a mild-bearish 200 DMA but holds above the 20 and 100 DMA, both converging around 1.1060. Technical indicators have lost their strength upward but hold within positive levels. In the shorter-term, and according to the 4-hour chart, the downward potential is also limited, as the pair settled a few pips below a still bullish 20 SMA, while technical indicators retreated from overbought readings to settle in neutral levels. The pair would turn bearish only with a break below the mentioned 1.1060 price zone.

Support levels: 1.1100 1.1065 1.1030

Resistance levels: 1.1145 1.1180 1.1210

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.