Zilliqa Price Prediction: ZIL makes a strong case for a 1,000% bull rally after rising to new yearly highs

- Zilliqa hits a new all-time high amid strong bullish momentum.

- The price may retreat to $0.028 before the growth is resumed.

Zilliqa (ZIL) price hit a new all-time high at $0.0397 on Wednesday before reversing to $0.037 by the time of writing. Zilliqa, the 50th largest digital asset with the current market value of $406 million, has gained over 15% on a day-to-day basis. It is the best-performing token out of top 50.

The project offers permissionless blockchain with the throughput of thousands of transactions per second. The platform hosts many decentralized applications and allows staking and yield farming.

Zilliqa enjoys bullish technical signals

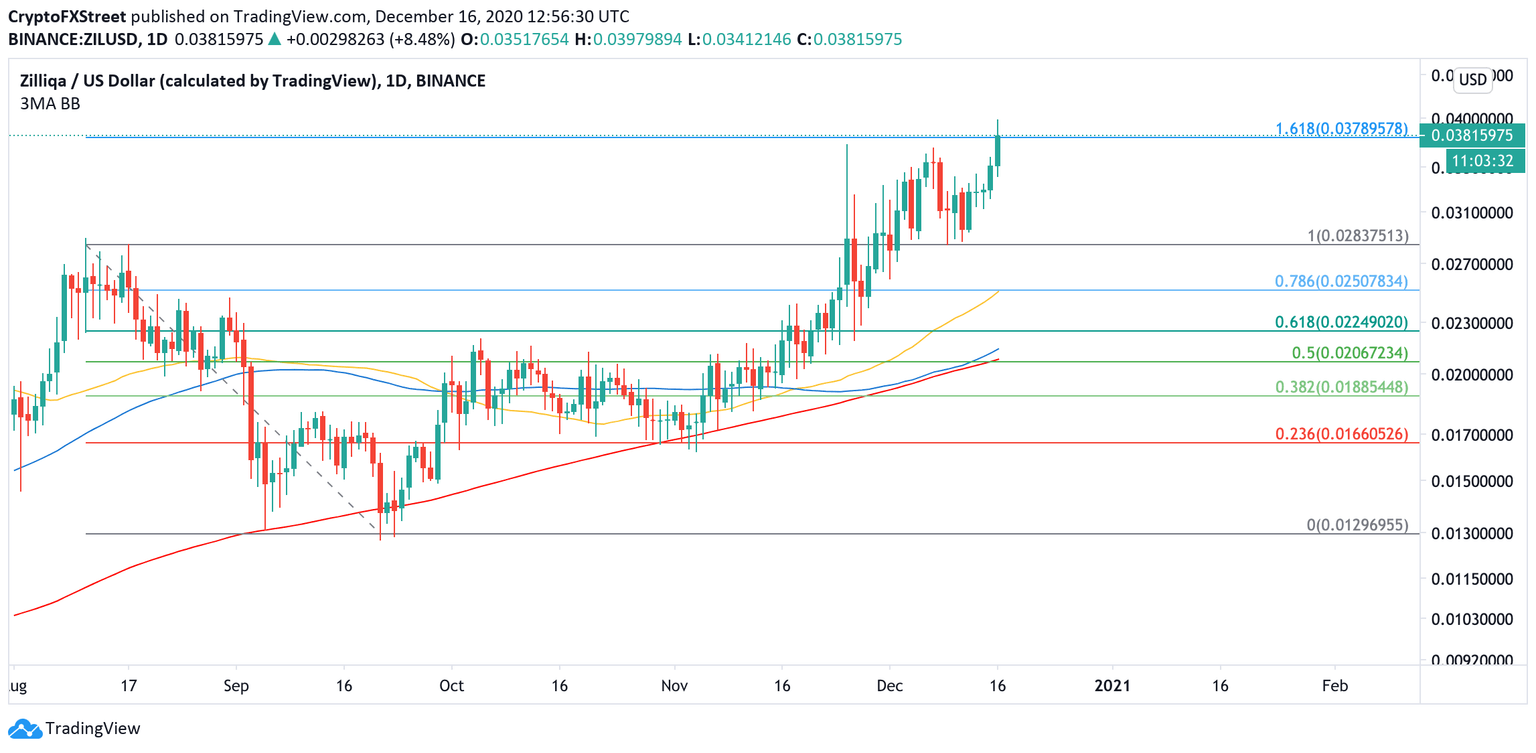

In the past couple of months, Zilliqa's price increased by nearly 200% and settled above 1.618 Fibo projection for the downside move from August 2 high to September 20 low.

As FXStreet previously reported, Zilliqa's price faced intense selling pressure after the TD Sequential indicator presented a sell signal on December 6. However, the correction proved to be short-lived as the price bottomed at $0.0284 on December 9 and resumed the upside move.

ZIL/USD daily chart

As the bullish momentum faded away on the approach to critical resistance of $0.04, ZIL may retreat to the channel support at $0.028. This barrier is also reinforced by 100% Fibo for the above-mentioned move. If it gives way, the next bearish price target of $0.025 will come into focus. This support coincides with the 78% Fibonacci retracement level and also the daily 50 EMA.

On the other hand, the rebound from $0.028 will bring attention back to $0.04 and take ZIL into uncharted territory with the potential of a 1,000% rally.

Author

Tanya Abrosimova

Independent Analyst