Shiba Inu Price Prediction: One more 30% pump before the dump

- Shiba Inu price descends on low volume.

- The bulls are trying to reclaim grounds of the 8-day exponential moving average.

- Invalidation of the bullish thesis is below $0.00000888.Hey

Shiba Inu price shows potential for one more wave up. Key levels have been defined.

Shiba Inu price for one more pump

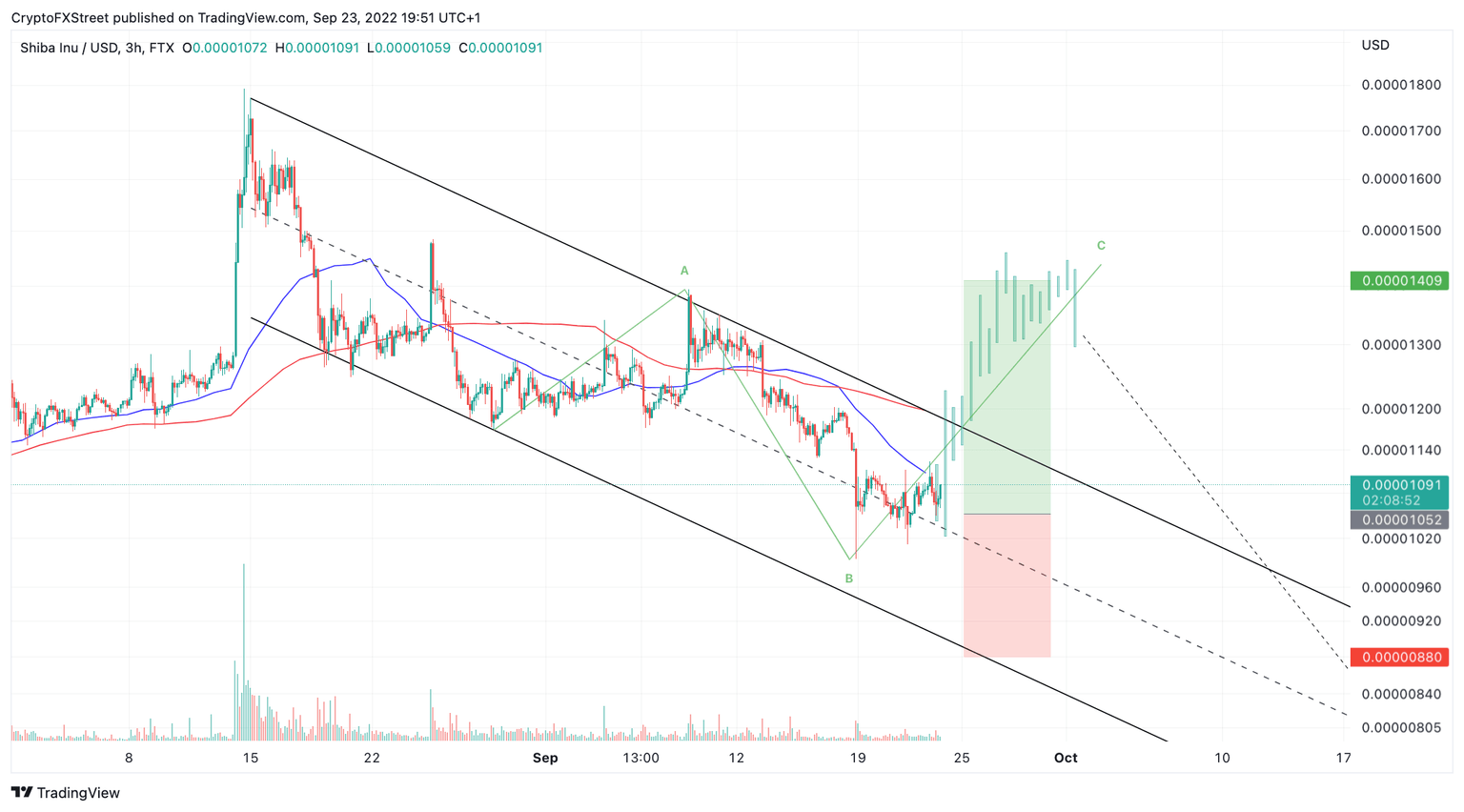

Shiba Inu price could present profitable opportunities for those willing to engage in the coming days. Throughout the week, Shiba Inu price has been treading south but in a turbulent fashion. The erratic pullbacks are the first gesture that the downtrend is weakening. Additionally, the overall downtrend has been minuscule in terms of volume compared to the previous uptrend move,

Shiba Inu price currently auctions at $0.00001060 as the bears are forging a barrier near the 8-day exponential moving average(EMA). The first rejection has come under low volume, while an uptick in volume shows in a doji candlestick below the barrier.

SHIB USD 3-Hour Chart

Traders should expect a congestive battle to ensue near the zone. If the bulls can hurdle the 8-day EMA, then an entry could be placed targeting the September swing high at $0.00001394. Such a move would result in a 30% increase from the current Shiba Inu price.

Invalidation of the bullish countertrend idea is dependent on $0.00000880 remaining as support. A breach of this level could give power to the bears. The next target zone would be the June 18 swing lows at $0.00000738, resulting in a 30% decline from the current SHIB price.

In the following video, our analysts deep dive into the price action of Shiba Inu, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.