Zilliqa price faces short-term selling pressure as bears target $0.04

- Zilliqa price could be on the verge of a sell-off, according to various indicators.

- The digital asset is up by more than 200% since November.

Zilliqa had a major bull rally in the past two months, climbing from a low of $0.016 at the beginning of November to a new 2020-high at $0.054, established on December 19. Now, the digital asset seems to be poised for a correction before resuming its uptrend.

Zilliqa price remains inside a daily uptrend but faces short-term selling pressure

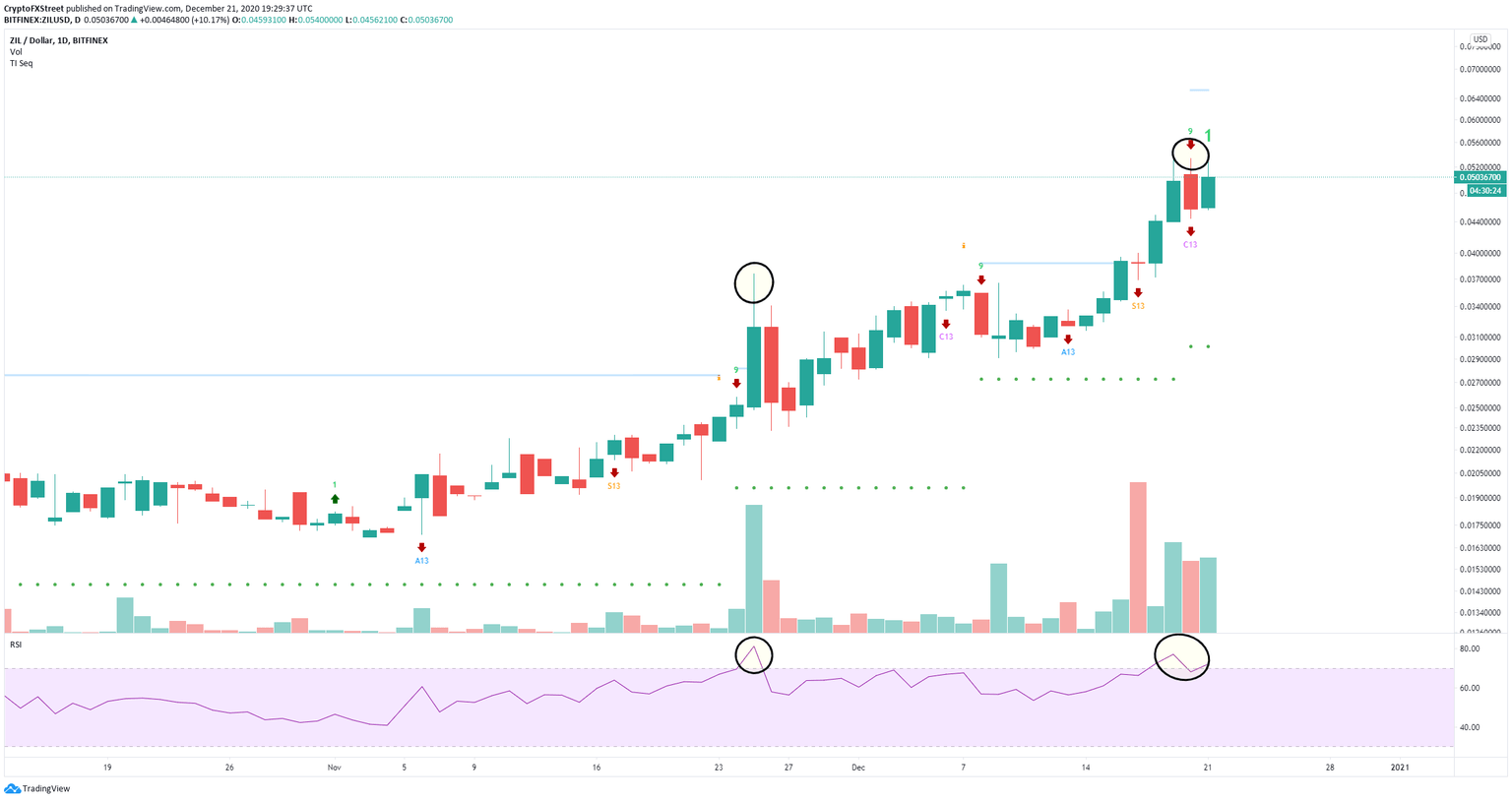

On the daily chart, the TD Sequential indicator presented a sell signal on December 20 which hasn’t been confirmed just yet. Additionally, the RSI has hit overextended levels for the first time since November 25, when ZIL experienced a significant sell-off.

