ETC price prediction: Stubborn bulls could be in for a harsh lesson

- Ethereum Classic is trading on thin support and looks vulnerable to a breakdown.

- ETC price could see bulls being pushed out of their positions and losing interest for now.

- That event could trigger ETC price to be axed in half with over 55% losses.

Ethereum Classic (ETC) price is trying to get its head around the current turn of market events after Fed Powell’s hawkish speech at Jackson Hole ast Friday. Over the weekend, cryptocurrency traders kept selling, although now, with the dust settling, a few bulls are trying to buy the dip, and they could be at risk of seeing their positions being cut in half on ETC price losing 55% of its value.

ETC price at risk of being cut in half

Ethereum Classic price is yet again at the mercy of investors and the woes of financial markets. To get profitable in their trading, cryptocurrency and altcoin traders are best off reading and learning about recessions and big financial events from the past decades. Ethereum Classic price action has dropped substantially since Friday as investors reshuffle their portfolios for the coming months.

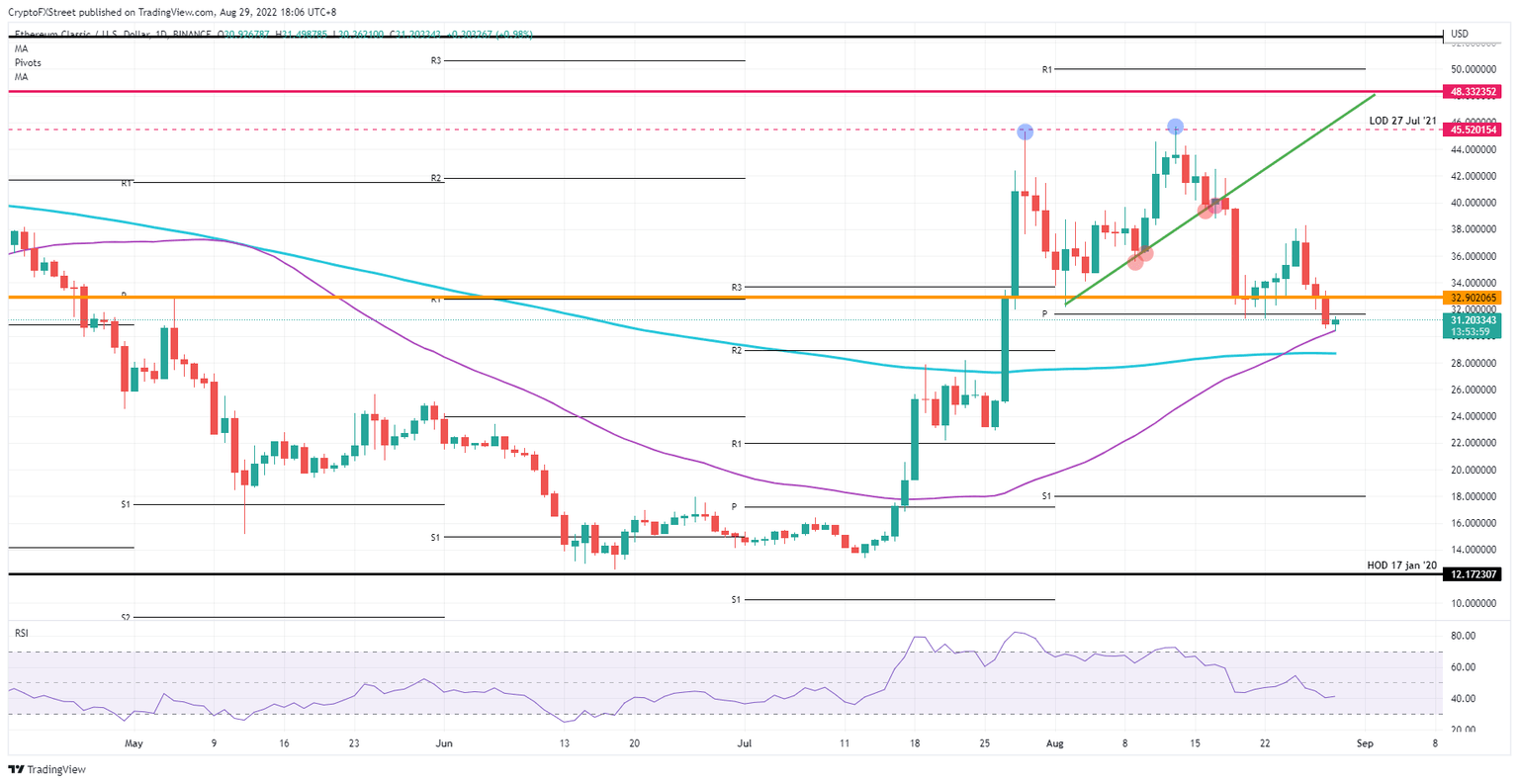

ETC price is currently underpinned by fearless bulls buying the dip against the 55-day Simple Moving Average (SMA) at $30.36. Even if that level does not hold and price breaks lower as US equities are trading lower, the 200-day SMA, at $28.68, could provide important support, as seen on July 19 and 23. Should US equities take a step lower and the US dollar strengthens, expect ETC price to collapse as bulls forfeit their positions and blow up the sell-side, dropping prices to as low as $12.17.

As is often seen on a negative opening on Monday, elements can improve throughout the week, with weekly gains being eked out on Friday. This could be the case this week – adopting an alternative bullish scenario. This might mean that bulls buy into the dip now leading price action to pop back above $32.90 anytime soon. From there, price could extend to $45.52 at the July 27th low, hitting 50% gains in the process.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.