Litecoin price will end in tears this evening as naive bulls get a market lesson

- Litecoin price turns negative halfway through the European session as a meltdown in sterling creates ripples in the markets.

- LTC price will slip below $50 if dollar strength continues towards the US closing bell.

- Expect to see a negative weekly close with a possible further breakdown over the weekend.

Litecoin price (LTC) sees bulls being taken to the cleaners as an early rally gets cut short and turns completely negative. The catalyst appears to have been UK Chancellor Kwarteng’s speech which triggered a meltdown in sterling with ripple-effects extending throughout financial markets. This is proof, yet again, that cryptocurrencies are fully entangled with the dynamics of global markets, and dedicated cryptocurrency traders would do well to dive into their history books and learn about how to trade a global recession.

LTC price drops as sterling relives 1992

Litecoin price is diving lower as GBP is painting screens red reliving its famed 1992 meltdown. UK Chancellor Kwarteng announced more spending, with a view to easing household budgets by the UK government picking up a large portion of the energy bill for them. Inadvertently, Kwarteng has increased inflation expectations, as households will likely spend the savings, leaving the BoE hanging out to dry with no clue on what to do next.

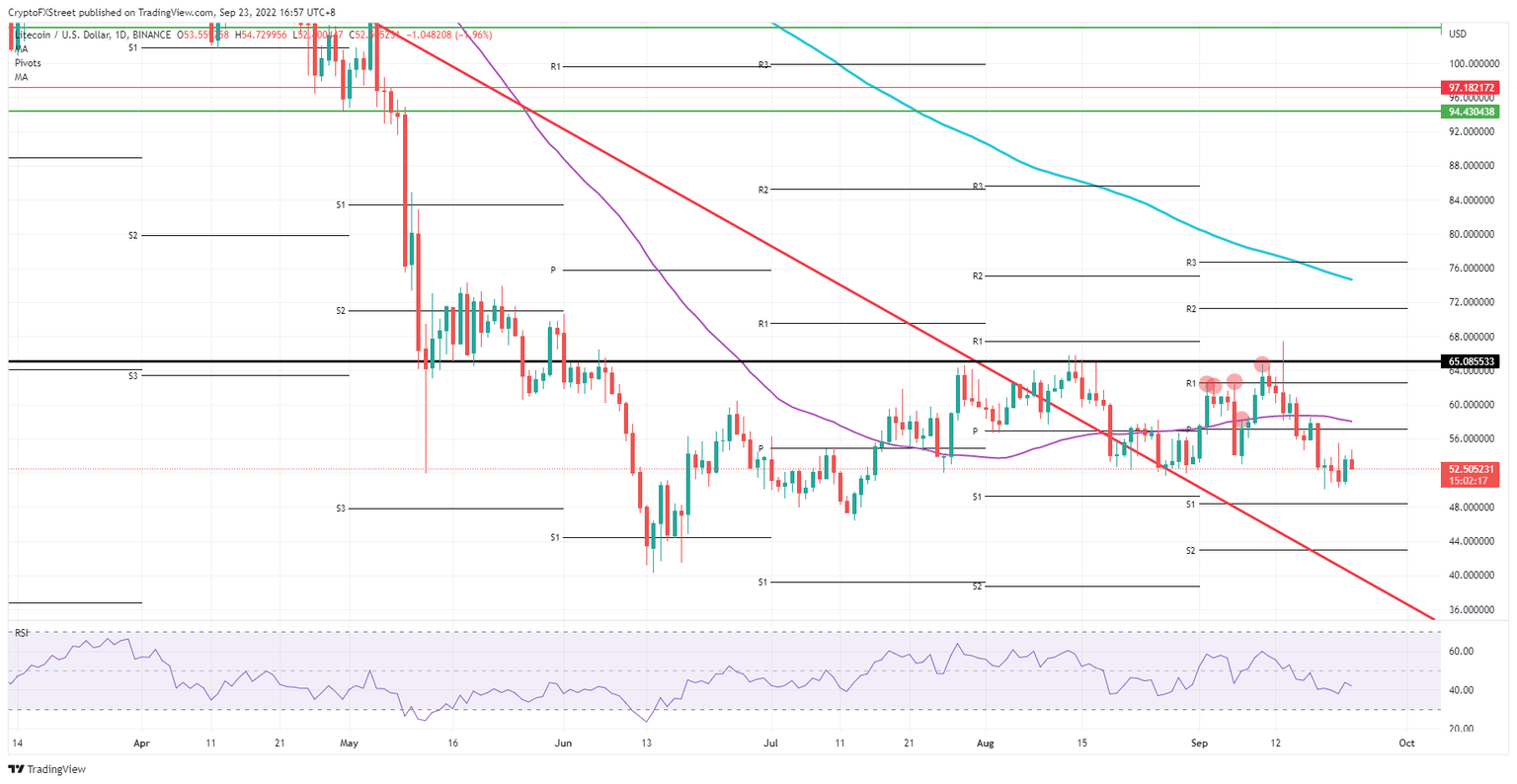

LTC price is set to fully pair back the incurred gains from this morning and drop back towards $50.46. Should sterling keep selling-off and more dollar strength comes in, expect to see a little nudge towards $48 and the monthly S1 support. A negative close for the week is inevitable and could see more losses being eked out as traders further sell-off near the US closing bell, pushing the price down towards $44.00 and the monthly S2 support.

LTC/USD Daily chart

Although an uptick is impossible, it could happen should the dollar weaken. That might happen if investors choose to close out their positions and scale out of dollar-long positions by taking profit. USD would then fade a bit and synthetically pull up LTC price action towards $56.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.