SafeMoon price plummets and remains trading sideways while interest fades away

- SafeMoon has been one of the fastest growing cryptocurrencies reaching a multi-billionaire market capitalization in a few days.

- The success of the coin prompted hundreds of other projects to fork it.

- The digital asset remains trading sideways but loses interest.

SafeMoon had a huge success reaching more than 1 million holders and a multiple billion-dollar market capitalization. The digital asset has been so successful that hundreds of new projects have forked it and copied springing a huge wave of scams and frauds.

SafeMoon price could be on the verge of extinction

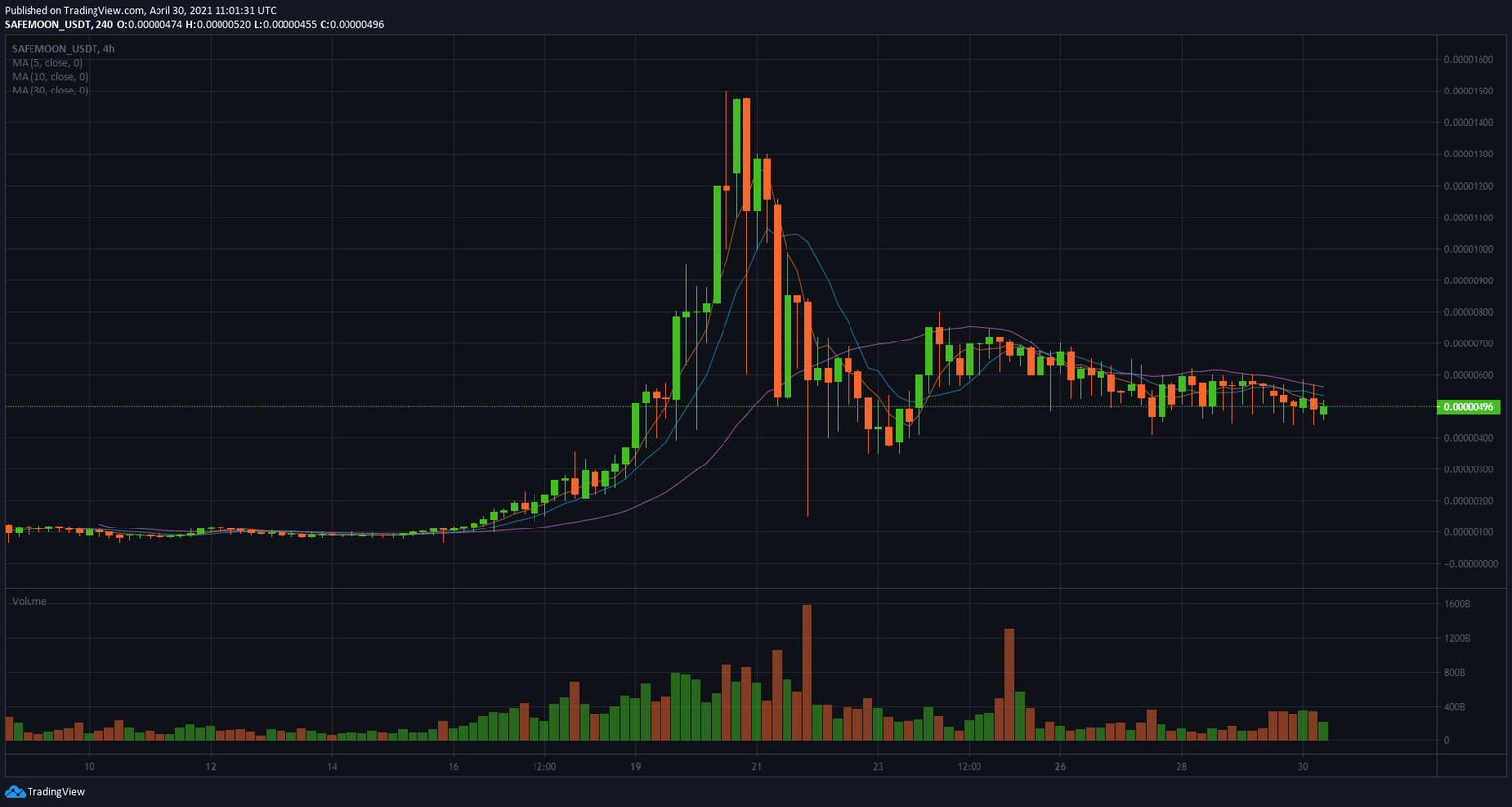

After reaching an all-time high price of $0.000015 on April 20, SafeMoon plummeted by 75% and was unable to recover since then. The digital asset remains trading sideways and holds a $2.8 billion market capitalization at the time of writing.

SAFEMOON/USD 4-hour chart

Another concerning factor is the social volume of SafeMoon which played a big role in its initial rally. Since its most massive peak on April 21, the digital asset’s social volume has declined significantly which could be a warning sign.

SAFEMOON Social Volume

On the 4-hour chart, the digital asset formed a symmetrical triangle pattern which is on the verge of a massive breakout or breakdown. A 4-hour candlestick close below $0.0000047 would confirm a breakdown which has a price target of $0.0000002, a 58% descent.

SAFEMOON/USD 4-hour chart

On the other hand, a breakout above the upper boundary of the channel should drive SafeMoon price toward $0.0000085.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.11.31%2C%252030%2520Apr%2C%25202021%5D-637553782260573824.png&w=1536&q=95)