Cryptocurrencies Price Prediction: Crypto.com, Ripple and Ethereum Classic – European Wrap 23 August

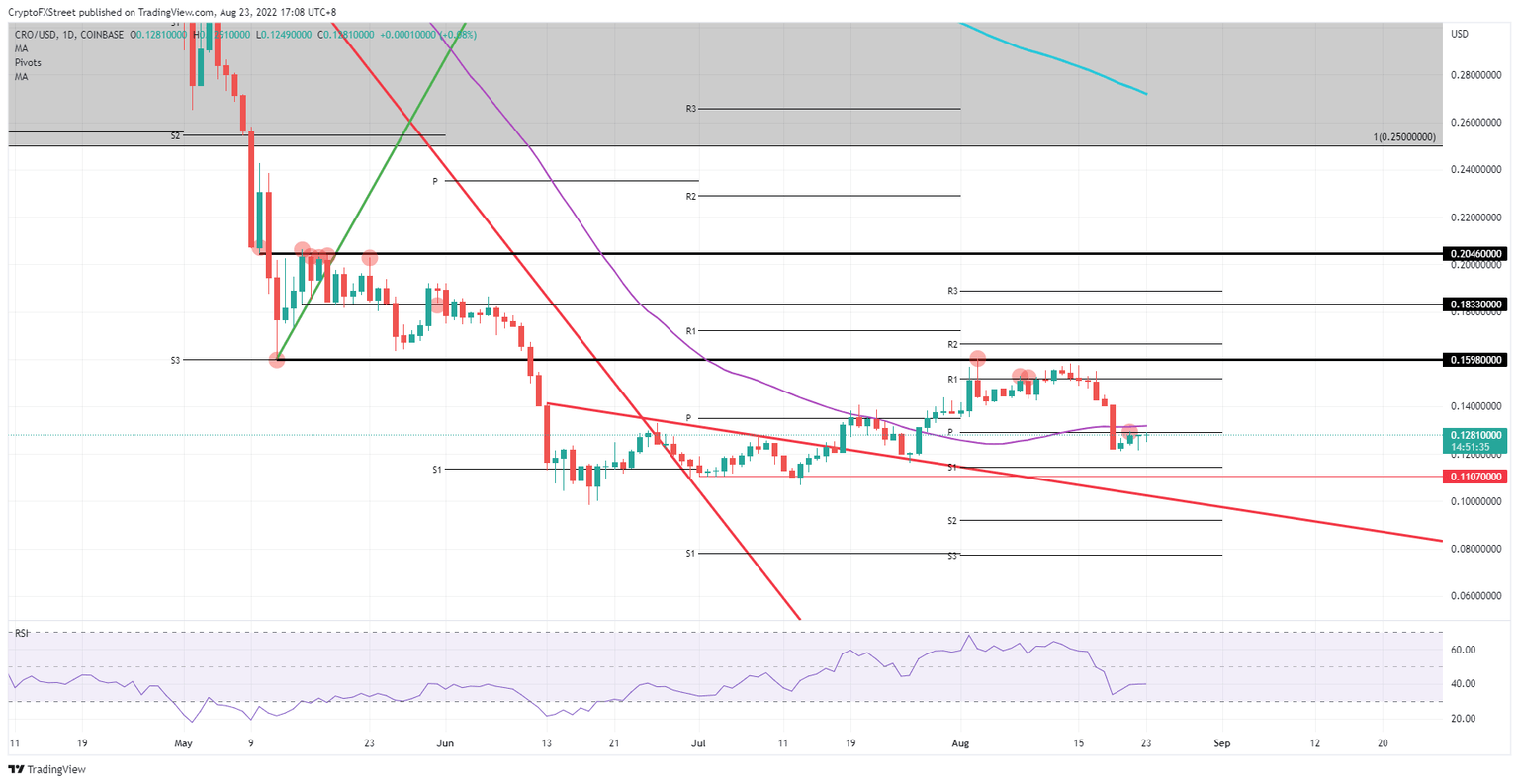

Last quarter forecasts from US banks spell trouble ahead for Crypto.com coin price action

Crypto.com coin (CRO) price action is seeing bulls not giving away their positions and trying to battle against the bearish price action that is holding on to cryptocurrencies. Although CRO price has been able to eke out four consecutive days of gains, any euphoria might be short-lived. Several US banks came out forecasting that cash is the best option going into the last quarter of 2022. That means plenty of investors are due to pull out their funds and drain the capital support for cryptocurrencies with another collapse unfolding.

