SafeMoon Price Prediction: SAFEMOON may rally 25% as it approaches key levels

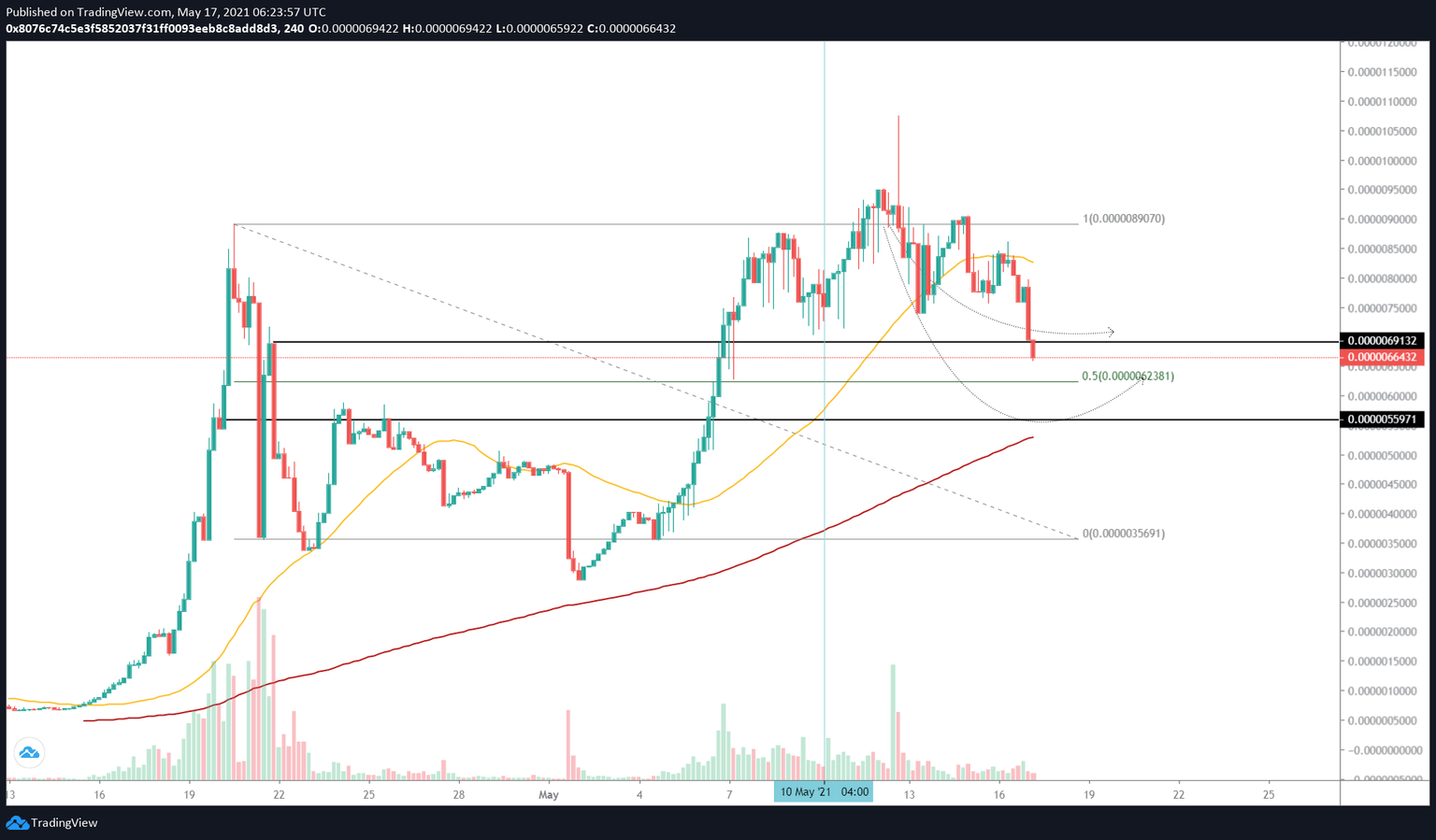

- SafeMoon price has dropped 17% today and is currently trading around the support barrier at $0.00000691.

- A continuation of this downtrend could place it at the 50% Fibonacci retracement level at $0.00000623 or the subsequent demand floor at $0.00000559.

- The levels mentioned above will most likely provide a foothold for SAFEMOON to pull a 180.

SafeMoon price has approached one of the three key levels that could trigger its reversal to the upside. SAFEMOON has stayed relatively uncorrelated to the recent market crash as it underwent a consolidation from May 8 to date.

SafeMoon Price vies for rally

SafeMoon price has sliced through the 50 four-hour Simple Moving Average (SMA) at $0.00000825 and is currently testing the $0.00000691 support level.

A breakdown of this barrier could lead to a 9.3% downswing to $0.00000623. This bearish descent could most likely tag the demand barrier at $0.00000559 if the bears keep piling up their ask orders.

Although it is unlikely for all three levels to be breached, under dire circumstances if this were to happen, the 200 four-hour SMA at $0.00000529 will be the last line of defense. Therefore, investors need SafeMoon Price to stay above this level to keep the bullish outlook intact.

While a bounce from either of the four levels is possible, the first primary area of interest will be the 50 four-hour SMA at $0.00000825. If the bullish momentum persists after this critical ceiling is breached, market participants could see SAFEMOON surge another 8% to tag the upper boundary at $0.00000890.

SAFEMOON/USDT 4-hour chart

A breakdown of the 200 four-hour SMA at $0.00000529 will invalidate the upswing and most likely result in a steep downtrend.

Considering the next area of support at $0.00000490 is not stable, SafeMoon price will most likely consolidate here briefly before dipping lower.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.