Chainlink sharks accumulation spree likely to drive LINK price higher

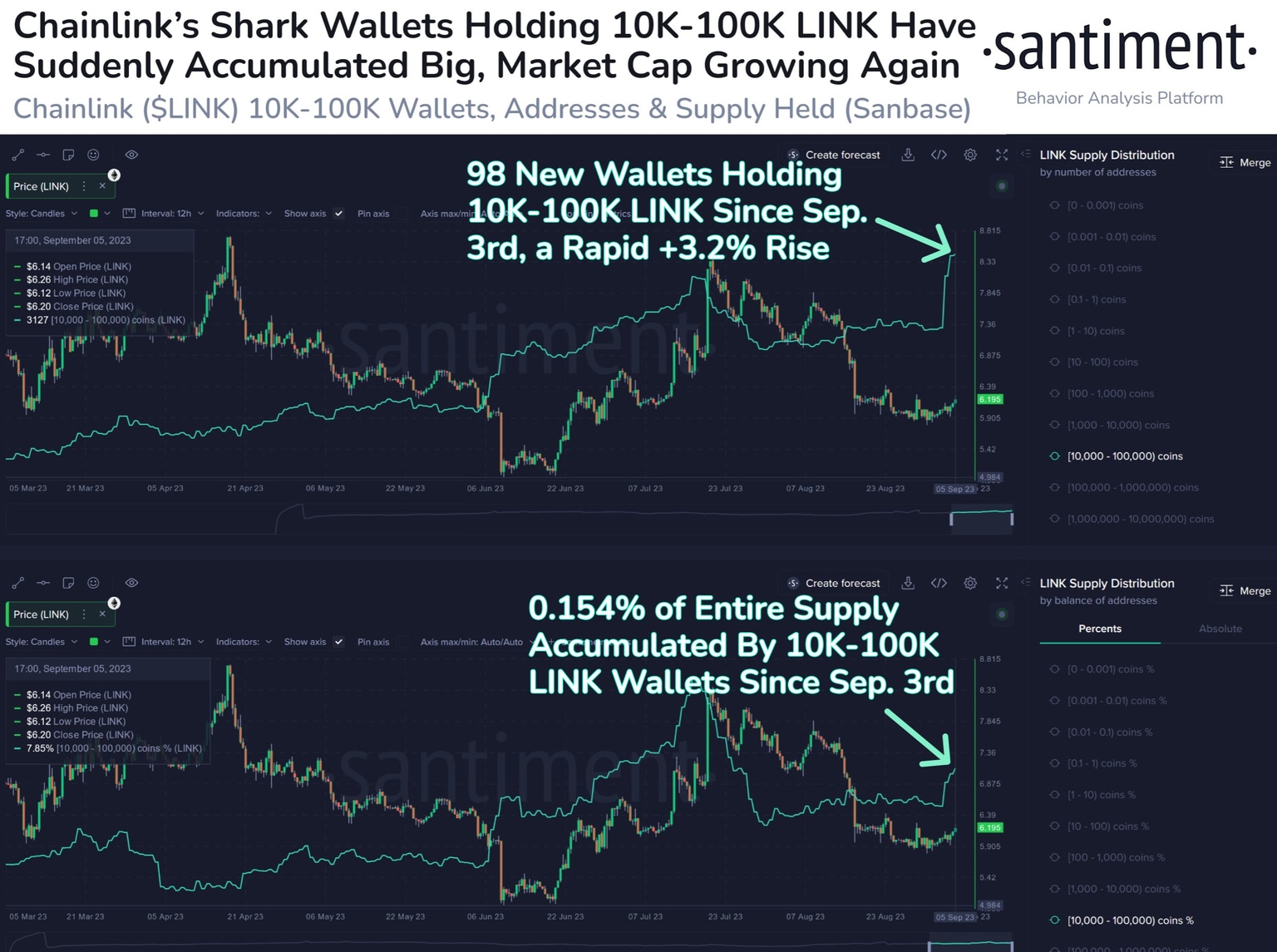

- Chainlink’s shark tier of holders owning between 10,000 to 100,000 LINK have accumulated $9.6 million worth of tokens in three days.

- There are now 3,127 Chainlink sharks, driving demand for the altcoin.

- LINK price has previously rallied in response to accumulation by large wallet investors.

-637336005550289133_XtraLarge.jpg)

Chainlink price has climbed past the key resistance level at $6 despite a broad bearish market for altcoins this week. The price increase could partly be driven by activity from large wallet investors holding LINK, who have consistently accumulated the token this week. The trend has been significant among sharks, or holders that own between 10,000 to 100,000 LINK tokens.

Also read: XRP price risks decline to support at $0.48, attorneys analyze the Howey memo and Hinman speech

Chainlink sharks are adding to their LINK token holdings

Accumulation of Chainlink by sharks has fueled a rally in LINK price on previous occasions. This makes it a key metric for determining the direction of the LINK price trend.

According to data from crypto intelligence tracker Santiment, Chainlink’s shark tier acquired $9.6 million worth of tokens within a three-day time frame. This increased demand is likely to act as a bullish catalyst for LINK.

As seen in the chart below, LINK accumulation by sharks in the first week of June drove Chainlink price higher. LINK price posted more than 20% gains in the two weeks following the increased demand from sharks. Similarly, sharks also scooped up LINK tokens at a rapid pace in the third week of July, pushing LINK price close to $8.3 afterwards.

Santiment data shows that 98 new shark wallets have emerged in Chainlink since Monday, a 3.2% rise. As of Thursday, there were 3,127 shark wallets holding between 10,000 and 100,000 LINK tokens.

Chainlink shark wallets buy more LINK tokens (Santiment)

The recent behavior of Chainlink’s large wallet investors can be attributed to Swift’s announcement on August 31 about its partnership with the protocol. Find out more about it here.

At the time of writing, LINK price is $6.28 on Binance. The altcoin is up 6.01% over the past week. For upside targets in the event of a price recovery in Chainlink, check this post.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.