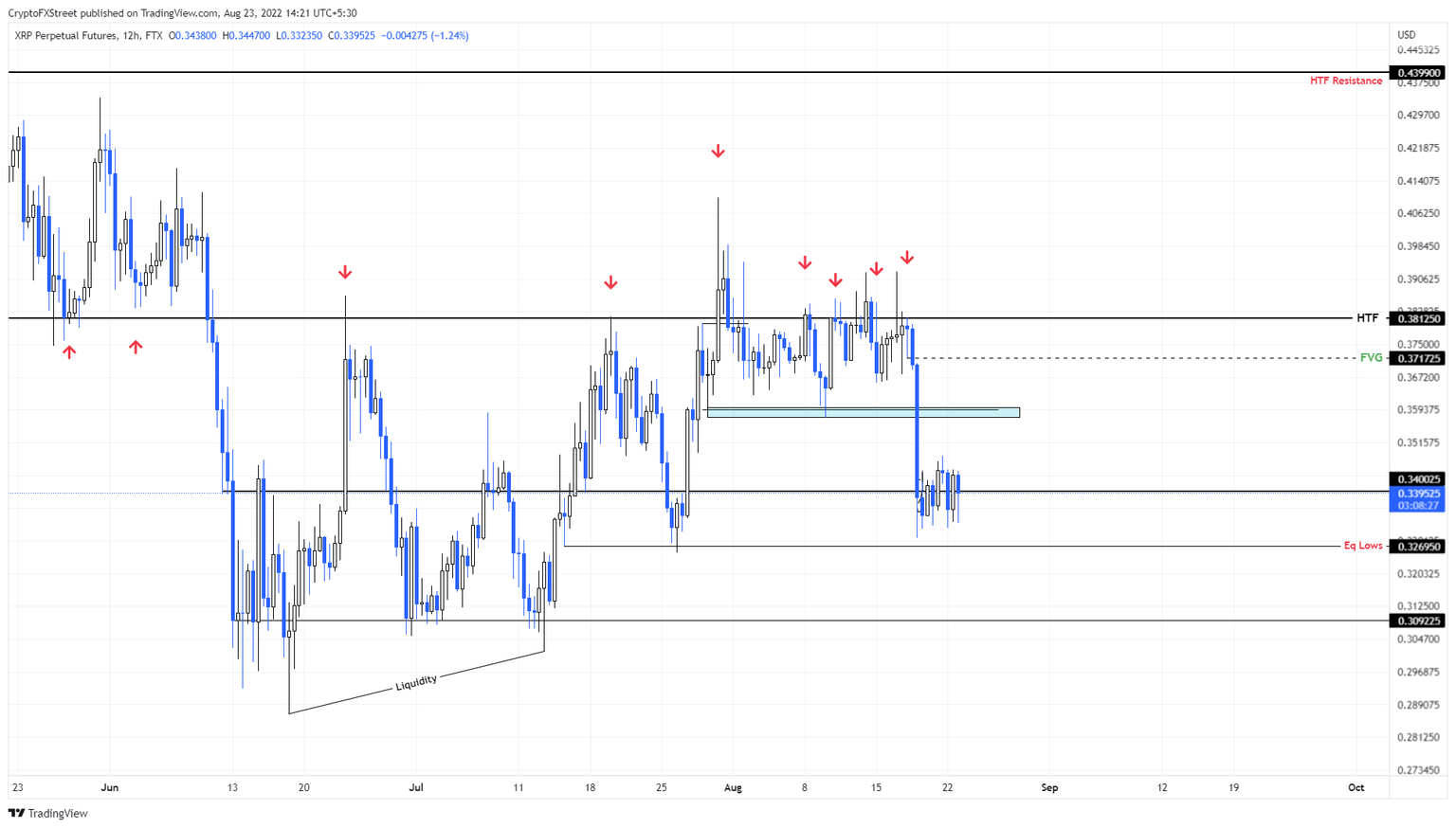

This is how you can spot XRP price recovery and ride it

XRP price shows no interest to move higher or lower as it consolidates around a stable support level. Devoid of any directional bias, Ripple investors can attempt to open long positions after the liquidity present to the downside is collected.