ZIL/USD daily chart

Considering how extended the daily chart is, Zilliqa price seems bounded for a correction down to the next psychological level at $0.04. Nonetheless, bulls are still in control over most time frames.

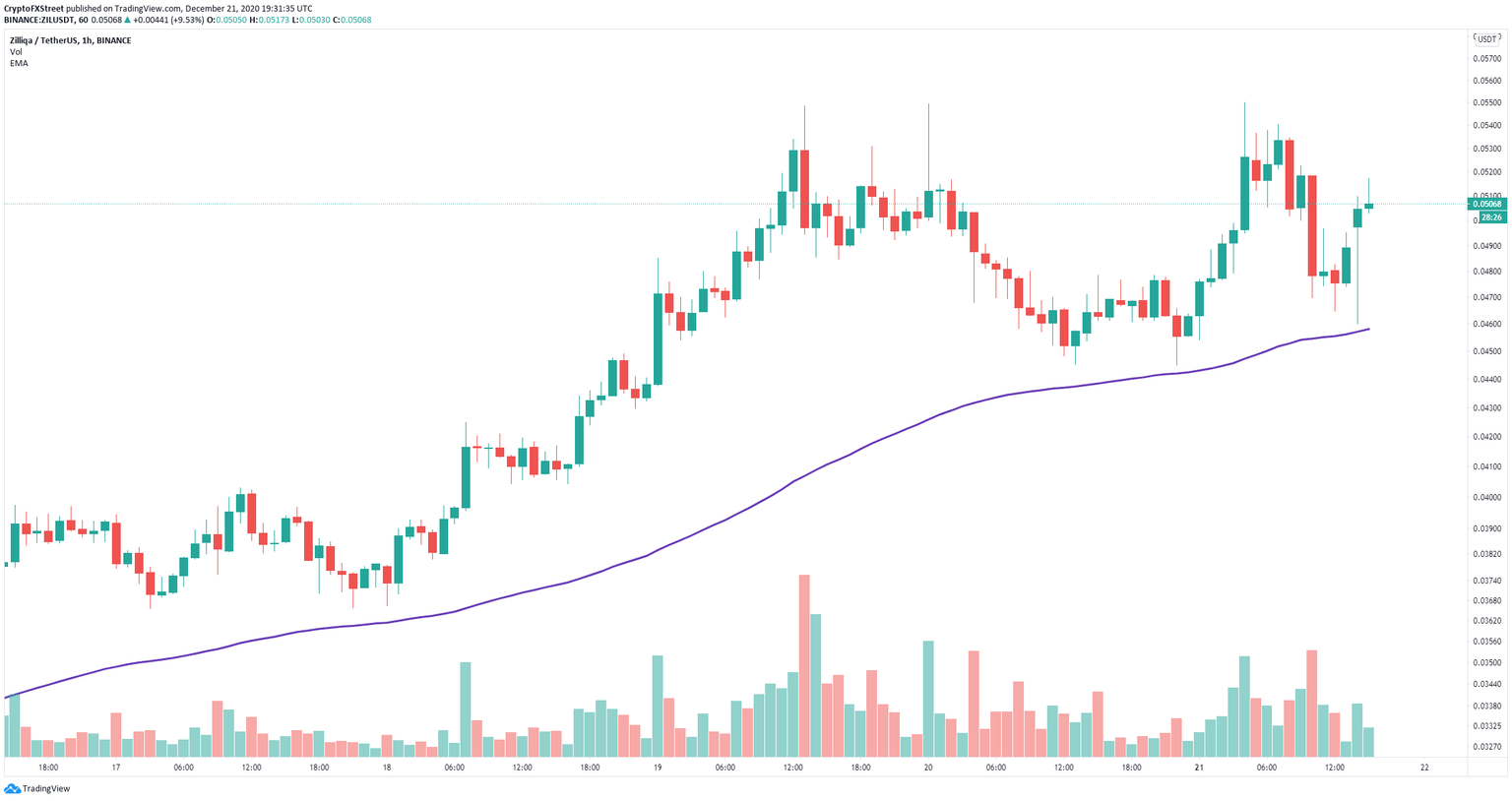

ZIL/USD 1-hour chart

On the hourly chart, the uptrend remains intact as bulls have defended the 100-EMA several times in a row in the past two days. The next clear resistance level is the high at $0.054. A breakout above this point can quickly drive Zilliqa price towards $0.06.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.