It’s time for Bitcoin price to rebound, here are the bullish targets

- Bitcoin price pops back above $30,000 in early Monday trading.

- A big wave of risk-on sentiment is rolling through the markets and seeing rallies in risk assets.

- Expect to see a continuation this week as markets get used to the current tail risks fading.

Bitcoin (BTC) price is set to rally and say goodbye to the $30,000-marker for a long time. An early summer rally is underway in several risk asset classes like stocks and cryptocurrencies. The shift in sentiment comes as several tail risks have been further deflated last week with more and more signs of a resolution to the Ukraine conflict, as well as inflation issues and Covid lockdowns getting unwound in Asia, which could filter into BTC price for at least a 20% rally.

BTC price set for a hot summer

Bitcoin price has made a big move in early Monday trading this week as bulls start buying massively, with an uptick of over 3% in ASIA PAC. As several risk elements are being downgraded, more room has been opened up for upside potential that is not going unnoticed by bulls, and by investors sidelined for too long this year. Expect to see this rally being stretched and moving further, at least throughout this week, as more dollar weakness is set to kick in and open up even more room to the upside for BTC price to rally.

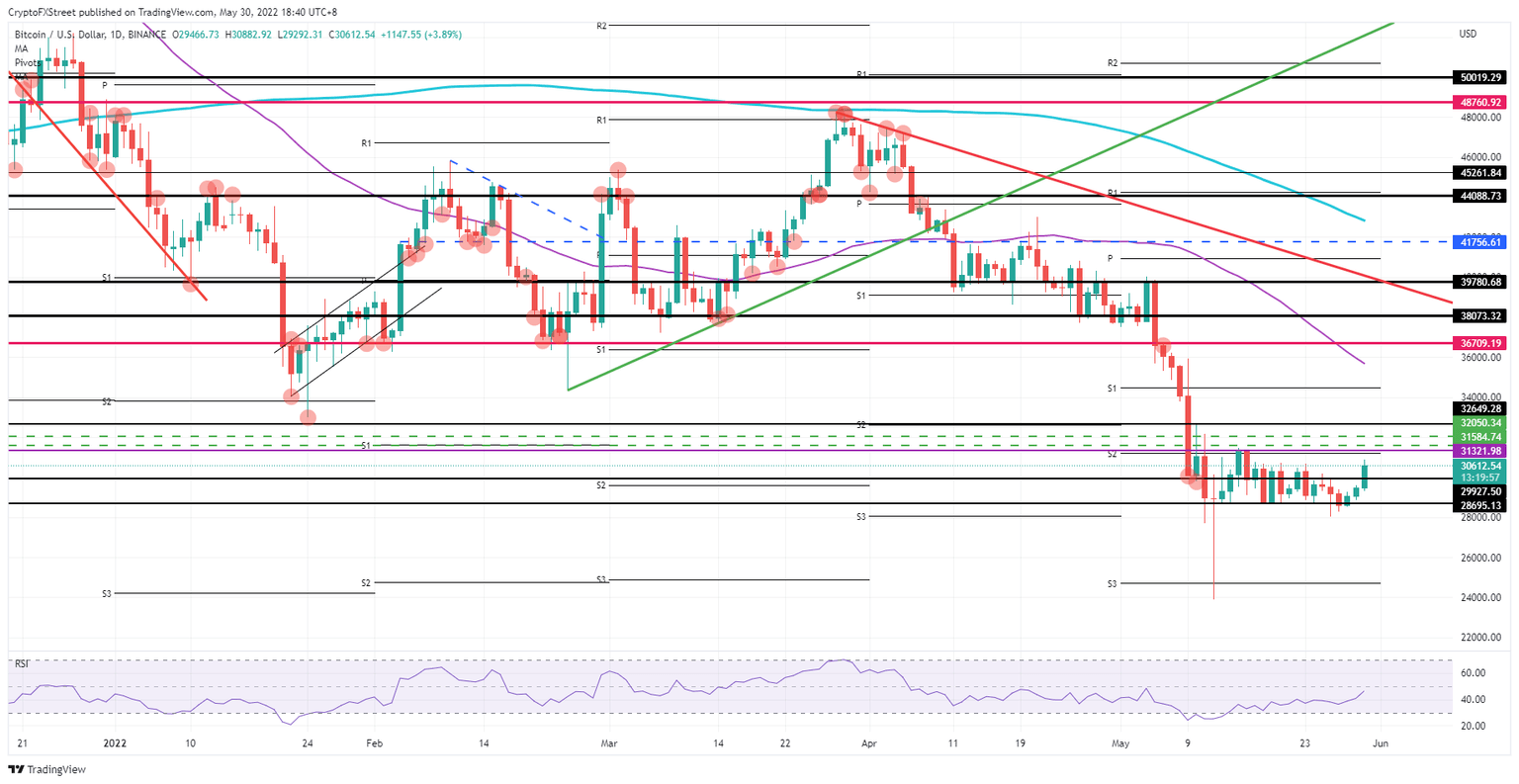

BTC price will first face $31,231.98, just above the monthly S2 and trading in the previous distribution zone, which should be favourable in lifting the price quite quickly towards $32,649.28. Then a relatively wide area is open for the taking with only the monthly S1 around $34,483.61 in the way before hitting the cap at $35,725.02 on the 55-day Simple Moving Average (SMA), which has been keeping price action muted since April. So, expect to see some profit-taking around that level before possibly rallying higher.

BTC/USD daily chart

With several historic pivotal levels nearby, the risk could easily be that a firm rejection at a level could trigger a setback for Bitcoin price action. For example, $31,321.98, together with the monthly S2, is a double cap that could see a massive inflow of bears and squash bulls’ uprising. That would mean that price tumbles back below $30,000 to test $28,695.13 to the downside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.