Cryptocurrencies Price Prediction: Ziliqa, Bitcoin & Solana — Asian Wrap 3 May

Why you should not panic sell Zilliqa at current price levels

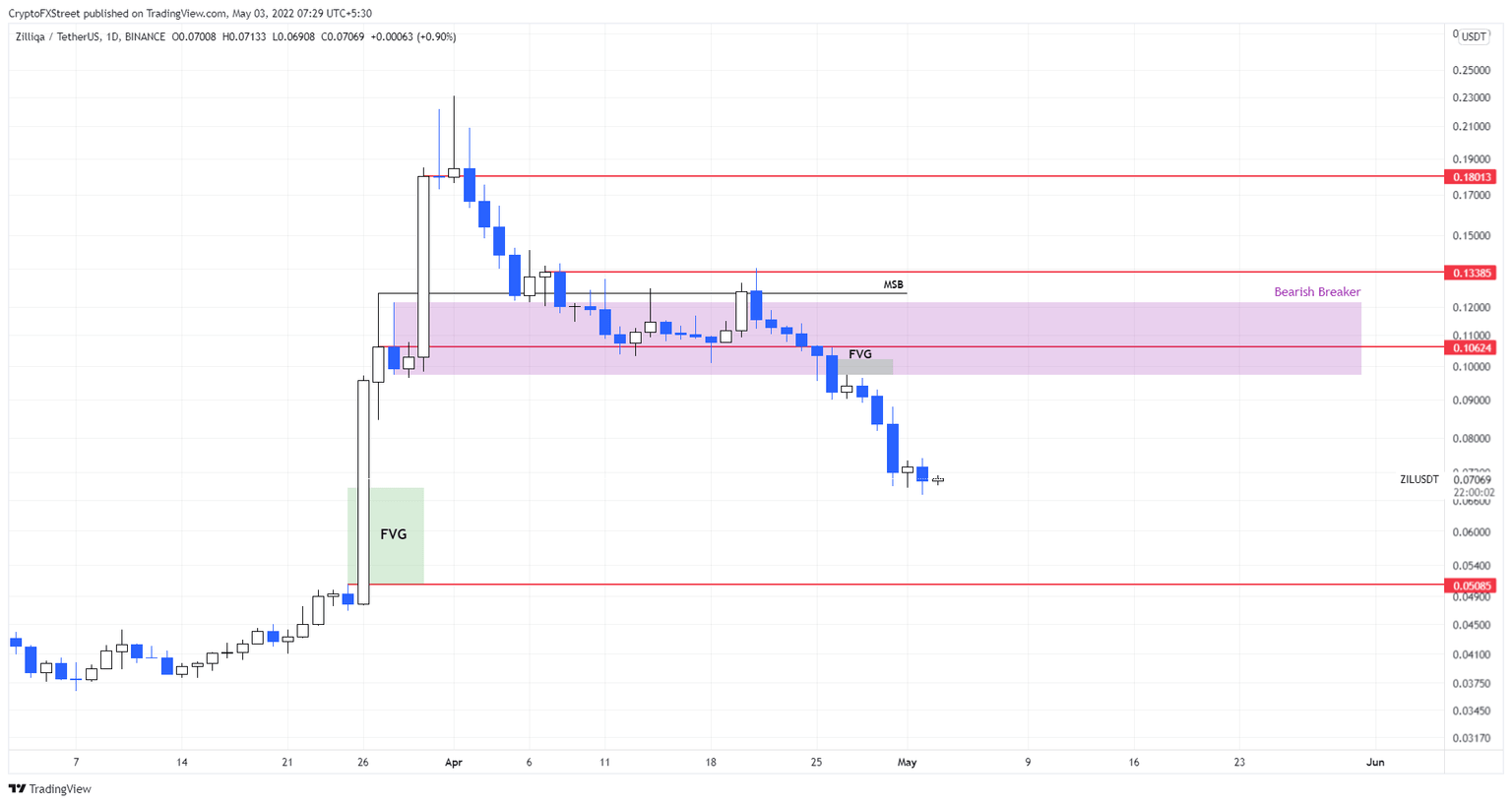

Zilliqa price continues to descend after breaching below a crucial area of support. The current downswing might have reached its temporary bottom and is likely to reverse, allowing investors a chance to offload their holdings. However, this potential upswing will also provide sellers to open short positions on ZIL.

Zilliqa price plummeted roughly 69% from its all-time high at $0.230. This downswing comes after a 400% upswing in late March. The resulting nosedive bounced off the $0.097 to $0.121 demand zone for quite some time in April but breached below it on April 26.

