Can Visa's large value payments on Ethereum fuel an ETH price rally?

- Visa is testing how to accept large value settlement payments from issuers in USDC starting on the Ethereum blockchain.

- At StarkWare Sessions 2023, Visa’s Cuy Sheffield shared the company’s vision for digital assets.

- Visa’s use of the Ethereum blockchain is likely to drive ETH adoption higher, fueling a bullish narrative for holders.

Visa, a global payments giant, seeks to build “muscle memory” around settlements, allowing customers to convert digital assets to fiat on its platform. At StarkWare Sessions 2023, Visa announced that the firm has been testing how to accept settlement payments from issuers on the Ethereum blockchain.

Visa’s utility of ETH’s chain for large value settlements is likely to contribute to the utility of the network and act as a bullish catalyst for the altcoin.

Also read: Will Uniswap V3 save Binance Coin price from a brutal 20% crash?

Visa unveils plans to settle large value payments on the Ethereum blockchain

Visa processed transactions worth $14.1 trillion in 2022, making it one of the largest payment giants in the world. Cuy Sheffield, Visa’s VP Head of the Crypto unit recently spoke at StarkWare Sessions 2023, sharing details of Visa’s payment settlement initiative on the Ethereum blockchain.

Cuy Sheffield was quoted as saying,

We’ve been testing how to actually accept settlement payments from issuers in USDC starting on Ethereum and paying out in USDC. So, these are large value settlement payments.

Visa is currently investing in global settlement with digital assets and fiat currencies, with the objective of increasing the ease of conversion between digital tokenized Dollars and traditional US Dollars.

The payment giant is exploring how to incorporate blockchain technology in its existing networks to move value faster.

Will Visa’s push to capture value on Ethereum act as a bullish catalyst?

One of the largest payment giants in the world, Visa’s use of the Ethereum blockchain for large scale transfers is likely to boost the utility of the blockchain. Ethereum holders have seen a slew of bullish catalysts since 2022, from ETH blockchain’s consensus mechanism changing from Proof-of-Work to Proof-of-Stake (Merge), to ETH token burn and staking on the Beacon chain.

These bullish catalysts have contributed to a consistent spike in Ethereum price. ETH yielded nearly 30% gains for holders over the past month. Visa’s move fuels a bullish narrative for Ethereum.

Ethereum turns deflationary with bullish catalysts on its network

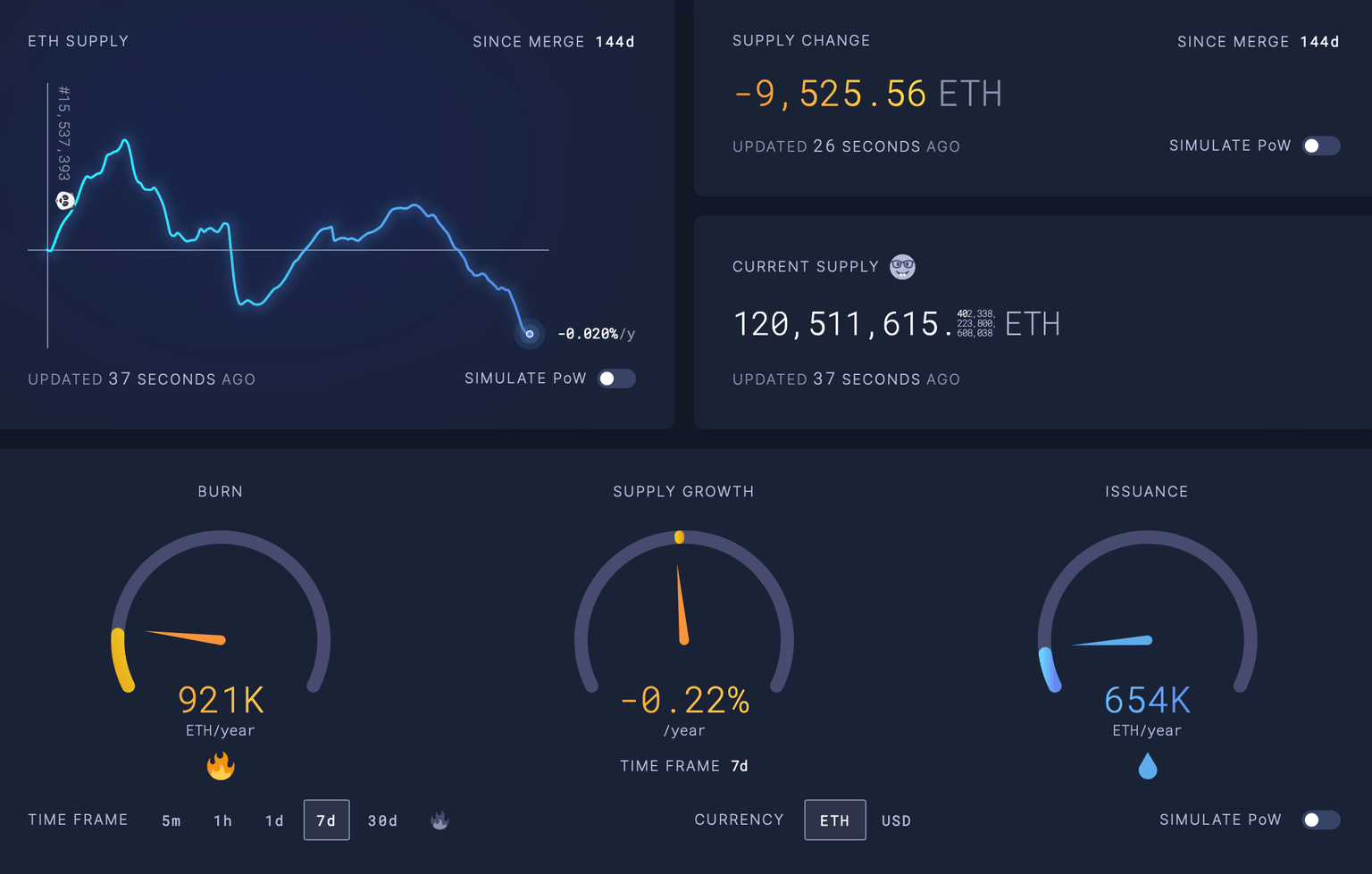

Ethereum’s transition through the Merge combined with the burning of ETH tokens, turned the asset deflationary. Based on data from Ultrasound.money, Ethereum’s supply has decreased by 9,525.56 since the Merge.

Ethereum supply since Merge and burn statistics

Based on the 7-day timeframe, Ethereum’s supply is set to decrease 0.22% every year. Ethereum turned deflationary since the Merge and the launch of the asset’s token burn mechanism.

Ethereum price eyes target at $1,700

Ethereum price is currently in an uptrend that started on January 3. ETH price yielded 30% gains for holders since the beginning of January and hit a peak of $1,710 before correcting lower to support at $1,619.

Based on the ETH/USDT price chart below, Ethereum needs to sustain above the support zone that starts at the $1,600 level. ETH price could bounce from support and climb towards the target at $1,700.

The 23.6% Fibonacci Retracement is a key level of interest for traders, at $1,581.11. Ethereum price uptrend remains supported at $1,600.

ETH/USD price chart

As seen in the chart above, RSI shows bearish divergence; the higher highs in price are met with a divergence on the RSI. This has occurred for the first time since November 2018 on the 4H chart of ETH/USD. This makes it a significant development. RSI is below neutral at 46.15.

The divergence implies that traders should be cautiously optimistic when trading ETH and adding to their positions. The $1,600 level is a key area to watch for a recovery if Ethereum pulls back further.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.