Shiba Inu: This is what happens when Ethereum whales move 4.35 trillion SHIB

- Ethereum whales have transacted 4.35 trillion Shiba Inu tokens according to the recent data on WhaleStats.

- The hundred largest whales on the Ethereum network have purchased more than 855 billion Shiba Inu tokens over the past three days.

- Analysts predict a 20% price rally in Shiba Inu before a decline in the meme coin.

Over the past three days, large wallet investors on the Ethereum blockchain have scooped up more than 855 billion Shiba Inu tokens. Massive Shiba Inu accumulation by whales is considered a sign of a bullish trend reversal in SHIB.

Also read: Bitcoin Price: Why Plan B predicts 5x rally in Bitcoin price using stock-to-flow model

Ethereum whales continue accumulating Shiba Inu tokens

Based on data from WhaleStats, the top 100 whales on the Ethereum blockchain have purchased over 855 billion Shiba Inu tokens. Interestingly, large wallet investors have moved 4.35 trillion Shiba Inu tokens.

Typically, the accumulation of Shiba Inu by large wallet investors or a massive number of tokens on the move signifies a shift in the meme coin’s price. Whales on the Ethereum network accumulate Shiba Inu tokens through dips. Local tops in Shiba Inu price coincide with massive whale activity. Therefore, proponents consider the accumulation phase bullish for Shiba Inu holders.

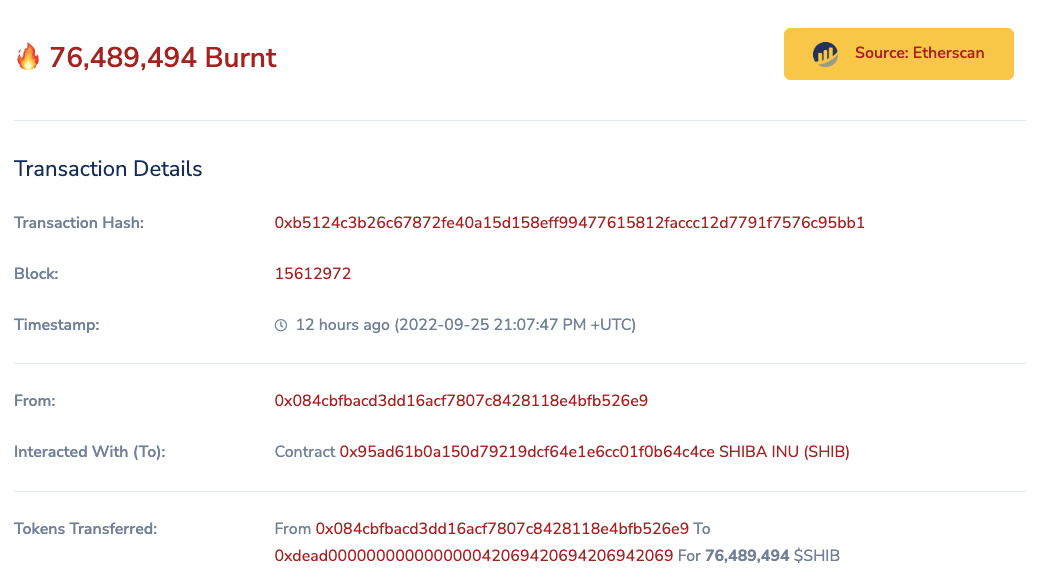

Shiba Inu’s burn tracker Shibburn revealed that 76.4 million SHIB tokens have been pulled out of circulation permanently. These tokens have been sent to dead wallets, effectively destroying them.

76.4 million SHIB were burned in a single transaction

Shiba Inu price ready for a 20% rally?

