Safemoon could be poised for a return to $0.0000016

- Safemoon price action is a leader in how much it has lost from prior swing highs.

- Regular bullish divergence is present between the price chart and a fundamental oscillator.

- Strong buyer participation at $0.000001.

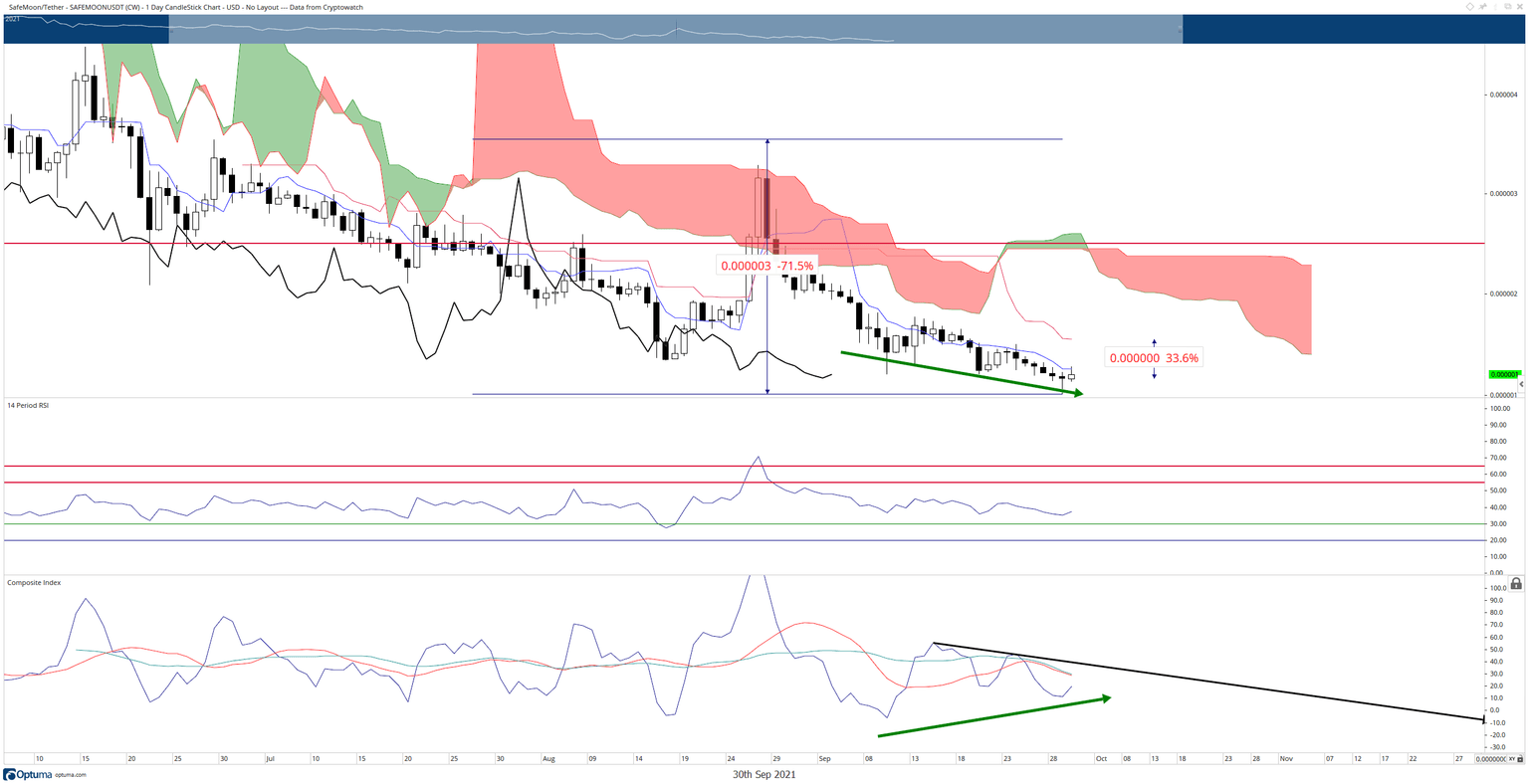

Safemoon price has lost over 71% of its value from the August 28th high. Although the broader cryptocurrency market has seen between 40% and 50% losses, Safemoon is a leader in both speed and amount of value that has been wiped out. However, there is some evidence that bounce may come.

Safemoon price action has buyers eyeing a move from $0.0000012 to $0.0000016

Safemoon price could surprise the cryptocurrency space by initiating a move higher. It has spent the last twelve consecutive trading days with closes below the Tenkan-Sen and finally saw a significant spike south to hit the $0.000001 exactly – a new all-time low. A large amount of resting limit buy orders were sitting at $0.000001, and the low very quickly got bought up. The critical level buyers need to overcome is the Tenkan-Sen.

If buyers can support Safemoon price above the Tenkan-Sen at $0.0000013, the oscillators may support a sustained move to $0.0000016. The Relative Strength Index is currently in bear market conditions but is relatively flat. However, the Composite Index shows higher lows while the candlestick chart shows lower lows – regular bullish divergence. Additionally, if the Composite Index crosses above the trendline, Safemoon price will likely have enough momentum to hit the target area.

SAFE/USDT Daily Ichimoku Chart

The bullish scenario is contingent on Safemoon first remaining above the Tenkan-Sen. Until that happens, bears remain in control and will continue to put selling pressure on Safemoon price. The bullish outlook will be invalidated if Safemoon price fails to close above the Tenkans-Sen or if it creates new all-time lows.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.