Ethereum whales gobble up SHIB, but Shiba Inu price withholds rally

- Shiba Inu price holds firmly onto support at $0.00001050 in a bid to collect liquidity.

- SHIB attracts investor interest, rising to the top ten most purchased tokens among the 500 largest Ethereum whales.

- Failure to break out of a falling channel may invalidate the uptrend and increase the risk of dropping below $0.00001000.

Shiba Inu price is moving sideways around $0.00001100 after getting rejected at $0.00001225. The second-largest meme coin has been in a down trending channel since it encountered an intensive seller congestion area at $0.00001801 in early August. Interestingly, SHIB’s declines respected a rising trend line alongside its primary support, encouraging investors to take up long positions.

Ethereum whales are buying Shiba Inu in droves

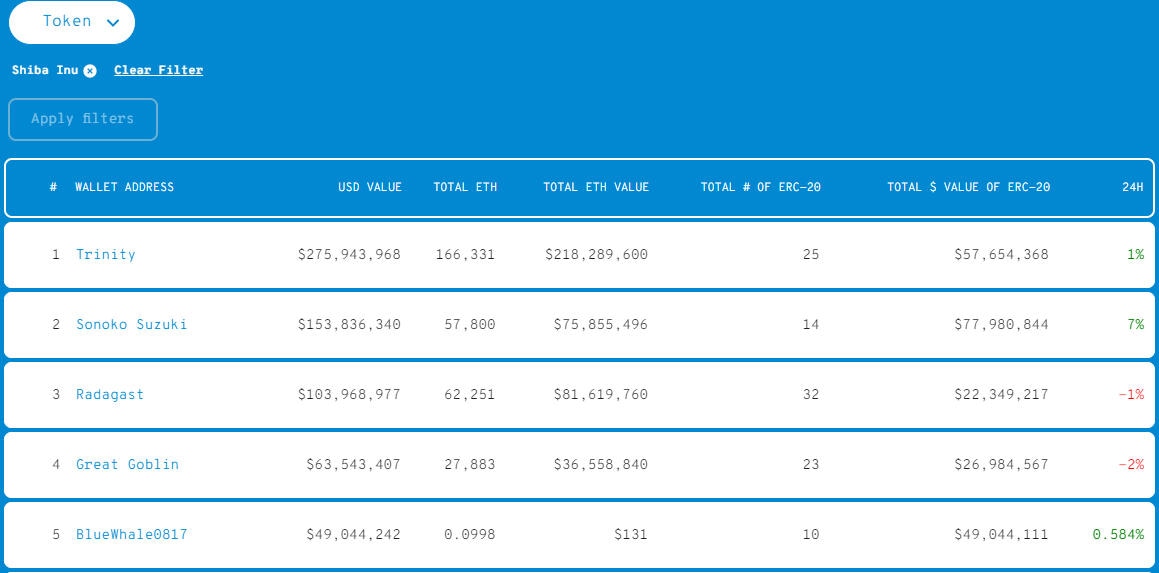

Shiba Inu price continues to attract investor interest as the cryptocurrency market deliberates on the next move. Meanwhile, signals from WhaleStats (tracking crypto whales) reveal that SHIB was one of the “top 10 purchased tokens among 500 biggest ETH whales in the last 24 hours.”

Trinity, the largest whale, now holds SHIB tokens worth 166,331 ETH with a dollar value of $275 million. Over the last two days, the biggest whales bought approximately 1.66 trillion SHIB tokens with a total cumulative value of roughly $18.6 million.

JUST IN: $SHIB @Shibtoken now on top 10 purchased tokens among 500 biggest #ETH whales in the last 24hrs

— WhaleStats (tracking crypto whales) (@WhaleStats) September 26, 2022

Peep the top 100 whales here: https://t.co/tgYTpOm5ws

(and hodl $BBW to see data for the top 500!)#SHIB #whalestats #babywhale #BBW pic.twitter.com/KO0DIlaEOF

Ethereum whales by WhaleStats

Read more: Shiba Inu: This is what happens when Ethereum whales move 4.35 trillion SHIB

Shiba Inu price is unresponsive

The bullish activity from the largest Ethereum whales is yet to reflect in Shiba Inu price. The token faces overhead pressure from the falling channel’s upper trend line and the 100-day SMA (Simple Moving Average – blue).

Shiba Inu price’s pullback from $0.00001225 is unlikely to come to a sudden stop. Traders eyeing new entry positions may consider support at $0.00001050.

SHIB/USD daily chart

The Moving Average Convergence Divergence (MACD) indicator’s sideways movement at -0.00000041 further invalidates expectations of an immediate bullish turnaround. Besides, a northbound move without strength might fail to crack the resistance highlighted by IntoTheBlock’s IOMAP on-chain metric at $0.00001100.

Shiba Inu IOMAP on-chain metric

The approximately 13,900 addresses that purchased 54.30 trillion SHIB tokens around $0.00001100 would destabilize Shiba Inu price as it tries to navigate the hostile regions for a breakout to $0.00001801. In other words, selling pressure rises as investors sell at their respective breakeven points.

For Shiba Inu price to secure a sustainable uptrend, buyers must break free from the falling channel. Possible take-profit positions to the upside are the seller centration zones at $0.00001300, the 200-day SMA (purple) at $0.00001514 and $0.00001801.

Read more: Shiba Inu price is in a buy zone but should you be buying the dip?

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637998033992519354.png&w=1536&q=95)