XLM Price Prediction: Stellar coiled and ready to spring

- XLM price consolidation provides an early warning that a breakout is about to happen.

- Two hypothetical trade ideas were identified – one long and one short.

- Traders look to capitalize on any clear move.

XLM price remains one of the most underwhelming major cryptocurrencies and a laggard with respect to its most recent price action. XLM is currently positioned for ideal trade setups on the long and short sides of the market. The two trade ideas identified in this article are based on two different sized Point and Figure charts.

XLM price has profit potential for bulls and bears alike

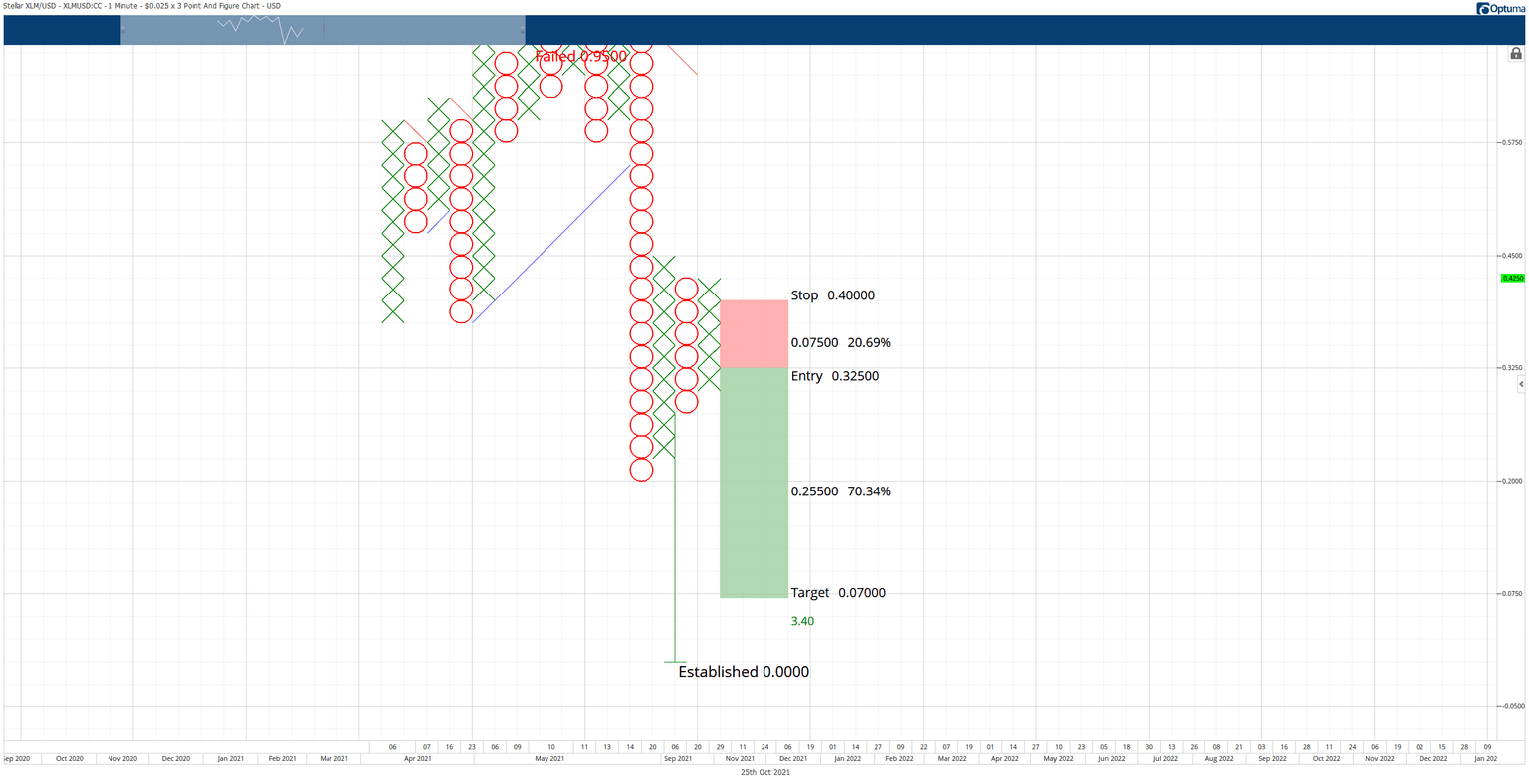

XLM price action shows there is a hypothetical trade idea for the short side of the market. The $0.025/3-box Point and Figure chart shows a constriction of price action with a possible bearish continuation pattern on the 3-box reversal. The short idea is an entry at $0.3250, a stop loss at $0.4000, and a projected profit target at $0.0700. This is the least likely setup, given the bullish nature of the aggregate cryptocurrency market.

