Solana price has another drop on the cards as bears aim for $94

- Solana price is in a steep decline on the 8-hour chart.

- SOL price is printing larger bearish engulfing candles as the downtrend progresses.

- Invalidation of the bearish downtrend is a close above $112.50.

Solana price is looking more bearish as the days progress. Traders should look to short the asset if market conditions continue

Solana price has seen better days

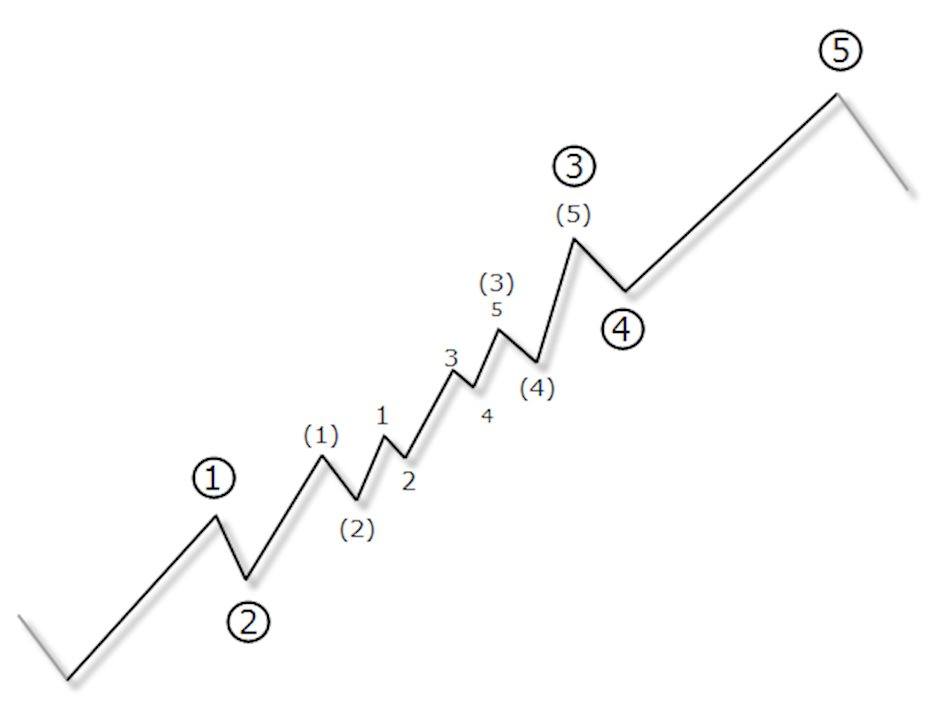

Solana price is likely to continue falling as the bulls fail to establish defensive support. It was predicted in last weeks’ bearish thesis that Solana price would fall to $100. The bears validated the bearish trade setup with relative ease as the SOL price printed a large bearish engulfing candle that wiped 10% off the Solana price in one shot.

Solana price currently trades at $101 and is experiencing more downside pressure from the bears at the current time. Investors should expect a $94 and possibly $90 SOL price by some time next week. The Relative Strength Index, alongside the Volume Indicator, is fully controlled by the bears on the 8-hour chart. Currently, there is no reason to believe in a short-term counter-rally.

SOL/USDT 8-Hour Chart

Invalidation of the steep declining downtrend will be a close above $112.50. If this scenario occurs, analysts will consider a counter-trend rally for SOL price with targets at $118 and $122, resulting in a 20% increase from the current Solana price.

Author

FXStreet Team

FXStreet