Ethereum Classic price to produce a buy trigger before exploding 25%

- Ethereum Classic price is attempting to recover after forming a local bottom at $31.20.

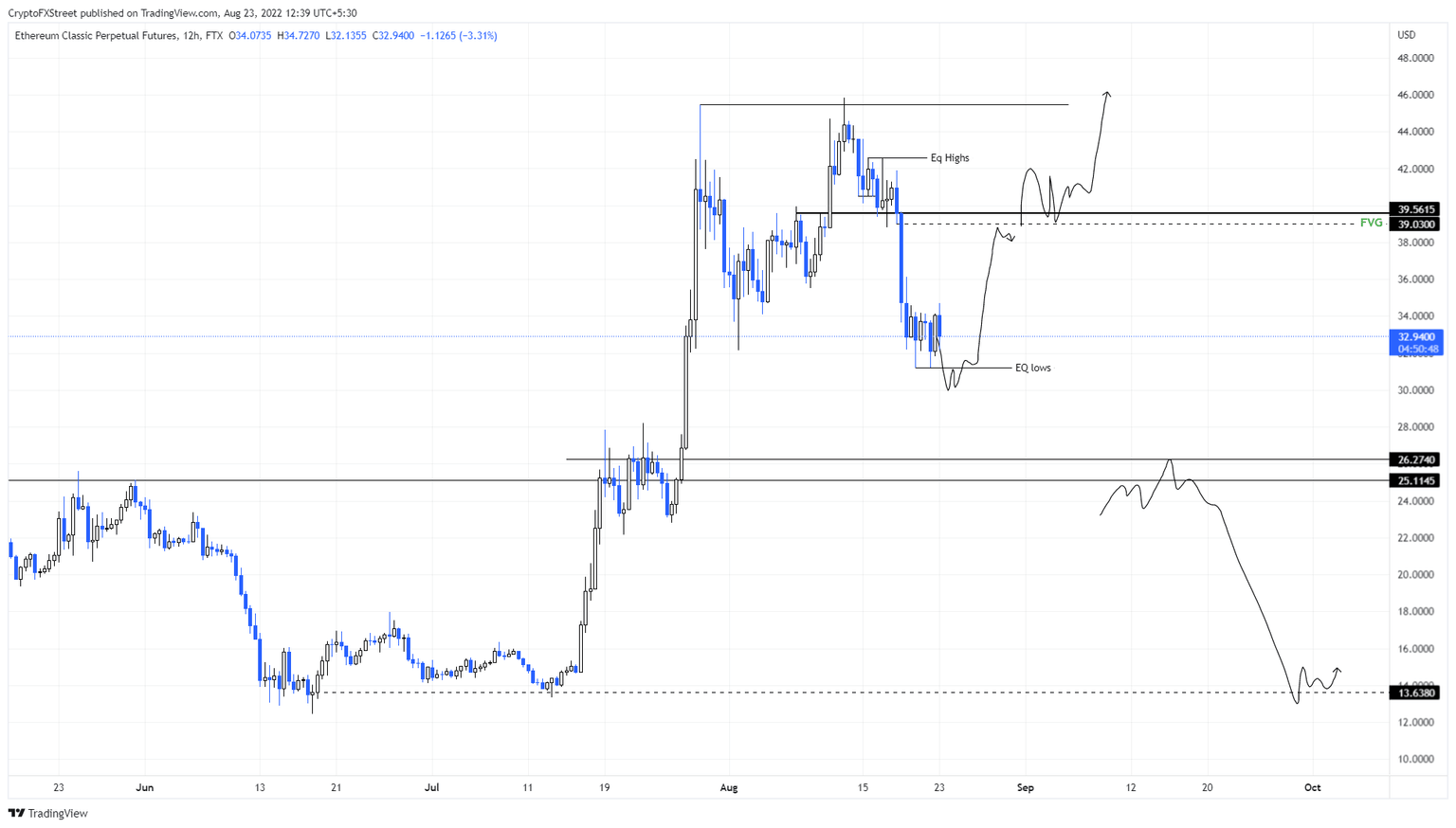

- If successful, this bounce could propel ETC by 25% to $39.03 or roughly $40.

- A flip of the $25.11 support floor into a resistance level will invalidate the recovery thesis and resume the downtrend.

Ethereum Classic price consolidates after forming a local bottom as Bitcoin price scrambles to find support. ETC's recovery depends on BTC potential upward bounce being triggered, which would be a sweep of the $20,750 support level. If successful, ETC could trigger an explosive move to fill the imbalance created during the recent crash.

Ethereum Classic price awaits a buy trigger

Ethereum Classic price formed a double bottom at $31.20 after crashing 25% between August 18 and 22. This development led to a quick 5% recovery, but the plan was foiled by BTC price, which took a tumble.

As a result, investors can wait for Bitcoin price to collect the liquidity present below $20,750 before entering a long position on ETC. After the big crypto sweeps the aforementioned level, investors can check to see if ETC has also swept the sell-stop liquidity resting below $31.20.

If that happens, then it will be the buy required to start accumulating Ethereum Classic price. In such a case, ETC could rally 25% to fill the imbalance present at $39.03. In some cases, the bounce could hit the $40 psychological level and form a local top there.

ETC/USDT 1-day chart

On the other hand, if Ethereum Classic price fails to stay above the equal lows formed at $31.20 or recover above it, it will indicate a weakness among ETC buyers. In such a case, market participants can look for a retest of the $26.27 and $25.11 support levels.

A daily candlestick close below the $25.11 barrier that flips it into a resistance level will invalidate the bullish recovery thesis for Ethereum Classic price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.