XLM/USD $0.025/3-box Reversal Point and Figure Chart

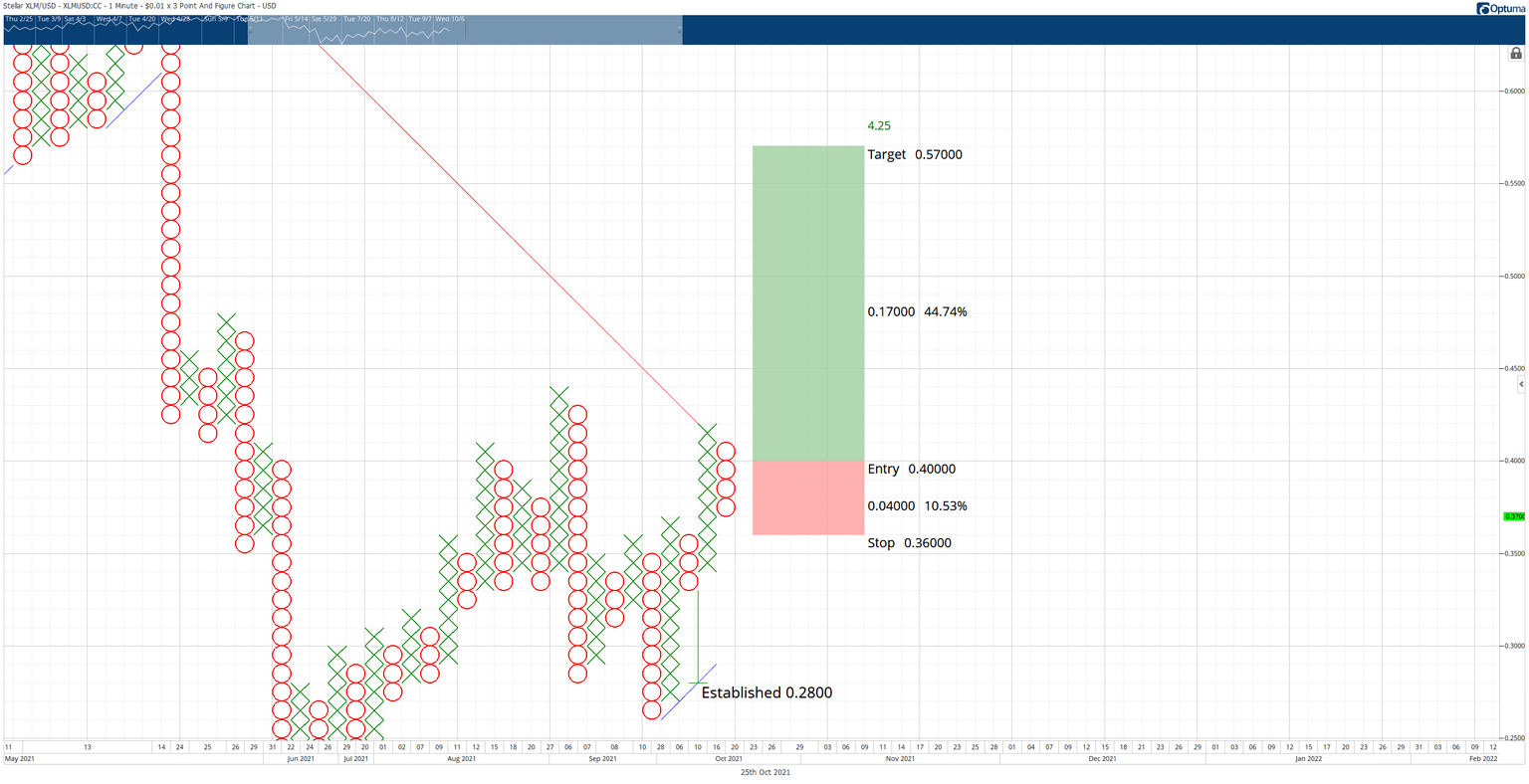

On the long side of the trade, XLM has a very ideal bullish setup. The most recent X-column broke the dominant bear market angle and converted the $0.01/3-box Point and Figure chart to a bull market. The current O-column is the first pullback from that bullish breach. The hypothetical trade for the long side of the market is the 3-box reversal of Xs. Currently, that entry would occur at $0.4000 with a stop loss at $0.3600 and a projected profit target at $0.57.

XLM/USD $0.01/3-box Reversal Point and Figure Chart

The long entry idea has the highest positive expectancy rate given the present trend and overall sentiment. Additionally, the $057 target may be entirely too conservative given that XLM price has been a significant laggard and has yet to create a new all-time high.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.