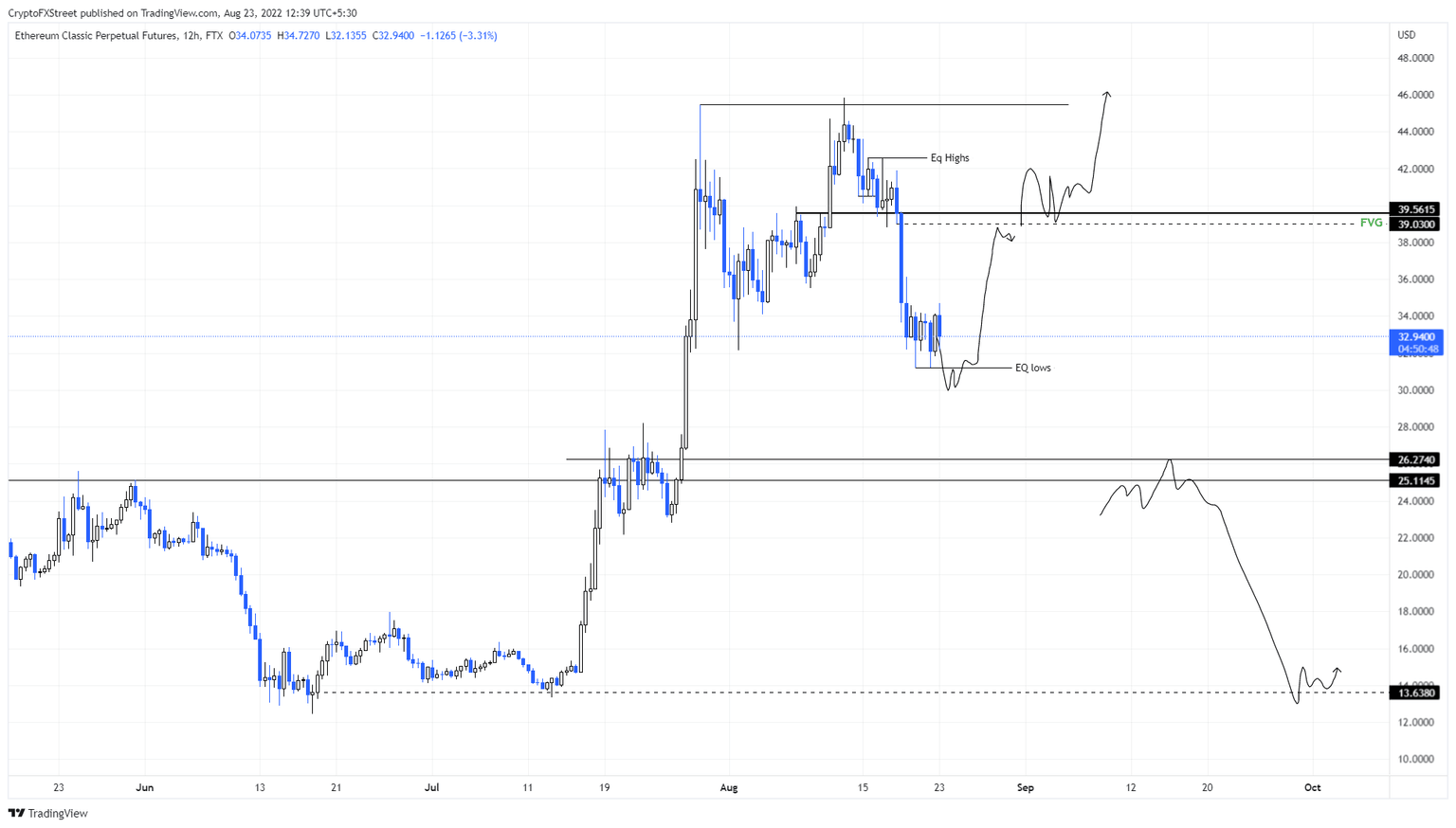

Ethereum Classic price to produce a buy trigger before exploding 25%

Ethereum Classic price consolidates after forming a local bottom as Bitcoin price scrambles to find support. ETC's recovery depends on BTC potential upward bounce being triggered, which would be a sweep of the $20,750 support level. If successful, ETC could trigger an explosive move to fill the imbalance created during the recent crash.

Author

FXStreet Team

FXStreet