Solana price has Smart Money traps embedded in the price action

- Solana price has breached the 50-day moving average.

- SOL is coiling into a wedge-like pattern.

- Invalidation of the bearish thesis is a close above $110.

Solana price could fall towards $80 to grab liquidity as the bulls have yet to show any interest in the $97 price levels. To create a climatic downslide, market makers could entice traders to open long positions in the coming weeks.

Solana price says, "expect choppy fakeouts"

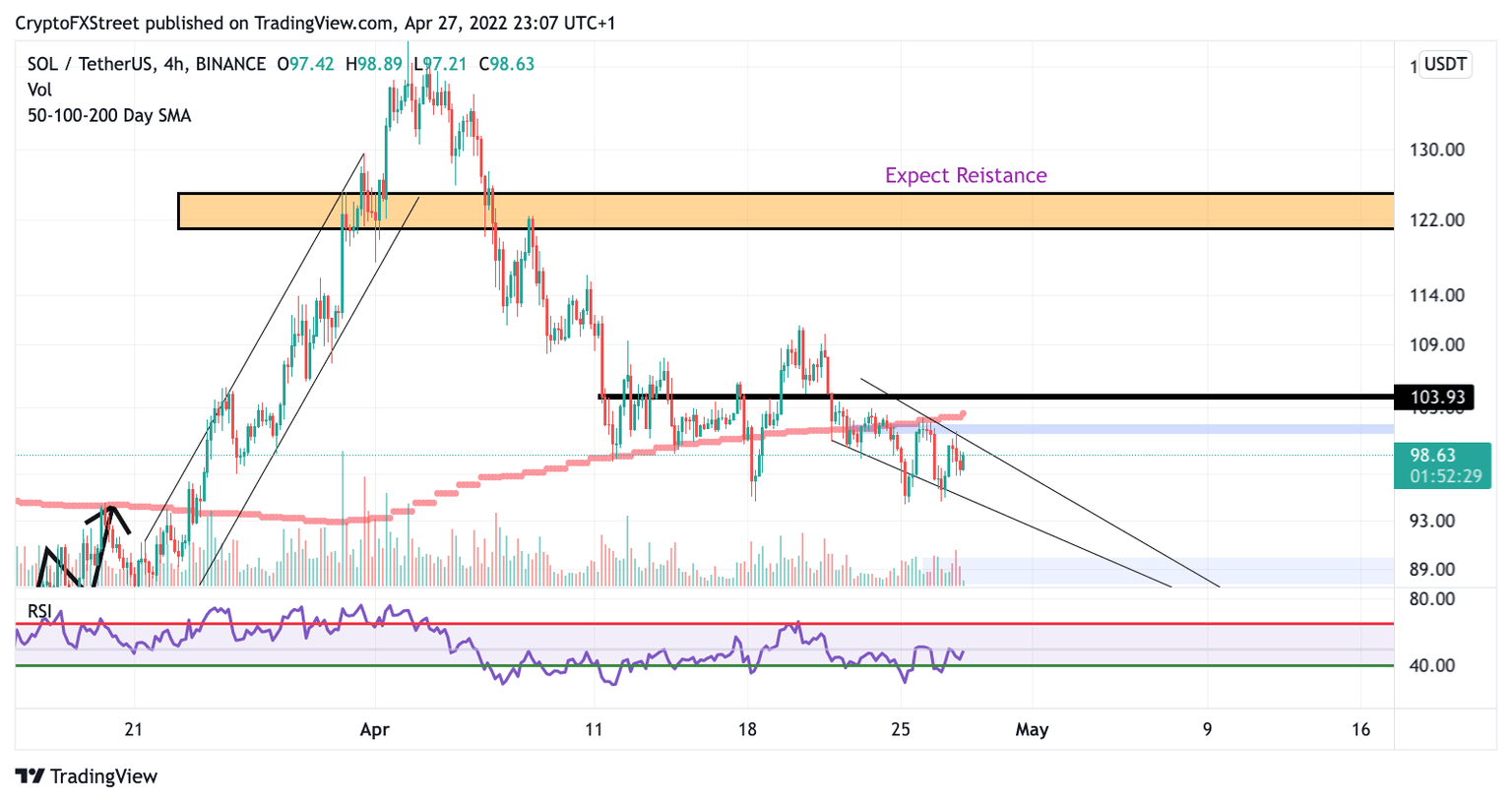

Solana price is currently trading at $97 and coiling into a wedge-like pattern. The wedge pattern forecasts a 6-10% move which could take the price back to $105. However, analyzing the technicals proposes that this wedge could be a part of a larger complex correction. If traders get overzealous, Solana price could trap traders on the wrong side of the trend.

Solana price is back above the buyers' territory on the daily Chart, which confuses a bullish counter-trend move. However, the 50-Day moving average has already been breached and retested before being suppressed to the current $97 levels. The SOL price could continue to chop around this area before making way to $88 and $80

SOL/USDT 4-Hour Chart

Traders should look for better opportunities in the market to avoid unnecessary losses. This Chart is very complex and does not forecast any significant moves at the moment. Invalidation of the current bearish thesis is a close above $110. If this price breach occurs, a revised count will be necessary. There is a slim chance Solana price could climb to $120, resulting in a 25% increase from the current price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.