VeChain Price Analysis: VET builds colossal liftoff to new record highs

- VeChain bulls are focusing on the recent ascending triangle breakout.

- Short-term technical signals like the MACD cross reinforced the bullish narrative.

- Closing the under $0.05 and, by extension, the 100 SMA on the 4-hour chart would lead to a spike in selling pressure.

VeChain is nurturing an uptrend after the key technical breakout. Recovery has been gradual but consistent since support was established at $0.036. Several resistance levels have been pushed into the rearview as VET eyes new record highs.

VeChain bulls push for a 39% upswing to new all-time highs

VeChain consolidated within the confines of a descending wedge pattern followed the dip from the record high of $0.61. Although this particular triangle pattern is usually bearish, VET bulls managed to pull a breakout above the hypotenuse.

The ascending triangle pattern comes into the picture when the asset consolidates above horizontal support (x-axis). On the other hand, the price prints a lower high pattern illustrated using a descending trendline.

Following the break above the hypotenuse, VeChain hit a snag at $0.055. At the time of writing, the token is exchanging hands at $0.051, while bulls push to complete the more than 39% breakout target to $0.064.

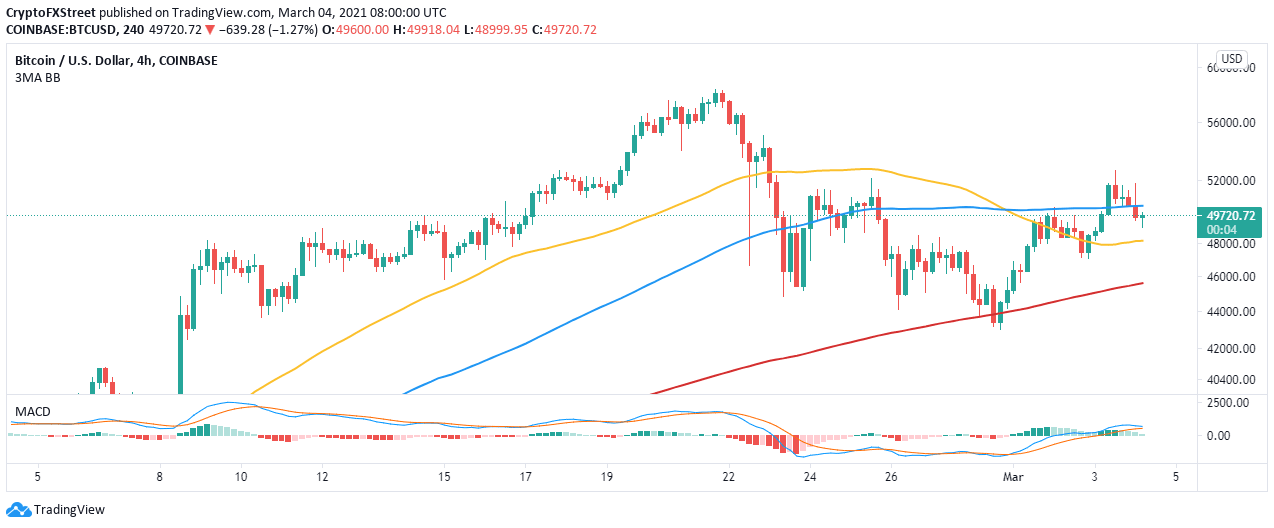

VET/USD 4-hour chart

The Moving Average Convergence Divergence (MACD) has remained steadfast in the recovery from the negative region. Besides, the MACD cross above the signal reveals that buyers have the upper hand. If this trend momentum indicator remains bullish, investors will be encouraged to leave the sidelines and buy-in for gains above $0.06.

Looking at the other side of the fence

As mentioned above, VET faces some challenges in the breakout to $0.064. Particularly the selling pressure at $0.055. On the downside, immediate support at $0.05 helps to keep the bears in check.

If push comes to shove and the bearish leg extends under the short-term support, it will trigger selling orders. Another critical support that must be guarded at all costs is the 100 Simple Moving Average (SMA) on the same 4-hour chart. Losing this support will be a big blow to the progress made in the last couple of weeks and might lead to a $0.04 and $0.036 support area being tested.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren