Ethereum repricing inevitable as ETH's tail risks multiply, $1,243 likely?

- Ethereum price went flat after the US job report threw a curve ball at the markets.

- ETH is set to tank further as tail risks increase by the day.

- Expect February to be a difficult month with a lot of pain to be priced in as ETH can drop 23% for the month.

Ethereum (ETH) price is trading quite flat as markets are moving across the board on the back of the big surprise out of the US jobs report last Friday. With a very steep inclination in people added and wages still gradually rising, the inflation in the US is changing from a supply chain-driven inflation to a demand-driven inflation with a higher paid working force still growing by the month. Add to that the cold war risk after the US shot down the Chinese balloon over the weekend and a nearby second Russian offensive in Ukraine spells trouble for traders ahead, with ETH set to tank back below $1,300.

Ethereum price faces gravity as tail risks weigh down

Ethereum price received a firm repricing on Friday after the US jobs report came out with an upbeat defeat of even the highest estimation pencilled in for jobs added. The numbers confirm the comments Fed Chair Jerome Powell made earlier in the week that the inflation in the US is becoming demand-driven as the US workforce sees its pay still increasing and more people are added to the labor force. Those elements alone mean that the Fed will keep rates steady for longer. This means the price of ETH will likely stay around $1,500 near the monthly pivot.

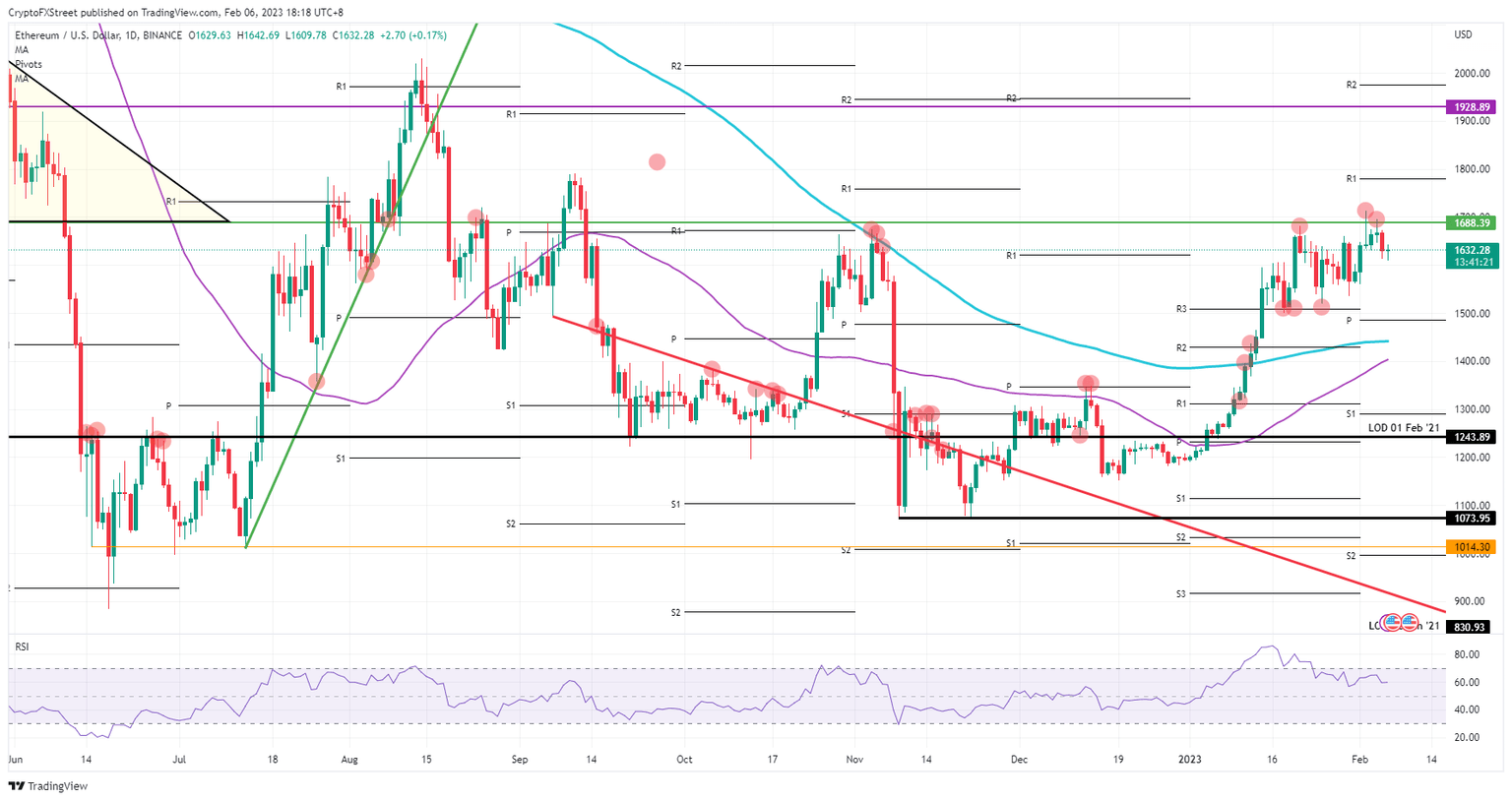

ETH does get even more weight to the downside as geopolitical headline risk is also flaring up. Not only is the headcount for newly deployed Russian soldiers revised above 500K, but the second offence could come too soon as it will still take over two months before Ukraine will receive its promised tanks. The war element will see ETH break below $1,400, below the 200-day and the 55-day Simple Moving Averages. The last risk factor comes from China and the US, where the spy balloon story is triggering the next phase in a cold war between the two nations and values Ethereum price rather near $1,243, down 23% from where it currently trades.

ETH/USD daily chart

Hard to see much upside with all the above mentioned tensions flaring up. Howevver some upside could come as war-fatigue is set to kick in after nearly a year and markets get accustomed to the stalemate in Ukraine. Expect to see a push through $1,688 and ETH advancing toward $1,928.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.