Bitcoin price could be undergoing Smart Money repositioning

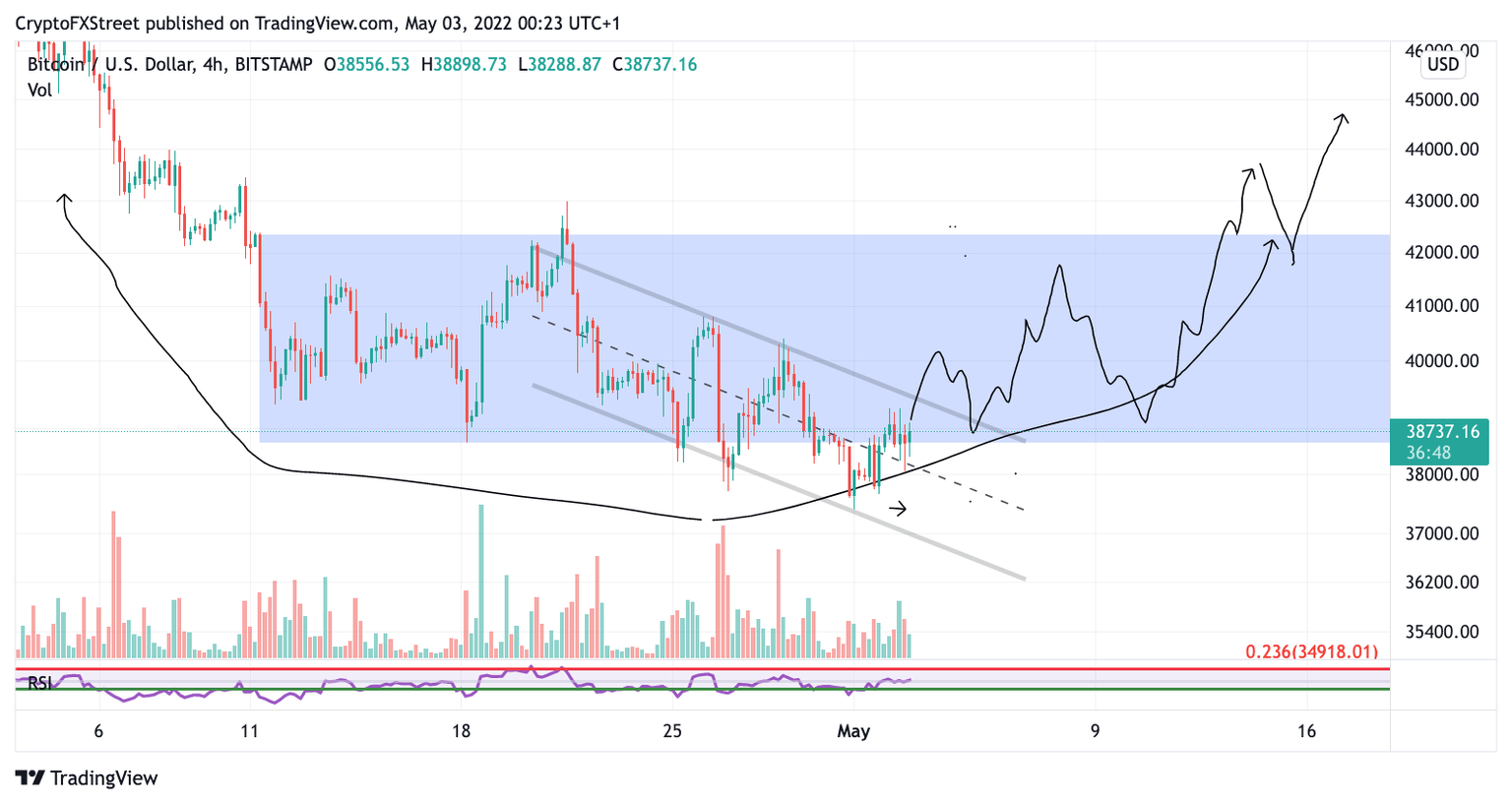

Bitcoin price presents a hopeful scenario of a Wyckoff Accumulation phase. Traders should expect low momentum trading before the next directional trend is established.

Bitcoin price currently trades at $38,600. Last month, this level was forecasted to be a significant price level for smart money. The bears are losing momentum as the price action is printing multiple dojis and indecision candles. The nature of this zone still portrays a Wyckoff accumulation event underway which is very optimistic for cryptocurrencies despite the harsh sell-offs experienced this weekend for altcoins.

