3 Signs that the stock market could be topping out [Video]

![3 Signs that the stock market could be topping out [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/Sentiment/RiskAversion/stop-sign-against-the-blue-sky-background-80266535_XtraLarge.jpg)

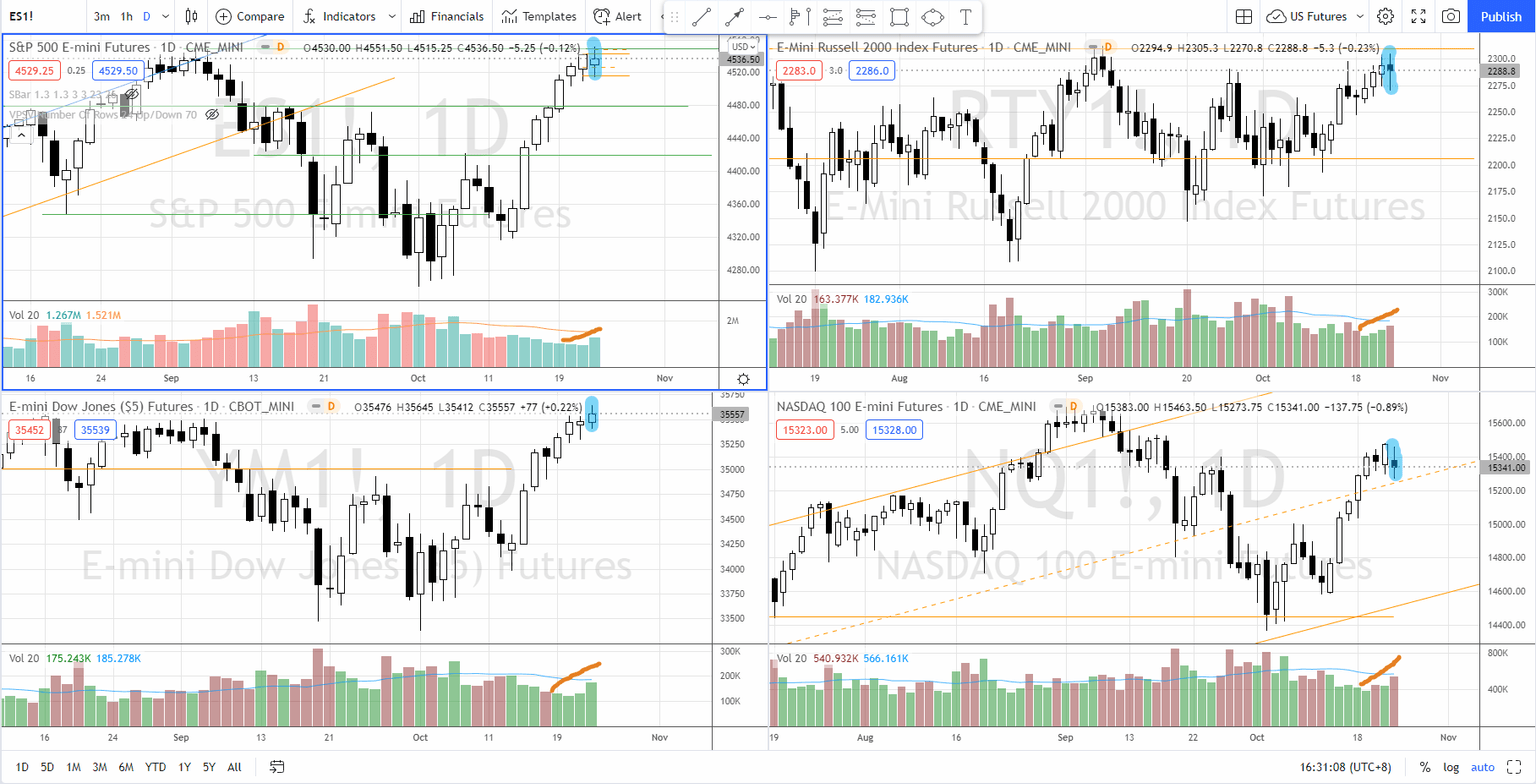

Last week, the 4 major US indices had a smooth rally with low volume suggested there is lacking of supply in the upswing.

This is especially obvious in the S&P 500, as shown in the upper left pane above. However, one thing stands out on last Friday among the 4 US indices:

- S&P 500 futures (ES) tested the all time high at 4550 followed by a mild rejection.

- Dow Jones futures (YM), as shown in the lower left pane, also had a mild rejection despite closing at all time high.

- Russell 2000 futures (RTY) failed to commit above the swing high formed on 15 Oct with mild rejection, as shown in the upper right pane.

- Nasdaq futures (NQ) had slightly larger rejection and also failed to commit above the swing high formed on 27 Sep 2021.

Most importantly, the price rejections for the 4 indices come with increasing of volume, despite not significant yet. The bearish price action together with the increasing volume suggested presence of supply, while happening at the key levels (which are the various resistance for the indices).

The Signs

These are the 3 things one should look for to spot a potential market top because this is the full context of interpreting what’s happening in the market.

- Price action: Bearish or bullish, which is the result.

- Volume: the effort behind the price movement. By reading together with the price, we will be able to interpret which force (supply or demand) is dominating, based on Wyckoff’s law — Efforts vs Results.

- Context: in this case, this price rejection happened at the key levels (all time high, resistance, etc…)

What’s Next

Based on the above, my directional bias for the market is to the downside. The catalyst could be the earnings announcements of the big tech companies. However, I am still waiting for a change of character bar for confirmation and timing. By calling a market top doesn’t mean it will crash from here on. It could be just a normal pullback as a market correction after an extensive run up.

Using S&P 500 as a case study, the immediate support area is at 4420–4480, as boxed up in blue with the possible travel annotated in orange, as shown in the chart above. This could be the most bullish scenario for S&P 500 should it reverse from the top near 4550.

If the support area 4420–4480 fails to hold, it is likely to go back to test the swing low near 4300, with a potential prolong trading range going into next year.

Nonetheless, should indices pullback in the coming week(s), it is the best time to monitor the stocks (that beat the market), which will be the next outperformers when the tide turns. Watch the video below to find out how to analyze the price action with the volume in the market using Wyckoff method:

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.