Dogecoin price rests at an inflection point for the bull market

- Dogecoin price staring at consecutive closes below the 50-day simple moving average (SMA) since November 2020.

- Daily volume has not closed above average since February 10.

- Squeeze formation puts DOGE traders on alert.

Dogecoin price is at an inflection point as two technical developments may ignite volatility and bring an end to the long drift sideways of the last month.

Dogecoin price holds a neutral bias for traders

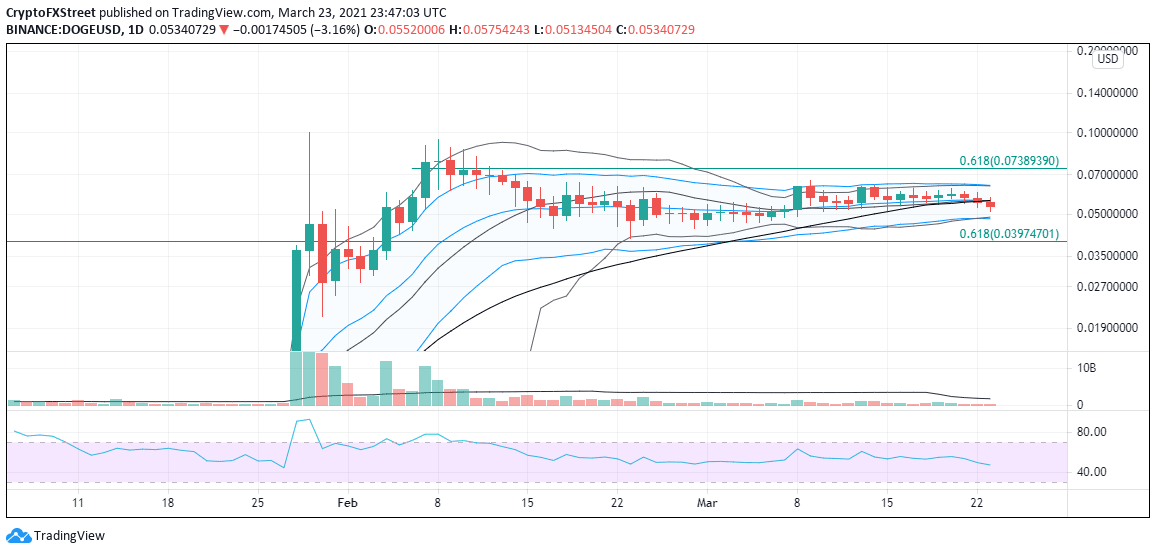

DOGE is set to close today with a squeeze formation confirmation, and it may be the catalyst that shakes the bulls or bears from hibernation. The formation comes at a time when the altcoin will close below the 50-day SMA for the second day in a row, something that has not occurred since November 1-2, 2020.

In early March, the last squeeze formation generated a 30% spike over four days, including a one-day gain of 22% on March 8.

If the squeeze formation resolves to the upside, the first important resistance is the upper Bollinger and Keltner bands at $0.640. A daily close above the resistance will raise the odds that the rally will reach the 0.618 Fibonacci retracement level of the February crash at $0.074.

The clustering of long wicks above $0.080 in early February warns traders not to get too greedy and lock in profits. New all-time highs will have to wait for some months.

DOGE/USD daily chart

With Dogecoin price set to close below the 50-day SMA around $0.056 at the time of writing, SMA traders should be ready for a potential decline to the lower Bollinger and Keltner bands at $0.048. The next credible support is at the 0.618 retracement level of the bull market beginning November 2020 at $0.039. Further weakness will lead to panic and will likely erase a significant portion of the social media-driven gains.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.