Dogecoin Price Prediction: This indicator suggests bulls are gaining momentum

- Dogecoin price is currently down 3% on the day.

- DOGE could rally once more towards $0.10.

- A change of trend would be confirmed from a breach of $0.084.

Dogecoin price is experiencing some resistance near the $0.09 barrier. Despite this fact, the notorious meme coin still shows promise as support has progressively arrived at higher price levels throughout the winter.

Dogecoin price absorbing the shock

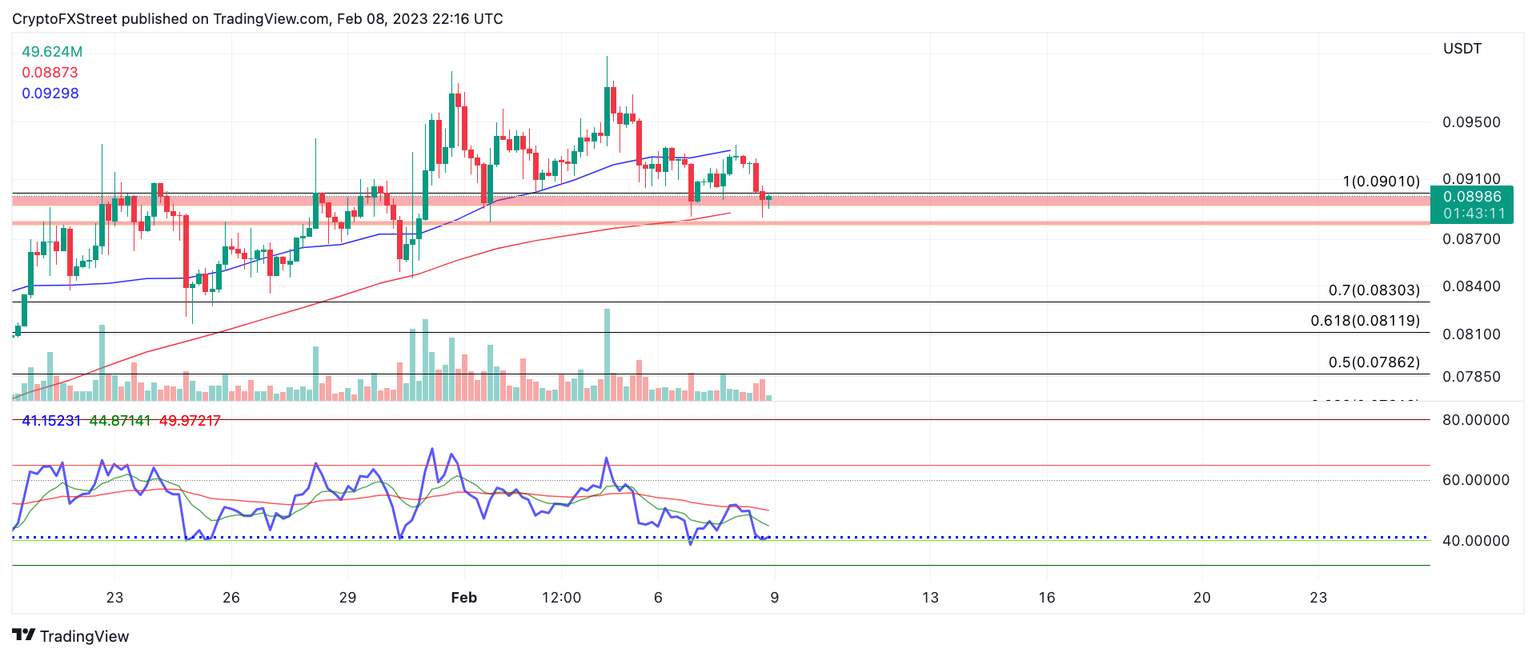

Dogecoin price is experiencing a minor dip, with its price down 3% daily. However, the bulls have established support near the upper $0.08 level, accompanied by a bullish divergence on the 4-hour Relative Strength Index (RSI). The RSI is a momentum oscillator that measures the kinetic potential of an asset. A bullish divergence occurs when the RSI forms higher lows while the price forms lower lows. DOGE's divergence signals a potential reversal during the current selloff and indicates underlying strength in the market.

Dogecoin price currently auctions at $0.089. The 21-day Simple Moving Average (SMA) is another key technical indicator that traders use to determine the trend and momentum of an asset. DOGE is currently testing the support of its 21-day SMA, which can be seen as a positive sign for the bulls. If DOGE successfully holds above this key level, it could trigger a rally toward $0.10. This would challenge the bearish liquidity at the $0.098 swing high and result in a 12% increase in its market value.

DOGE/USDT 1-Day Chart

On the other hand, traders should also keep an eye on the crucial barrier at $0.084. A breach below the previous swing low would indicate a change in market structure and prompt a stronger reversal. In such a scenario, DOGE could decline as low as $0.067, resulting in a 25% loss in its market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.