Dogecoin Price Prediction: One more drop and then uptrend again?

- \Dogecoin witnessed an 11% downswing last week.

- DOGE has the potential for an additional 15% drop.

- Invalidation of the bearish thesis will arrive if DOGE hurdles $0.092.

Dogecoin price is showing weak retaliation signals, which could suggest that investors are not finished taking profit from the winter rally. Key levels have been defined to gauge DOGE’s next potential landing ground.

Dogecoin price has room to fall

Dogecoin price is undergoing bearish pressure during the second trading week of February as it consolidates in the mid-$0.08 zone. The technicals are forecasting the potential for another downswing in the days to come.

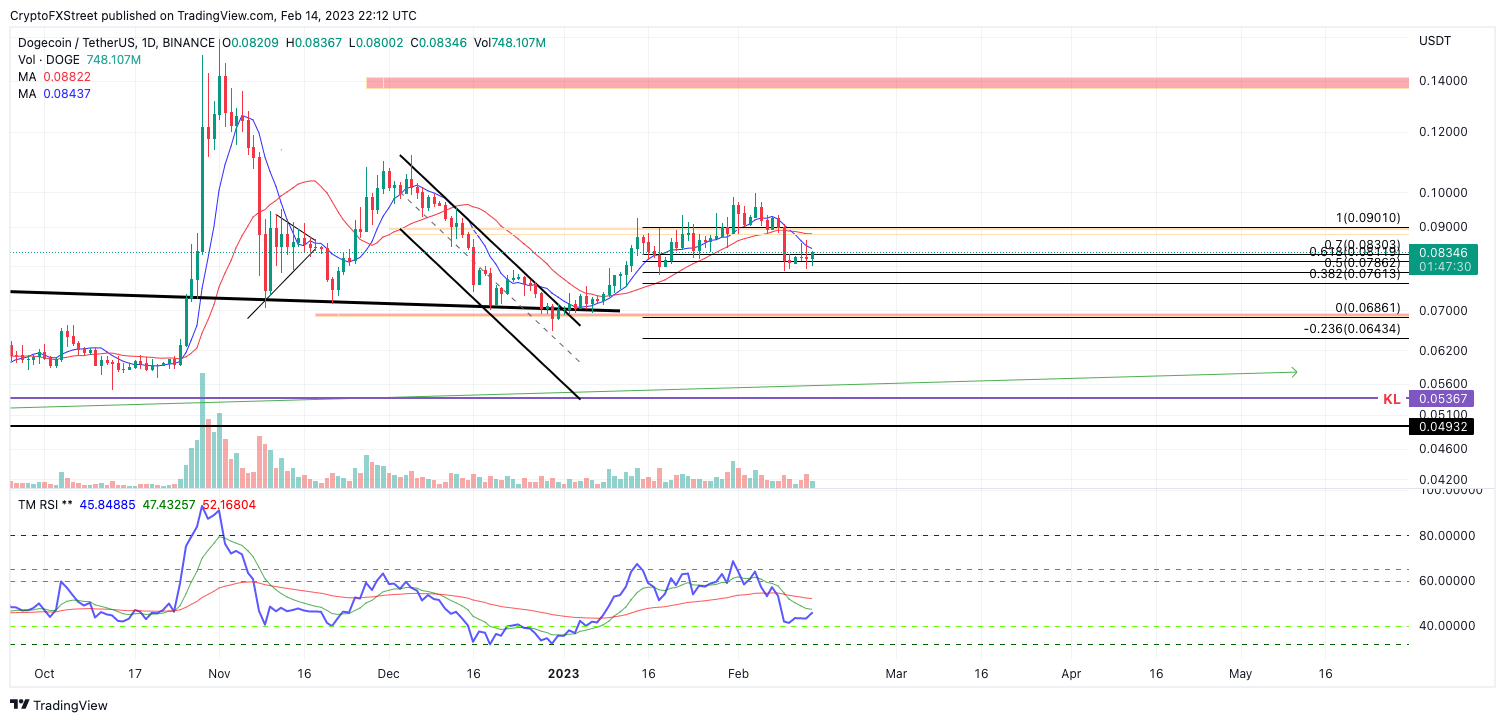

Dogecoin price currently auctions at $0.083 as bulls face resistance near the $0.09 region. If bulls do not reconquer the $0.084 level, it is likely that another downswing targeting the untested $0.068 liquidity zone will occur.

The Relative Strength Index suggests that DOGE is in a make-or-break situation, as the price is hovering over the last level of support after facing resistance near a crucial barrier during the final months of January. The RSI could suggest that DOGE still has the potential to bounce so long as it remains above the 40 levels. Therefore, traders must keep a healthy risk management strategy if they attempt to join the bears.

Invalidation of the bearish thesis would arrive from a breach of the $0.092 candlestick high that induced the 11% mudslide last week. A move above the barrier could put the Dogecoin price back on pace to rally toward the $0.14 liquidity zone, resulting in a 70% increase in market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.