Ripple price remains stuck in second gear

- Ripple price erased its recovery from last week's soft patch.

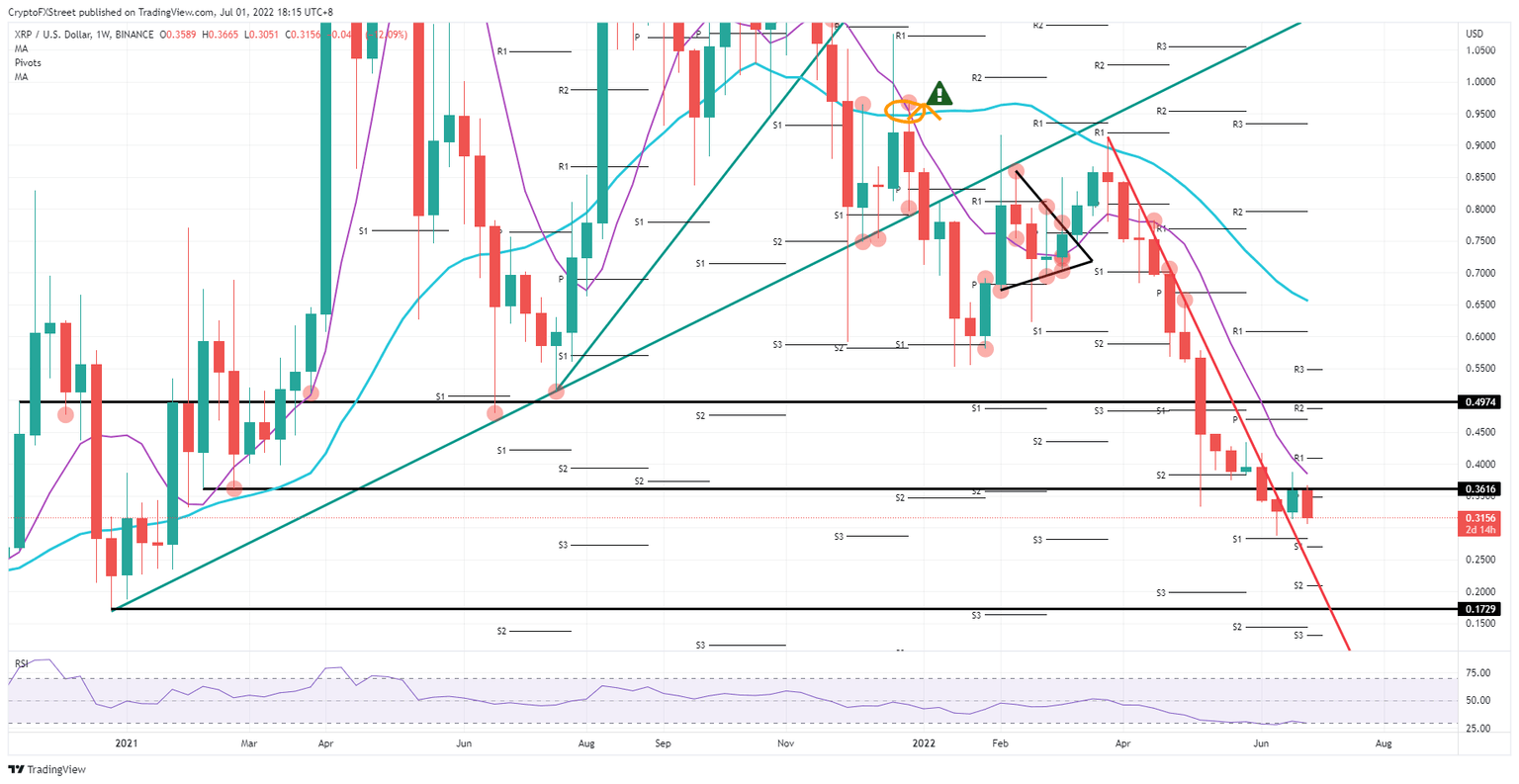

- XRP price broke below last week's low and looks set to go for a new yearly low.

- With the pivots for July coming in so close to one another, a breakout is due anytime now.

Ripple (XRP) price looked to go for some solid gains and a set of consecutive weekly gains on the back of last week's price action. However, the soft patch got cut short quite quickly and turned out in a complete reversal to the downside, erasing all gains and even performing a bull trap against investors that went long XRP on the break above $0.3616. With price action this week having broken below last week's low, the recovery has been broken anyway, and more downside room is open now, possibly printing new lows for the year.

XRP price is set to drop another 15% next week

Ripple price has smashed a lot of investors' dreams this week as global markets made sure that traders are reminded that the current tail risks can flare up that easily and set the record straight that this pain trade is not over but rather entering the next phase. As the weeks evolve, it becomes more and more clear what the game plan going forward will be: The US will go for a controlled recession while Europe will let inflation run wild and rely on the back of time will heal all wounds, and meanwhile we will try to do something against it, but do not get your hopes up to high. Time will tell who had the right strategy, but for now, the big cash exodus continues out of cryptocurrencies.

XRP price on a purely technical basis will shed some more value in the coming weeks. As a new month has started, the pivot levels have been recalibrated for July, and from the looks of it, a breakout is bound to happen soon. The monthly pivots have less room between them than the previous month, pointing to price action getting squeezed towards each other and a slowdown in volatility, making the S1 at $0.270 an excellent candidate to limit XRP price from in the worst-case dropping towards $0.1730.

XRP/USD weekly chart

As mentioned in the above paragraph, the monthly pivot levels are nearing each other sharply, indicating a breakout is due at any moment. That could as well be a breakout to the upside. As the volume dies down over the summer months, bulls could seize this momentum to pump price action higher as bears are absent, tanning on the beach and having their burgers grilled, and lift price action to $0.4974 printing 59% gains on the back of that.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.