Dogecoin Price Prediction: Whales patiently building the cause

- Dogecoin price has surged by 24% since January 1.

- DOGE shows potential for a 60% rise in the future.

- Invalidation of the bullish thesis would arrive from a weekly close below $0.069.

Dogecoin price has somewhat underperformed compared to most cryptocurrencies during this winter uptrend. Still, the notorious dog coin may be teaching investors an important lesson on patience.

Dogecoin price shows any dip is a discount

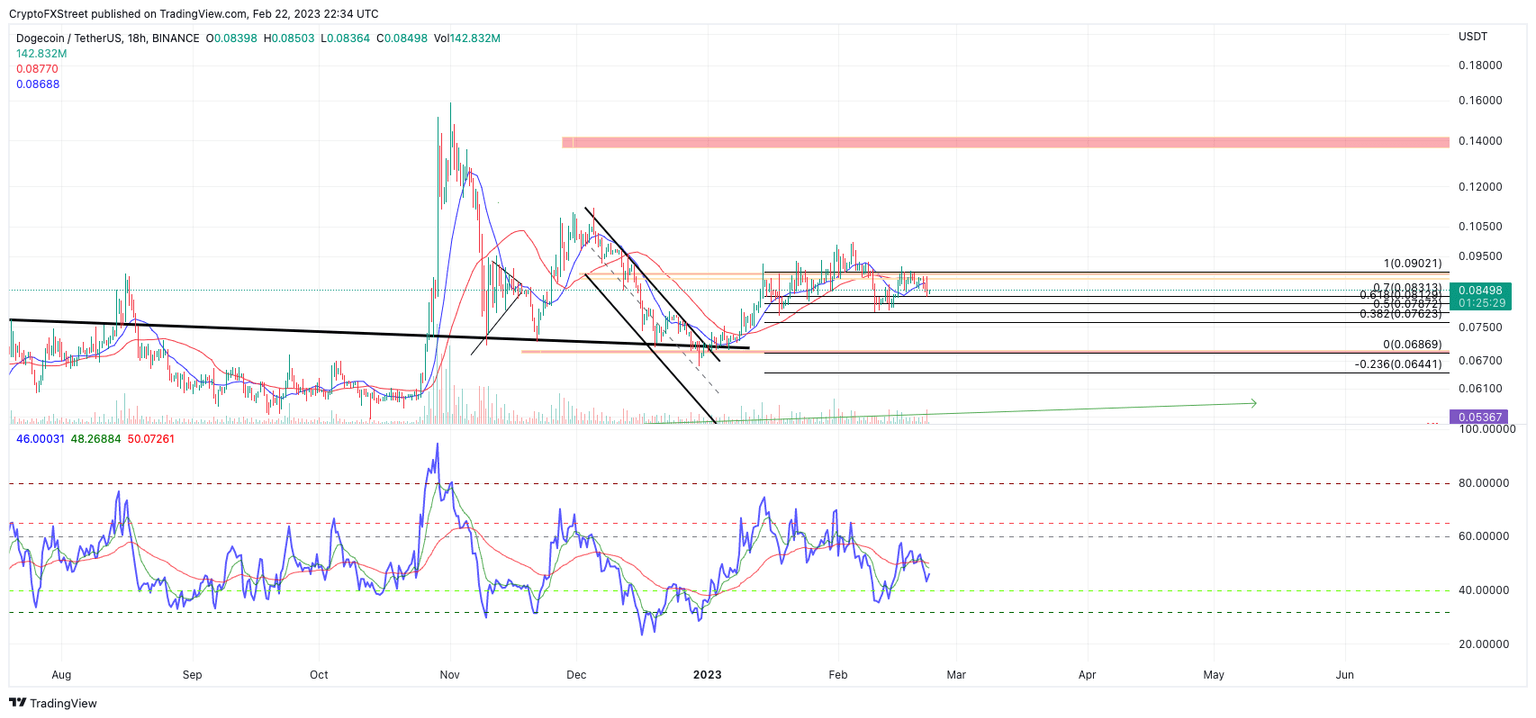

Still, under the hood, the DOGE priceshows strong kinetic potential. The fixed volume profile indicator (FVPR) is a technical analysis tool that displays the volume traded at each price level, which can help traders identify significant support and resistance levels.

Dogecoin's FVPR surrounding the last two trading quarters of 2022 is consolidating exactly at DOGE's main average price. This is noted in DOGE’s adjacent position to the strong red line on the technicals called the Volume Weighted Average Price (VWAP).

The FPVR's VWAP would suggest that the current price of Dogecoin is at a fair market value and that the 25% uptrend move witnessed this winter is only the beginning stages of a true crypto-season-styled rally.

Dogecoin price is currently trading at $0.084.The Relative Strength Index on the weekly time frame confirms this bias as it surged impulsively into the massive resistance zone near $0.14 in November of 2022.

The RSI has been bouncing back and forth since the initial move north and has most recently climbed above the 50-level medium line during winter's 25% move. This thesis proposes that the market is in a consolidation phase with momentum building to the upside. DOGE’s market structure confounds the idea of momentum building as bullish support is prevalent around the ascending support levels within the low-$0.07 region.

Traders should consider what the ultimate structure for a bottoming price would look like under this ricocheting market-environment. Furthermore, be on the lookout for any wedging-like patterns to end the three-way pullback structure. The VWAP and market structure suggests a decline toward $0.071 would be viewed as a discount.

Ultimately, the bulls could provoke a rechallenge of the trading liquidity above $0.14 zone once more in the future. The bullish scenario creates the potential for a 60% increase from Dogecoin's current market value.

DOGE/USDT 1-Day Chart

Invalidation of the bullish thesis could occur from a weekly candlestick close below the $0.069 liquidity zone. In doing so, a decline towards the liquiditylevels as low as 2022's market bottom near $0.049 would occur, resulting in a 40% decrease from Dogecoin's current market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.