SafeMoon price may retrace 25% as bulls fail to establish dominance

- SafeMoon price surged roughly 145% over the past five days.

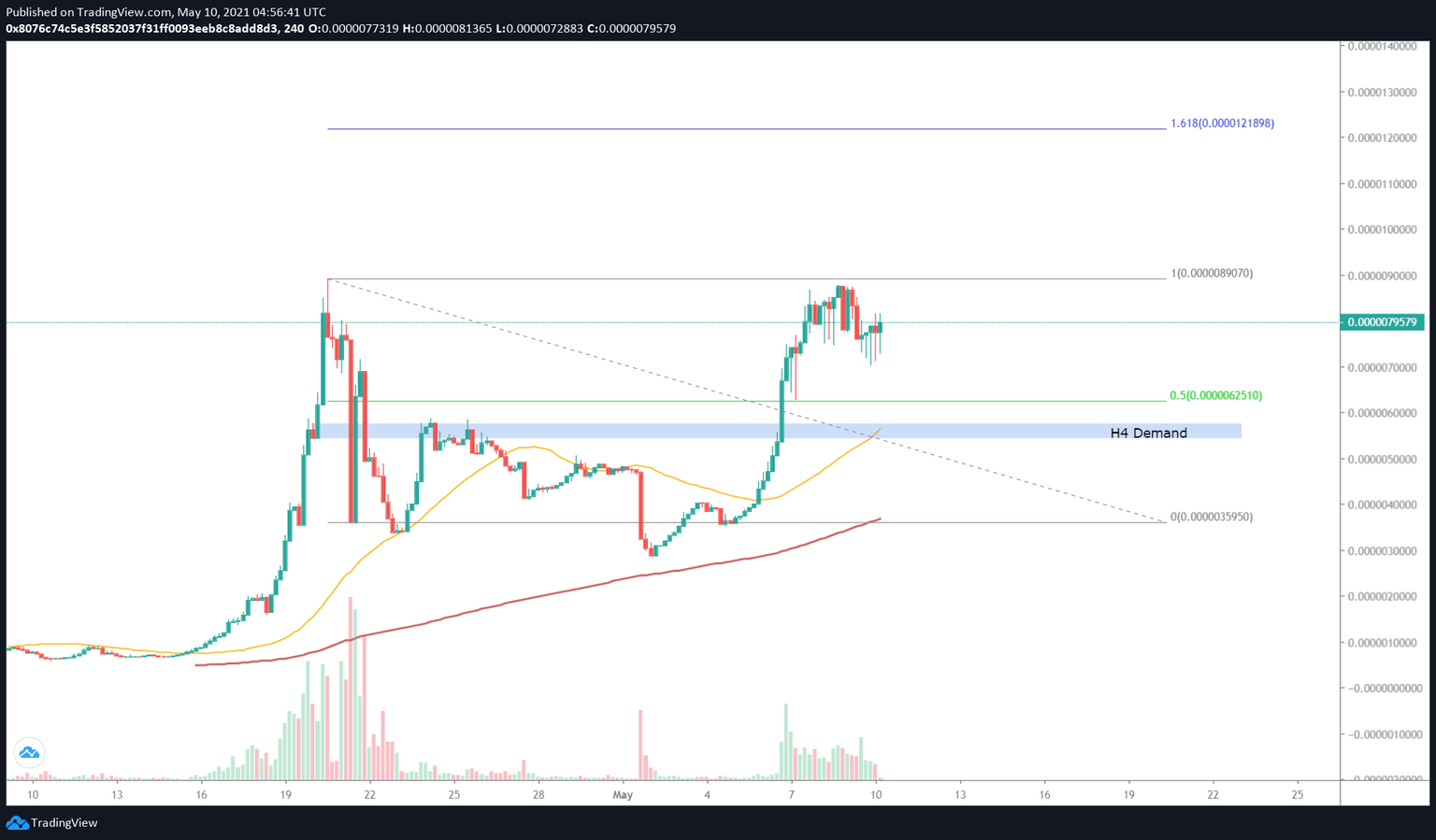

- This rally failed to produce a higher high above the previous swing point at $0.00000890, signaling weak bullish momentum.

- SAFEMOON is likely to correct 25% to the demand zone, extending from $0.00000543 to $0.0000075.

SafeMoon price shows a massive rally that pushed it to the recent local top. However, the inability of the buyers to propel it past this crucial level might lead to a pullback.

SafeMoon price calms down before heading lower

The 4-hour chart shows SafeMoon price is hovering around $0.00000784 after setting up a lower low at $0.00000876. Hence, any short-term upswing will allow the buyers to tag the recent local top, but anything beyond that seems unlikely.

Therefore, investors can expect this altcoin to slide toward the 50% Fibonacci retracement level at $0.00000625. Breaching this floor will push SafeMoon price toward the demand zone, extending from $0.00000543 to $0.0000075. In total, this downward move would constitute a 25% pullback.

Interestingly, this support area has the 50 four-hour Simple Moving Average (SMA) at $0.00000564, which promotes the likelihood of an upswing.

If this rally produces a decisive 4-hour candlestick close above $0.00000890, it will signal a resurgence of buyers.

In such a case, SAFEMOON could rally 36% to tag the 161.8% Fibonacci extension level at $0.0000121.

SAFEMOON/USD 4-hour chart

A breakdown of $0.00000543 support floor will signal the invalidation of an upswing. Under these circumstances, SafeMoon price might crash 30% toward the 200 four-hour SMA at $0.00000359.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.