Solana price to experience severe sell-offs as the bears aim for $63

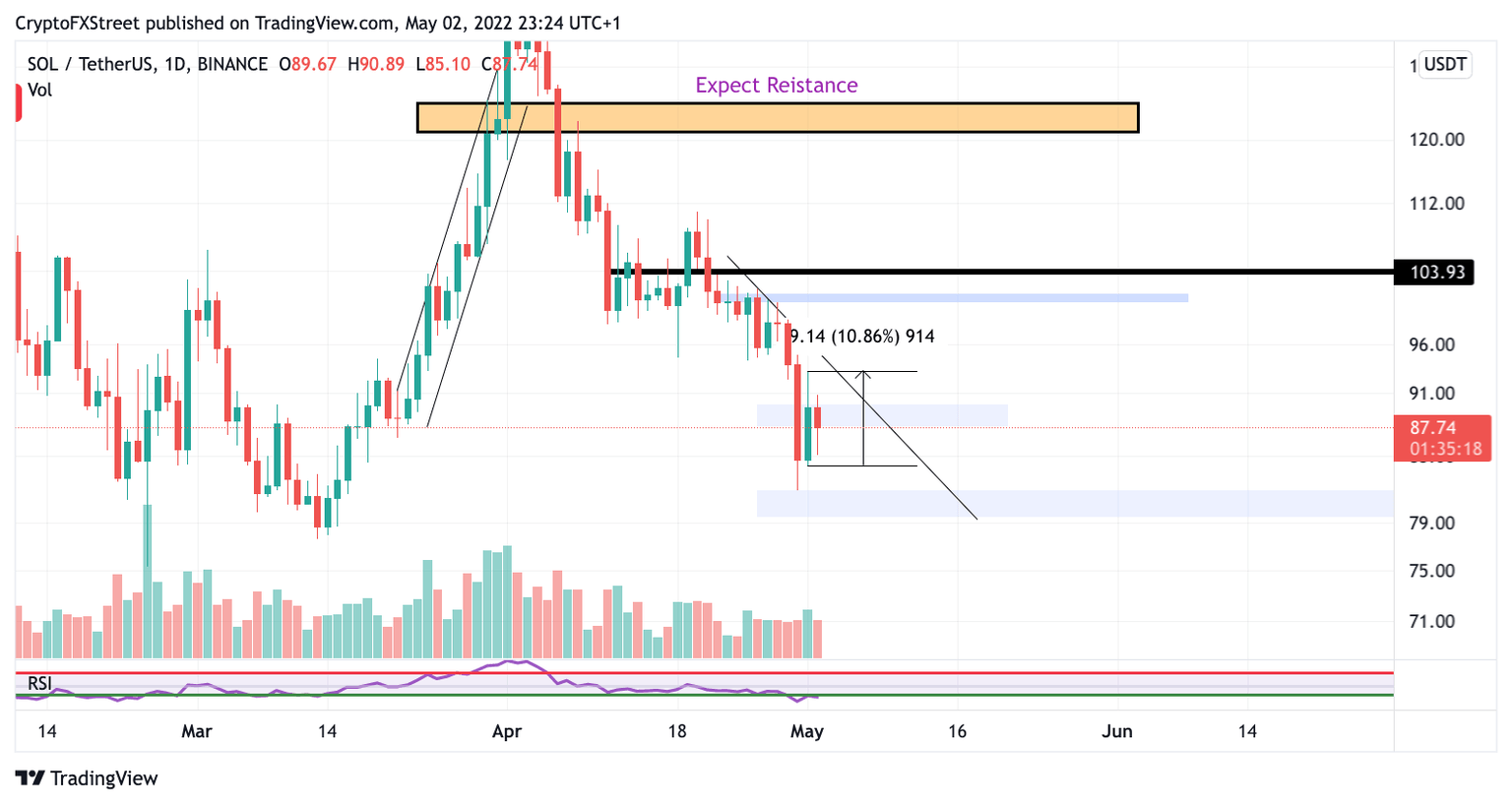

Solana price is enduring one of the strongest downward slides in the crypto market. Despite the community's vocal optimism on social media, the digital asset could still experience more severe sell-offs if market conditions persist.

Solana price is looking very weak compared to other cryptocurrencies at the time of writing. So far, the bears have validated every bearish thesis forecasted since the April highs at $140. Analyzing the advancing decline, the bears are ultimately aiming to take out all retail liquidity around the $80 and $70 zones. Unfortunately, a $60 Solana price will be unsurprising in the coming weeks.

Author

FXStreet Team

FXStreet