SafeMoon Price Prediction: SAFEMOON may crash before bulls’ comeback

- SafeMoon price tried reversing the downtrend and surged 27% but failed to follow through.

- SAFEMOON is likely to retrace 23% toward the lower range at $0.00000357 before looking to rally higher.

- If the bulls come to the rescue here, there is a chance the altcoin will rally 56% to the resistance level at $0.00000559.

SafeMoon price is currently undergoing a sell-off after getting rejected by an immediate supply barrier. The sellers’ conviction will decide how much SAFEMOON will drop before the buyers come to its rescue.

SafeMoon price on the lookout for support floor

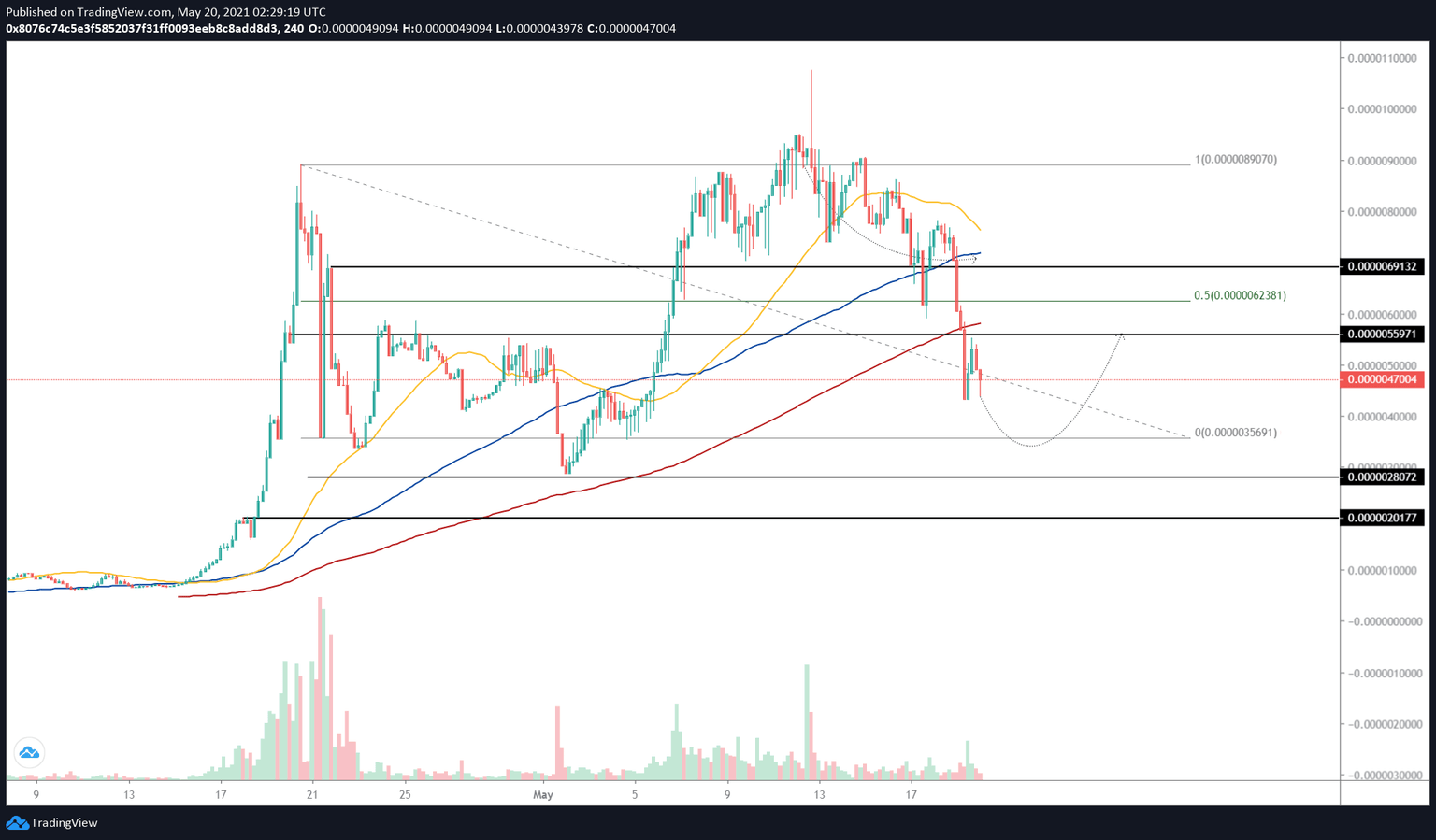

SafeMoon price sliced through 200 four-hour Simple Moving Average (SMA) at $0.00000581 as the market tumbled Wednesday due to a massive meltdown. However, SAFEMOON established temporary support at $0.00000433. From here, the altcoin rallied 27% but faced a swift rejection by the immediate resistance level at $0.00000559.

So far, SAFEMOON has dropped 18%, but this descent could continue up to the lower range at $0.00000357, a 24% decline from the current price ($0.00000470). This support floor could serve as a point of inflection, allowing the bulls to make a comeback. However, under dire circumstances, SafeMoon price could drop down to the next support at $0.00000280 like it did on May 2.

Therefore, investors can expect this altcoin to begin its uptrend from either of the two demand barriers mentioned above. The potential ascent will stretch roughly 55% from the lower range at $0.00000357 or 100% from $0.00000280.

SAFEMOON/USDT 4-hour chart

While the bullish narrative seems farfetched, it is not out of the realm of possibilities. However, if the sellers push SafeMoon price below $0.00000280, it will invalidate the bullish thesis and signal that the sellers are running free.

In such a case, market participants could expect SAFEMOON to pull back 27% to the next support level at $0.00000202.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.