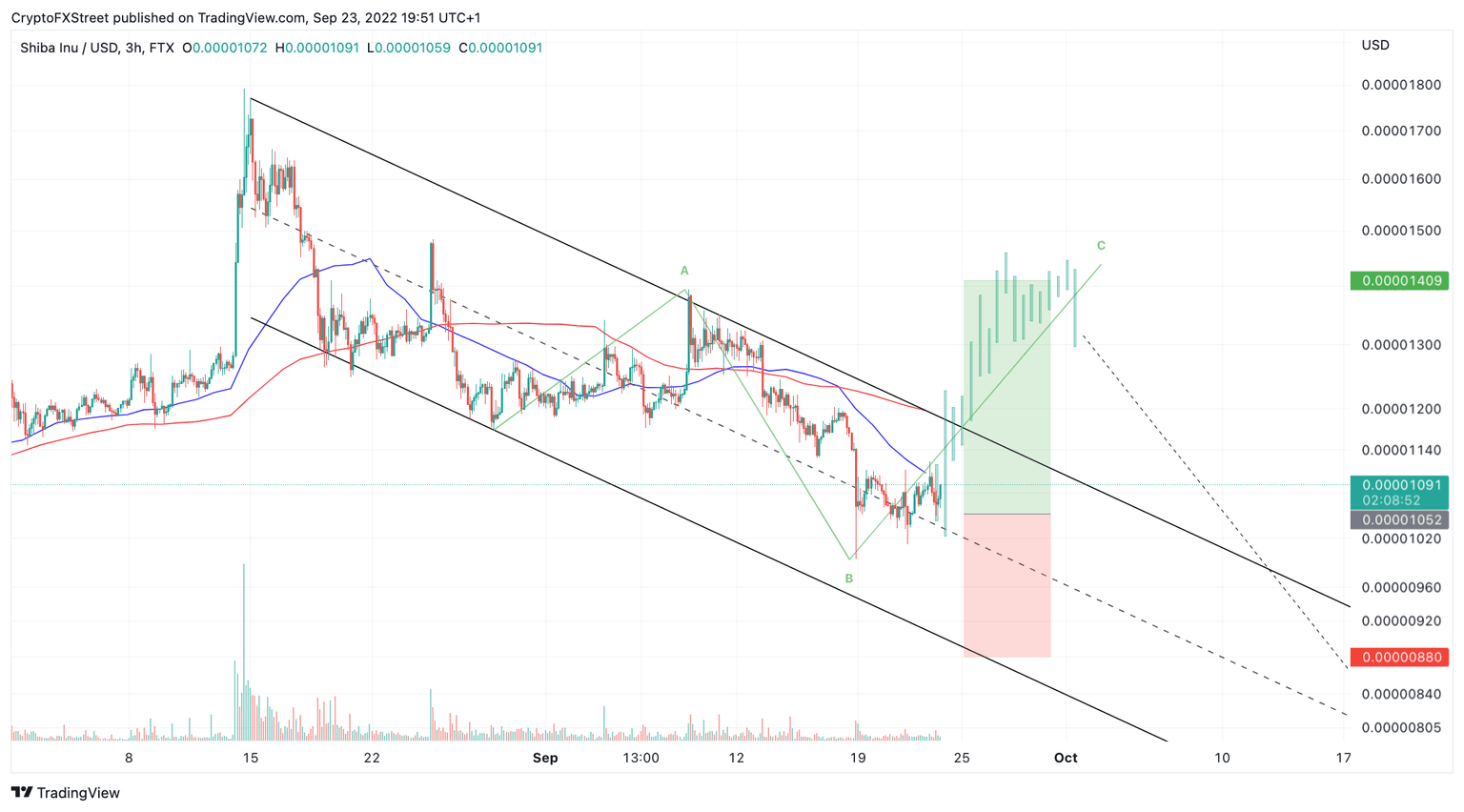

Tony M, technical analyst at FXStreet, believes Shiba Inu price is primed for a climb to the $0.00001394 level. The analyst notes that Shiba Inu price has trended south over the past week in a turbulent manner. The erratic pullbacks during this period indicate that Shiba Inu’s downtrend is weak and there is a likelihood of a bullish trend reversal.

SHIB-USD price chart

The analyst believes that an invalidation of Shiba Inu’s bullish trend depends on bulls defending the $0.00000880 level as support. If Shiba Inu price declines below this level, it is likely to descend in a downward spiral to $0.00000738.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.