Litecoin stuck in consolidation leads to investors’ balance falling to 5-year lows

- The overall average balance on every Litecoin address fell to $507, levels last visited back in April 2017.

- Litecoin on the chart has been virtually unmoved for almost four months now, trading at $52.9.

- Litecoin’s low correlation with Bitcoin opens the altcoin up to the possibility of a rally if Bitcoin concedes to the market’s fears.

“Silver to Bitcoin’s Gold” has been Litecoin’s identity since its inception, and rightfully so since it is truly no different than Bitcoin in any way except that it is not as well known as the king coin.

Regardless, Litecoin has achieved sustainability in a unique way which is how it manages to draw users towards itself. Except now, these investors might begin second-guessing their decisions.

Litecoin investors losing money

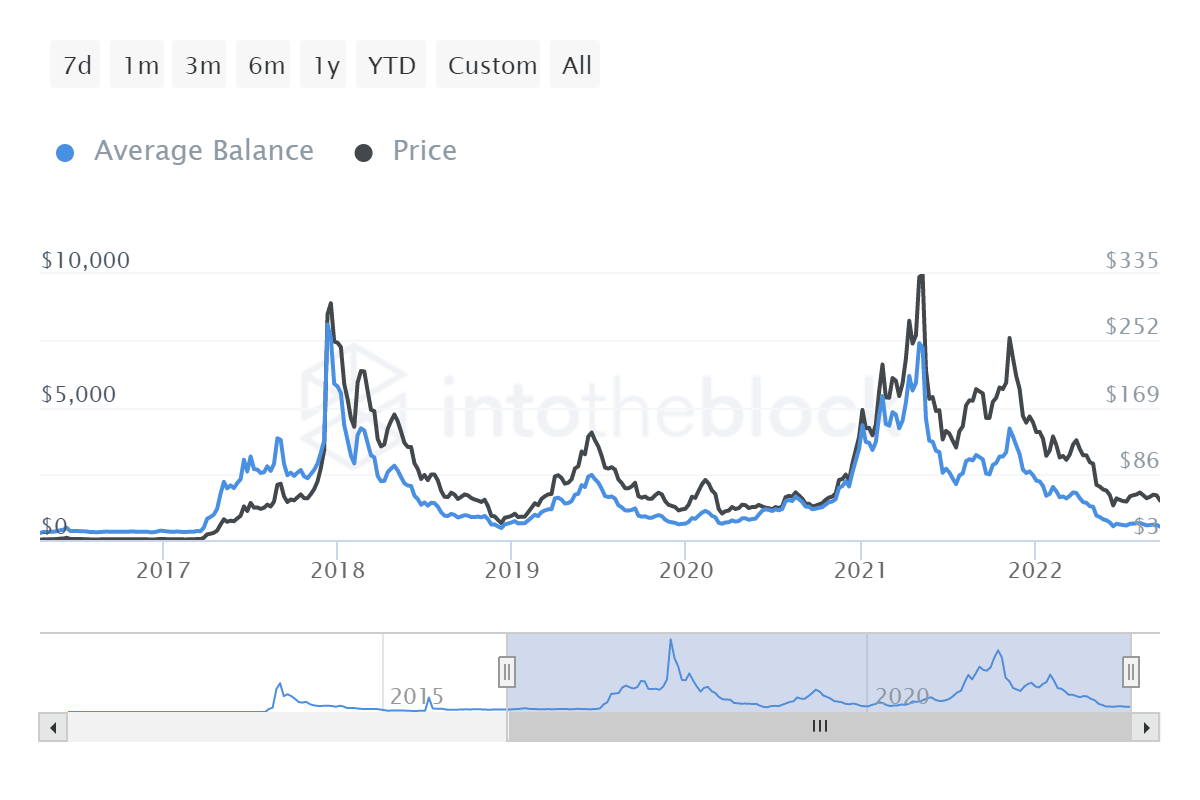

Usually, individual address analysis reveals the investors’ reality highlighting the overall profit loss ratio. But the average balance shows the network’s reality and vested monrtary interests.. By dividing the market cap by the number of addresses, we can see how much each address has on average and in the case of Litecoin, that figure stands at $507.10.

Falling since May’s all-time high at $7,397, the lack of recovery at LTC’s end has resulted in the average falling by 93.1%. This figure is also the lowest average balance recorded by Litecoin since April 2017, placing it at a 5-year low.

Litecoin investors’ average balance

On the charts, LTC has been moving sideways with minimal fluctuations since the beginning of June. This lack of growth has caused significant losses to investors.

The situation is likely only going to get worse since price indicators signal a price drawdown on the way. The candlesticks are below the 50-, 100- and 200-day Simple Moving Averages, and the Parabolic SAR’s (white dots) presence above the candlesticks highlights an active downtrend.

Room to escape?

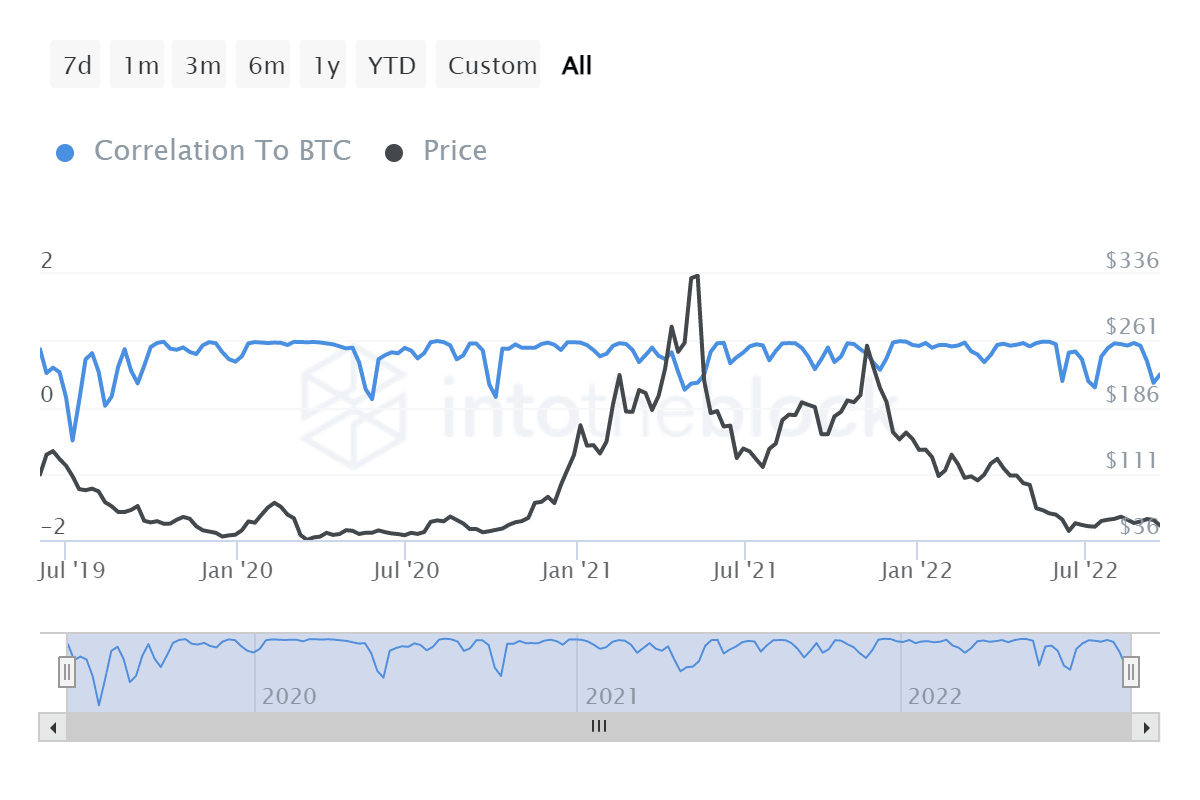

While rare, Litecoin at the moment is sharing a very low correlation with Bitcoin, and this is its window of escaping the bears’ clutches.

If Bitcoin sticks to the bearish market conditions, LTC could end up finding some bullishness. But if LTC rises after the correlation return closer to 1, the efforts will be in vain.

Litecoin correlation to Bitcoin

The next week will be crucial in this sense for Litecoin investors.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.